Cryptocurrencies Price Prediction: Bitcoin, Ethereum & Solana – European Wrap 14 April

Bitcoin Weekly Forecast: What to expect from BTC after overcoming $30,000

Bitcoin (BTC) price has shown no signs of slowing down as it continues to climb higher at a steady pace after the recent US Consumer Price Index (CPI) noted a decline from 5.2% to 5%. This outlook caused BTC to spike higher in the short term but noted a continued uptick in the next few days.

Bitcoin price continued its ‘consolidate and rally higher’ after the US CPI results came out on April 12. After a brief period of rangebound movement below $30,000, BTC has climbed higher and is currently eyeing the $32,687 hurdle and the buy-stop liquidity resting above it.

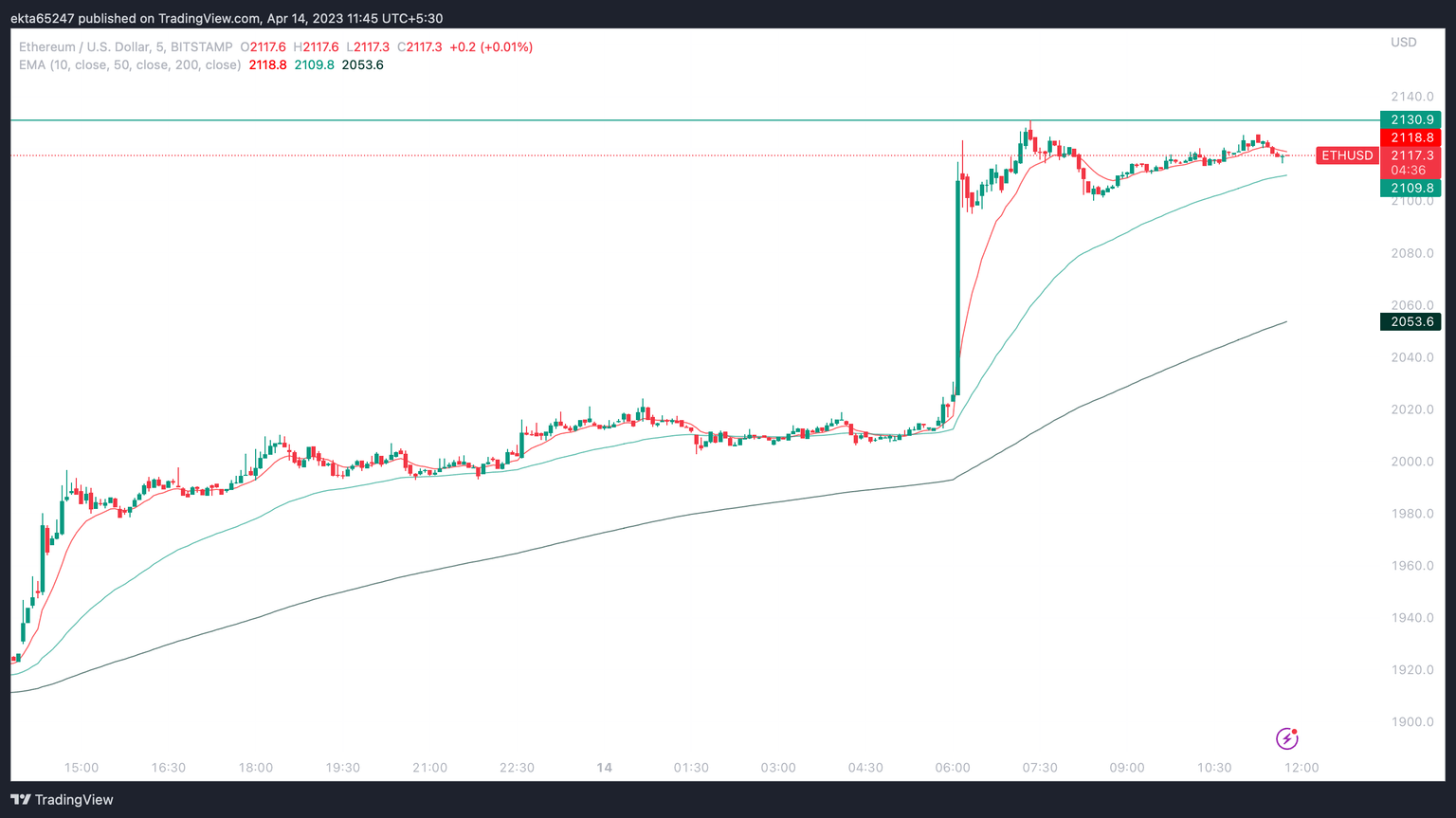

Ethereum price explodes, ETH deposits pick up pace

Ethereum price witnessed a massive spike after the successful completion of its Shapella upgrade. The altcoin climbed to the $2,100 level after crossing key resistance at $2,000. There is a spike in ETH withdrawals, however analysts have noted a rise in deposits on the ETH2 contract and this is a bullish sign for the asset.

