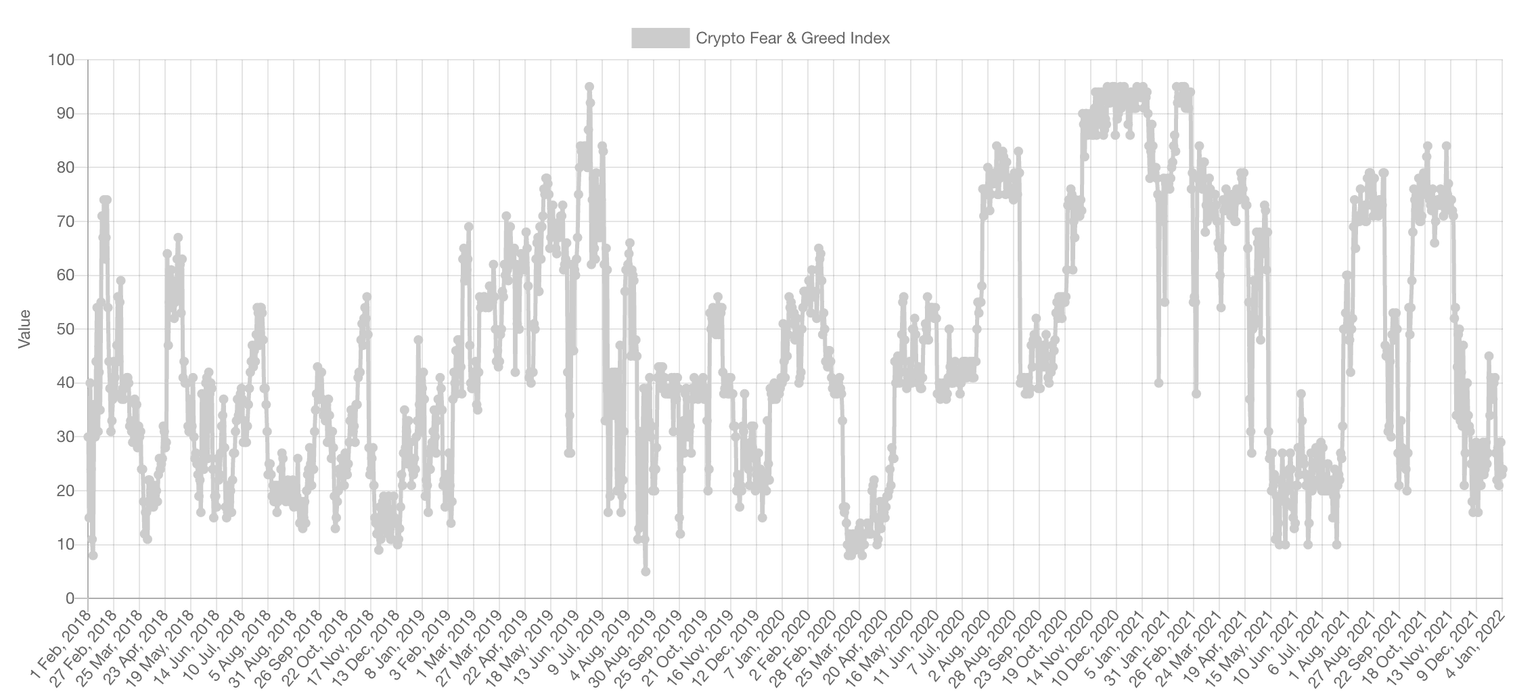

Crypto market sentiment in extreme fear provides an opportunity to profit

- The cryptocurrency market sentiment is currently displaying extreme fear after a prolonged period of sluggish performance.

- The last time that the Crypto Fear and Greed Index flashed a reading of extreme fear, the digital asset market capitalization rebounded by 63%.

- The March 2020 market crash witnessed a reading of 10, but the new asset class recovered by 264%

The Crypto Fear and Greed Index (FGI) is currently displaying extreme fear in the cryptocurrency market while the new asset class is currently struggling to reverse the period of sluggish performance.

Cryptocurrencies trading below intrinsic value

The Crypto FGI aims to establish whether traders are too bullish, when the index steers into “greed,” or bearish when the indicator moves into “fear.” The current market sentiment, extreme fear, suggests that cryptocurrencies are trading below their intrinsic value.

When the cryptocurrency market is in a state of extreme fear, the prices of the assets are usually under pressure as investors consider selling due to panic. However, other investors use this as an opportunity to purchase more digital assets at a discounted price.

Considering the relatively low digital asset prices in the market as well as FGI’s low reading of 24, analysts suggest that crypto assets are currently oversold and are about to rebound sharply.

