Cryptocurrencies Market Update: Bitcoin and Ethereum lead the rest in consolidation on low volatility

- Bitcoin and gold would be the biggest contenders for best-performing commodities in 2020 – Bloomberg report.

- The Fed chair Jerome Powell endorses an Ethereum-based reference rate project for financial institutions.

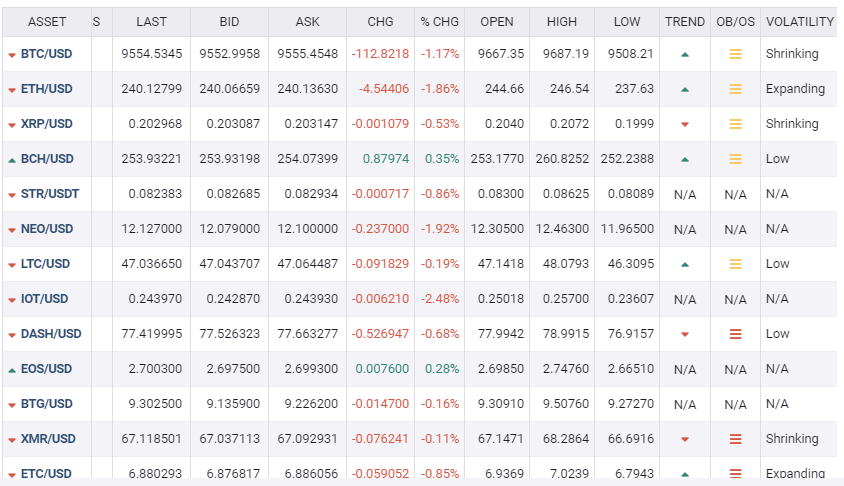

The cryptocurrency landscape is mostly painted green during the European session on Thursday except for Bitcoin and Ethereum. Bitcoin has sunk by 0.38% on the day while Ethereum is down 0.60%. Ripple is in the green, leading the top three with 0.41% in gains.

Read more: Cryptocurrency Market News: Bitcoin and gold to outperform other commodities in 2020

Generally, the market is experiencing low volatility. Prior to this, most cryptoassets retreated from their weekly highs led by Bitcoin’s drop from levels above $10,000 to $9,300. The cryptoassets that have managed to stay comfortably in the green among the top 30 include Bitcoin Cash (up 1.63%), Litecoin (up 1.24%), Monero (up 1.28%), and EOS (up 1.09%).

Bitcoin and gold set outperform other commodities – Bloomberg

The Bloomberg June 2020 commodity outlook finds that Bitcoin and gold have not only outperformed other commodities in the first half of the year but also are likely to outshine other commodities by the end of 2020. The report said that the ongoing COVID-19 pandemic could be the force behind both gold and Bitcoin’s performance.

Among the few assets up in this tumultuous year, gold and Bitcoin are building foundations for further price appreciation, in our view.

Ethereum-backed reference rate project endorsed to replace LIBOR

The Chairman of the Federal Reserve in the US, Jerome Powell recently mentioned that an Ethereum-backed blockchain reference rate project referred to as AMERIBOR is likely to take the place of LIBOR. The London Interbank Offered Rate (LIBOR) plays a vital role in global finance by determining measures such as interest rates for both corporations and individuals.

It has been found that some banks are using fake LIBOR reported interest rates to benefit themselves by earning more profits. At the moment the Fed is looking into AMERIBOR as a potential replacement. According to Powell:

Ameribor is a reference rate created by the American Financial Exchange (AFX) based on a cohesive and well-defined market that meets the International Organization of Securities Commission’s (IOSCO) principles for financial benchmarks.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren