Crypto weekly flashback and best trades for the week

- Meme coins ranked by market cap, Dogecoin, Shiba Inu, PEPE, Dogwifhat and Bonk erased between 2% and 8% of their value in the past week.

- Solana meme coins Book of Meme, Cat in a dogs world, Ponke and Bonk started their recovery early on Sunday.

- Ethereum turned inflationary in Q2 2024, likely contributing to the selling pressure on Ether.

- Bitcoin sustained above key support at $67,000 as US listed Spot ETFs now hold over $61.37 billion in BTC.

- Traders showed appetite for Solana amidst Ether ETF approvals the past week, strong demand could push SOL higher.

Crypto weekly updates

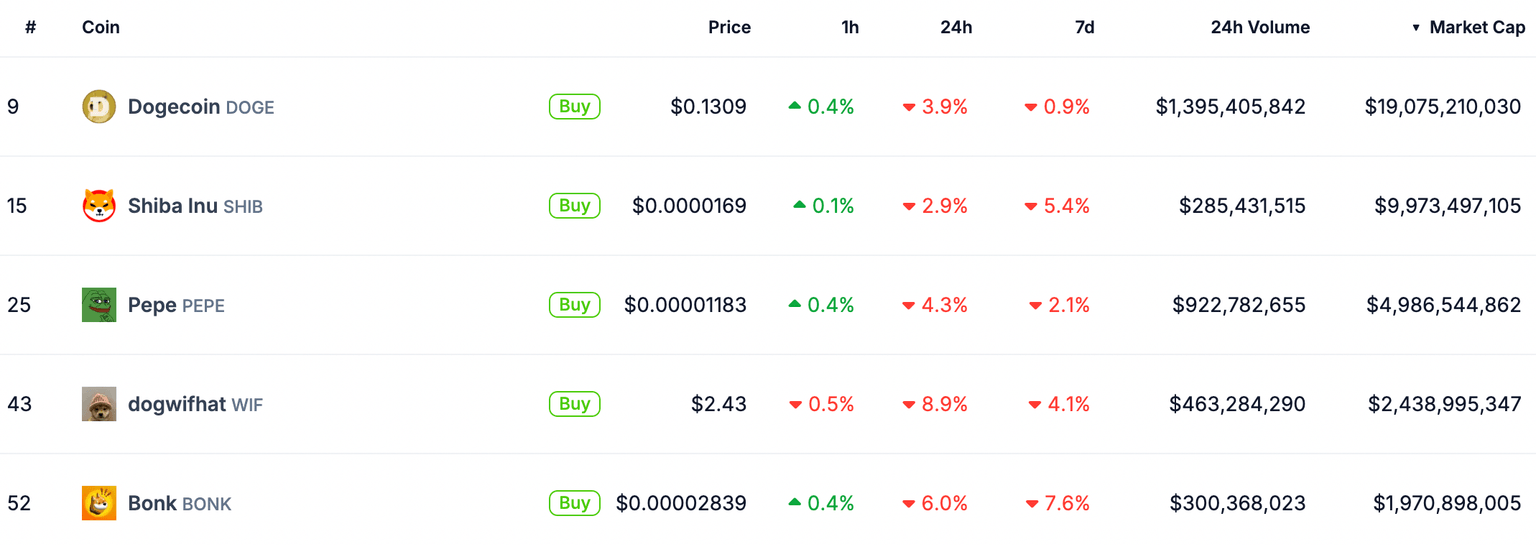

- Meme coins showed mixed results in the past week. Dogecoin (DOGE), Shiba Inu (SHIB) and Pepe (PEPE) started their recovery early on Sunday while Dogwifhat (WIF) and Bonk (BONK) extend losses. Coingecko data shows the state of the top 5 meme coins ranked by market capitalization:

Meme coin price performance per CoinGecko data

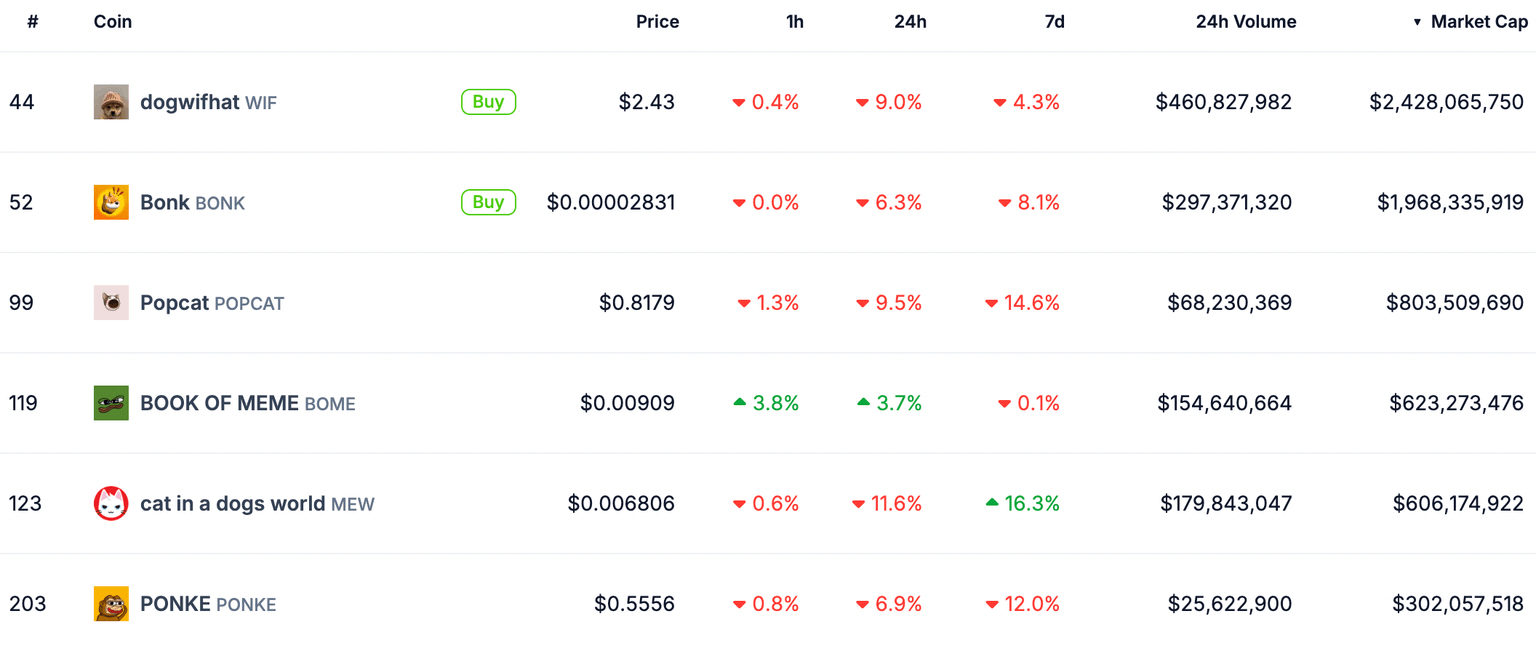

- Solana meme coins grabbed the spotlight in the past week, in the last 24 hours however, most assets in the category suffered a steep correction. Book of Meme (BOME) and Ponke (PONKE) are the exceptions, these meme coins started their recovery from the recent decline, per price data from the CoinGecko feed.

Solana meme coins price performance

- Stablecoins: USDC Treasury minted an additional 250 million USDC on the Solana chain on July 28, Sunday.

- Ethereum turned inflationary in Q2 2024, Ether supply increased by over 120,000 tokens, contributing to the selling pressure on the altcoin.

- US listed Bitcoin ETFs hold over 900,000 Bitcoins worth $61.37 billion as of last week.

- US Presidential candidate Donald Trump promised to build a stockpile of Bitcoin and that the US government will hold 100% of its Bitcoin, at a conference in Nashville on July 27.

- Jersey City pension fund announced plans to invest in Bitcoin, after Wisconsin’s announcement in May 2024.

- Solend protocol rebranded to Save and launched a stablecoin SUSD alongside two investment products.

- Injective ecosystem sees yield-generating stablecoin issuer Mountain Protocol’s launch in its network.

- Gasless transactions went live in the TON blockchain following the implementation of a new smart wallet standard.

Top 3 trades for the week

-

Solana

Solana is currently in an upward trend. The token of the Ethereum competitor could extend gains by over 13% and hit its target of $210.18, the March 18 peak, also the 2024 high of the altcoin.

SOL could face resistance at the Fair Value Gap (FVG) between $192.24 and $193.69. At the time of writing, SOL trades at $185.74.

The momentum indicator, Moving Average Convergence Divergence (MACD) shows underlying positive momentum in Solana’s price trend.

SOL/USDT daily chart

A daily candlestick close under $170 (the 61.8% Fibonacci retracement of the rally from March 5 low of $105, to the March 18 high of $210.18), could invalidate the bullish thesis for Solana. SOL could find support at July 26 low at $171.

-

Dogecoin

Dogecoin trades at $0.1296 at the time of writing. The largest meme coin by market capitalization could extend gains by 23% and rally to its target of $0.1601, the 50% Fibonacci retracement of the decline from the March 28 top of $0.2288 to the July 5 low of $0.0913.

DOGE could face resistance at two Fair Value Gaps (FVG) in the daily chart, between $0.1348 and $0.1358; and $0.1583 and $0.1621.

DOGE/USDT daily chart

A daily candlestick close under $0.1348 could invalidate the bullish thesis and DOGE could sweep support at July 25 low of $0.1201.

-

Popcat

Popcat is currently in an uptrend forming higher highs and higher lows. The Solana-based meme coin could correct in the short-term. The momentum indicator, Moving Average Convergence Divergence (MACD) supports the thesis of correction and POPCAT could extend losses by 14%, dipping into the Fair Value Gap (FVG) to collect liquidity.

POPCAT could find support at $0.6916, the meme coin could find support at $0.7368, in its correction.

POPCAT/USDT daily chart

A daily candlestick close above the July 24 high of $0.8940 could invalidate the bearish thesis and POPCAT could rally towards it 2024 peak of $0.9975.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.