- BlockFi Bitcoin mining loans will be backed by 68,000 mining machines.

- Some of these loans are undercollateralized thanks to the decline in mining rigs’ prices.

- Earlier this month, Celsius Mining also filed with the court to issue the sale of its mining equipment worth $1.3 million.

BlockFi took a major hit last year following the collapse of FTX in November and Three Arrows Capital in Q2 2022. Filing for bankruptcy right after FTX, BlockFi initiated a list of companies that went under soon after which are still attempting to recover their customers’ funds. BlockFi itself is looking to achieve the same.

BlockFi Bitcoin mining loans

BlockFi is currently looking to sell Bitcoin mining machine-backed loans to users using its 68,000 rigs. The loans, which amount to $160 million, are expected to be undercollateralized due to the drop in the price of the mining machines.

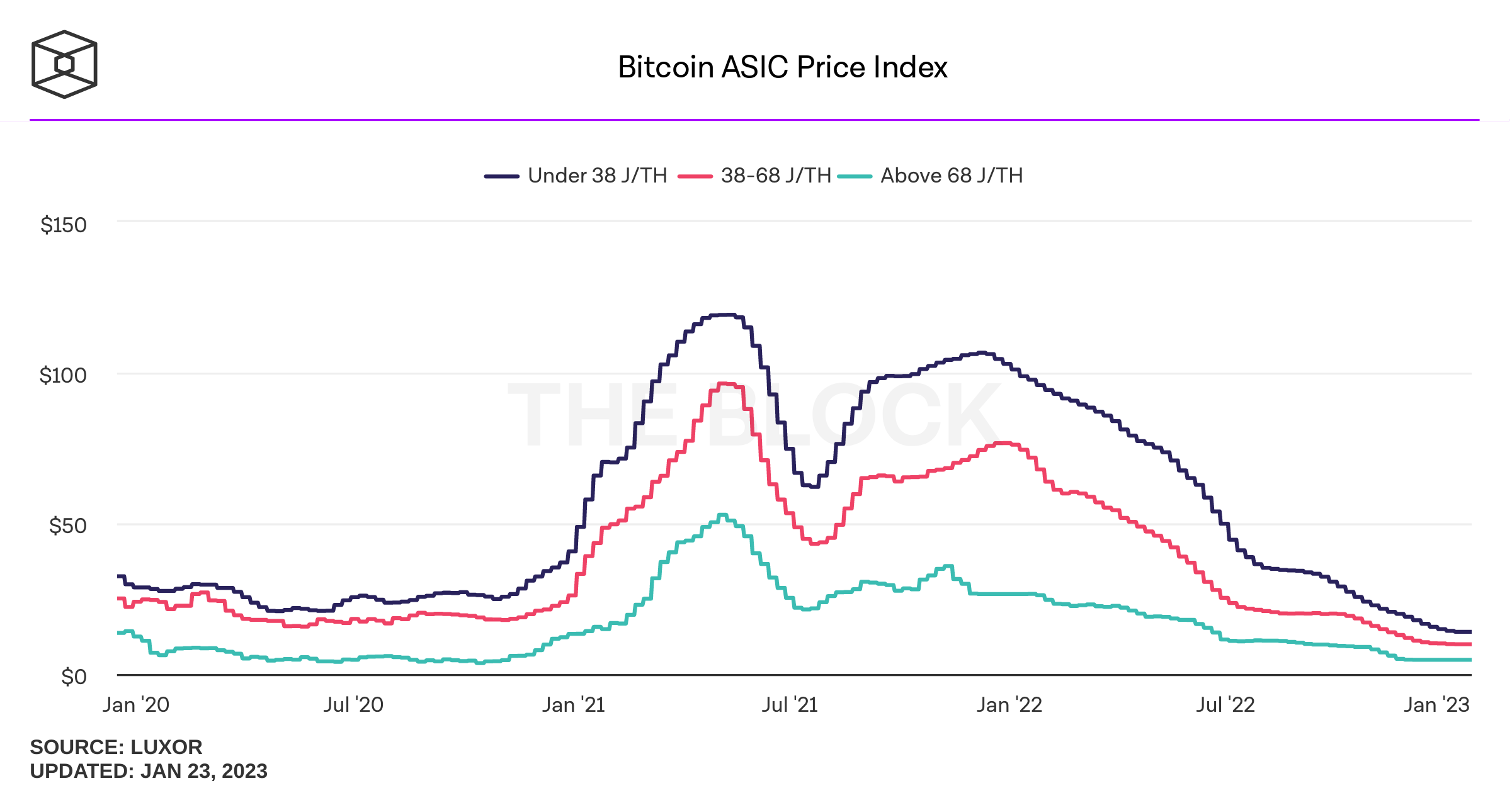

On average, this time last year, mining rigs under 38 J/Th were worth around $98, which have since lost their value by almost 90% and are currently worth around $9.9. Reasons behind this range from the crash of the crypto market and decline in BTC price as well as the rising costs of operations, including power costs.

Bitcoin ASIC miner price

The drowning mining market had the likes of BlockFi financing it even though traditional lenders maintained a distance due to the high volatility of the crypto market.

Other financiers included the New York Digital Investment Group, Digital Currency Group’s Foundry, Galaxy Digital and the bankrupt lender Celsius Network.

Celsius Mining sells its miners

Unlike BlockFi selling Bitcoin mining machine-backed loans, crypto lender Celsius Network was reported to be selling its mining equipment. Filing with the bankruptcy court on January 13, the mining arm of the bankrupt company said it was looking to sell about 2,687 rigs of Bitcoin miners to an investment company called Touzi Capital.

Earlier this month, the founder and Chief Executive Officer (CEO) of the bankrupt lending firm, Alex Mashinsky, was sued by New York Attorney General Letitia James.

According to James, Alex was responsible for defrauding hundreds of thousands of customers and sought to bank him from conducting business in New York again, along with recovering the losses faced by the investors.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 meme coins price prediction Dogecoin, Shiba Inu, Bonk: Memes face steeper correction than Bitcoin

Dogecoin eyes February lows after nearly 23% decline in the past seven days. Shiba Inu could plummet another 13% amid the broader crypto market correction. Bonk price is likely to regain lost ground as technical indicators point at recovery.

XRP sustains above $0.50 as traders digest news of Ripple XRP Ledger entry in the Japanese market

Ripple (XRP) sustained above $0.50, a key support level, on Wednesday. XRP price is down nearly 6% in the past ten days. The altcoin is in a confirmed downward trend, and wiped out all gains since February.

Optimism OP struggles to gain momentum despite alleged $90 million OP purchase by a16z

Venture capital firm a16z has purchased $90 million in OP tokens under a two-year vesting period, Unchained crypto reports. Sources told Unchained Crypto that Optimism has done well and the project is still doing airdrops.

Sei price action forecasts an opportunity to accumulate SEI Premium

Sei (SEI) price is at a crossroads and could trigger a steep correction or potential bounce after setting up an all-time high (ATH) of $1.145 roughly a month ago. Based on the Bitcoin price action, a potential bounce will likely occur anytime now.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.