Ethereum hit several developmental milestones since 2022. With the successful completion of its Merge, a transition from Proof-of-Work to Proof-of-Stake, and smooth Shapella upgrade, the altcoin wiped out its losses since August 2022 and climbed to the $2,100 level in a swift move on Thursday.

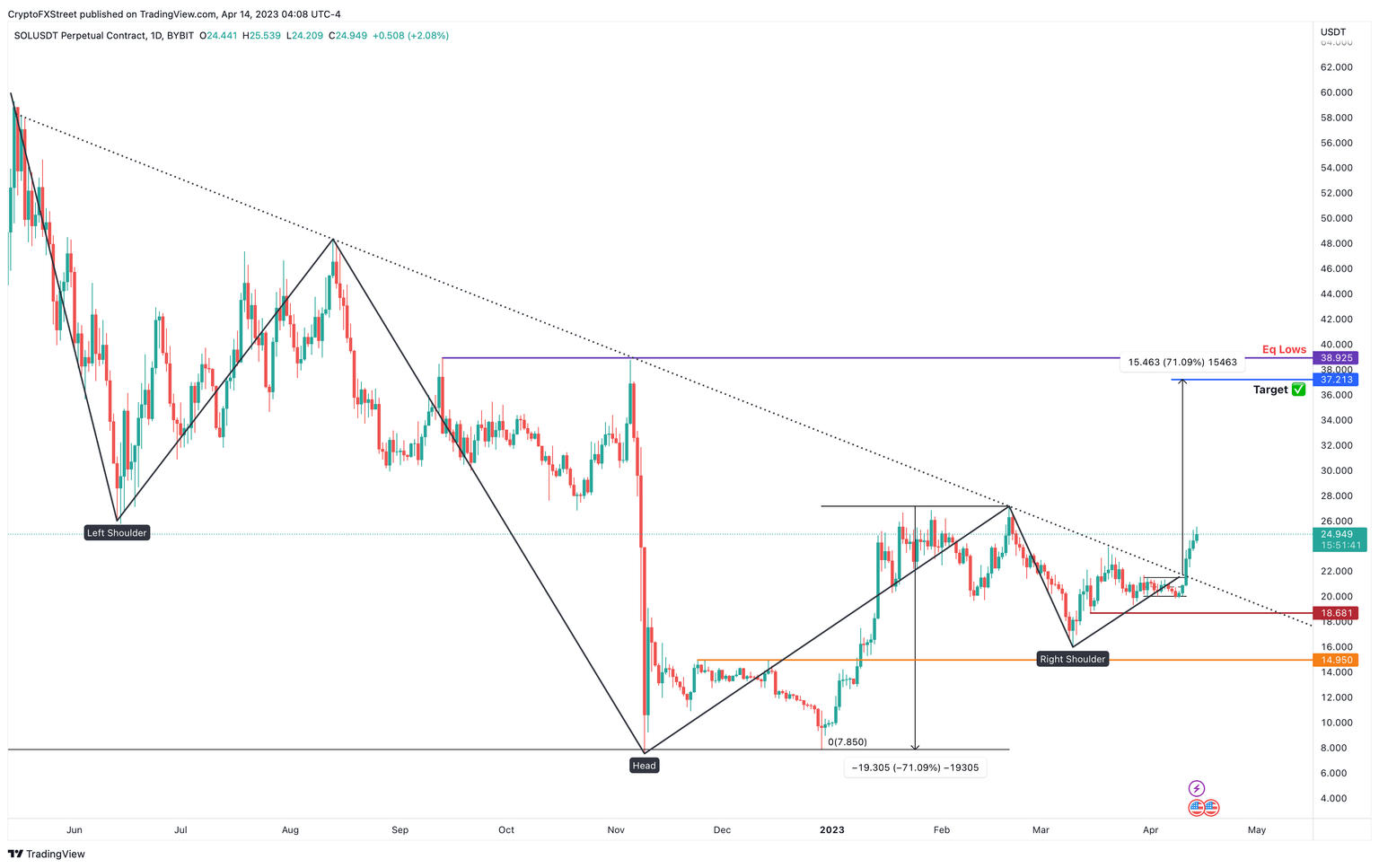

Solana price breaches multi-month bullish pattern, forecasts $40 SOL

Solana price successfully breached a multi-month pattern on April 11 – and has not looked back since. With Bitcoin also exhibiting a bullish outlook, SOL holders are in for a treat.

Solana price action between May 15, 2022, and April 11, 2023, set up a bottom reversal pattern known as an inverse head-and-shoulders. This technical formation contains three distinctive swing lows. The central trough is named the head and is lower than the other two troughs, which are referred to as shoulders. Hence the namesake inverse head-and-shoulders. In this case, a declining trendline connects the peaks of these swing lows, known as a neckline and serves as a confirmation level.

Author

FXStreet Team

FXStreet