Crypto AI tokens outperform several altcoins with price rally: TAO, AKT, PRIME, AGIX

- The Artificial-Intelligence narrative gains popularity: Bittensor, Akash Network, Echelon Prime and Singularity NET prices rally.

- TAO, AKT, PRIME and AGIX prices rallied between 2% and 7% in the past day.

- Crypto experts note that their AI token holdings are likely to outperform altcoins in their portfolio.

Artificial intelligence tokens are making a comeback with their price rallies and crypto experts believe a crypto AI wave is ready to kick off soon. Bittensor (TAO) has taken the lead with several developments and updates in its ecosystem.

In the past 24 hours, TAO, Akash Network (AKT), Echelon Prime (PRIME) and Singularity NET (AGIX) prices rallied up to 7%, leaving top altcoins like Binance Coin (BNB), Solana (SOL) and Tron (TRX) to bite the dust.

Also read: XRP price rallies to $0.5590 amidst on-chain activity surge, following Bitcoin's rally to $52,500

Bitcoin price rally catalyzes gains in AI tokens

Bitcoin price tackled resistance and hit a local peak of $52,500 on Thursday. The largest asset by market capitalization’s price rally catalyzed gains in several altcoins in the ecosystem. AI tokens like TAO, AKT, PRIME and AGIX stand out with between 2% and 7% gains in the past 24 hours.

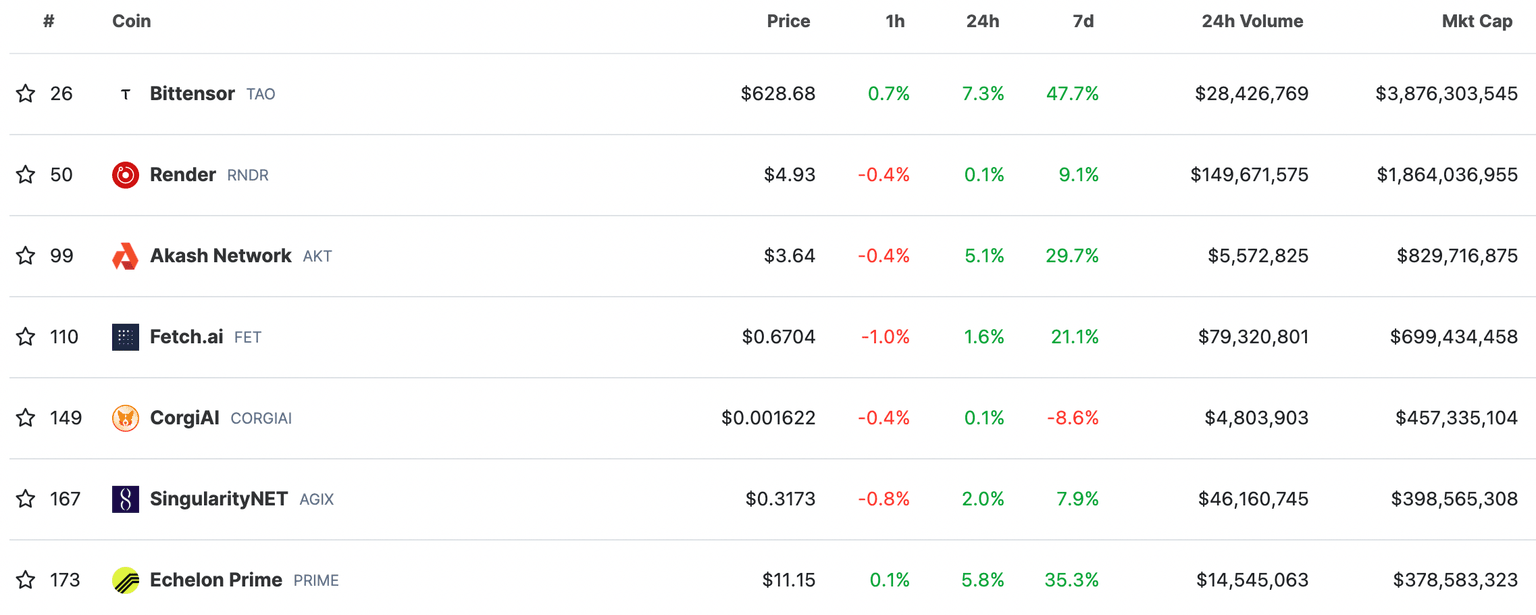

TAO, AKT, PRIME and AGIX prices rallied 7.3%, 5.1%, 5.8% and 2.0% respectively, as seen on CoinGecko.

AI token price rally. Source: CoinGecko

Several recent developments in Bittensor support TAO’s price rally. Four key projects are building on TAO:

- AIT, the world’s first AI data infrastructure

- KIZUNA, an ERC-20 decentralized AI token

- ROKO, a protocol building reality augmenting simulations

- TPAD, a Bittensor focused launchpad for projects

These projects are launched in order of market capitalization and not all have launched yet. However, crypto experts are keeping their eyes peeled for developments in Bittensor as projects line up for release in the coming weeks and months.

VanEck, an ETF and fund management firm, recently labeled “Bittensor” as the “Bitcoin” of machine intelligence, when describing the project.

VanEck calls Bittensor the #Bitcoin of machine intelligence $TAO pic.twitter.com/GuUAphXrur

— Quinten | 048.eth (@QuintenFrancois) February 14, 2024

Developments such as this continue to support TAO price gains and boost its relevance among market participants.

Crypto analyst behind the X handle @EricCryptoman recently observed that AI tokens in their crypto portfolio are likely to outperform other assets in the portfolio.

Feel like my AI bags are going to continue to drastically over perform vs the rest of my portfolio.

— Eric Cryptoman (@EricCryptoman) February 15, 2024

Quite obvious the potential & demand for this sector is insane.

Betting big on high/mid: $TAO $AIT $OPTI $COMAI $PAAL

Low cap: $WBAI $TPAD $CX $SENT $AEGIS $SCANS $ENCR $xALPHA pic.twitter.com/gE1qsGDbF2

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.