Crypto FGI

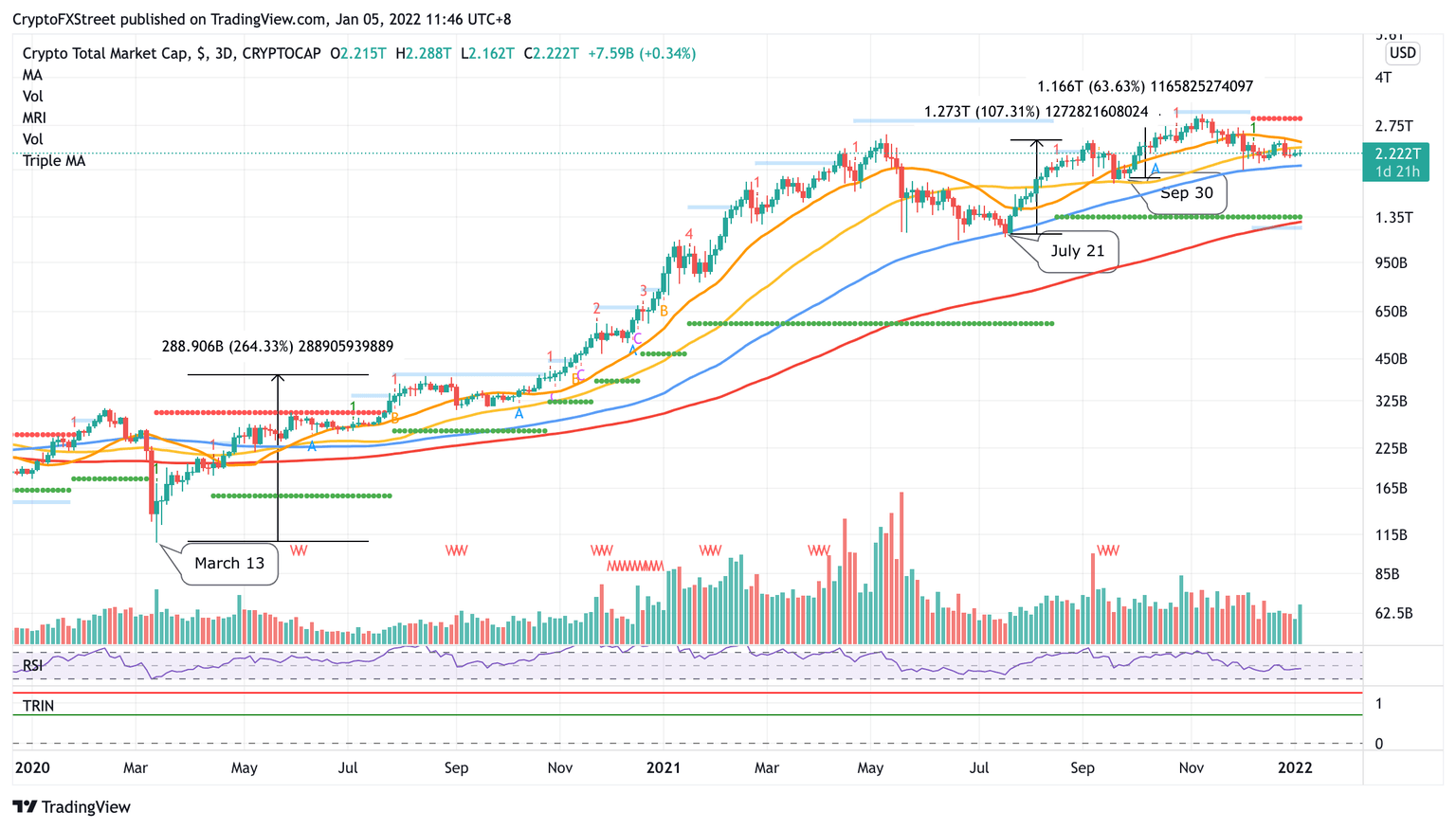

The lowest point reached on the Crypto FGI in 2021 was on July 21 when the index displayed a reading of 10, indicating extreme fear. Despite the bearish sentiment given by the reading, the cryptocurrency market capitalization rebounded quickly, from a low of 1.189 trillion to 2.461 trillion on September 7, resulting in a 107% increase.

Another occasion when the Crypto FGI reached extreme fear in 2021 was on September 30, when the index displayed a reading of 20. The cryptocurrency market capitalization surged from 1.832 trillion on September 30 to 3.001 trillion on November 10, resulting in a 63% increase.

Crypto market capitalization

The extreme fear sentiment displayed on the Crypto FGI has also appeared during the market crash in 2020, when the crypto market capitalization fell to 108.651 trillion on March 13, 2020. The Crypto FGI flashed a reading of 10, indicating that investors began to panic which kickstarted the sell-off.

However, the market rebounded in the following months, as the crypto market capitalization surged by 264% to 396.989 billion on August 16, 2020.

Despite the compelling data showing that a significant recovery follows extreme fear indicated by the Crypto FGI, Troy Wiipongwii from the blockchain research lab at William & Mary university states that "ultimately no indicator or index can perfectively predict market movements."

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.