Cosmos price might have reached a local top after ATOM's massive 200% rally

- Cosmos price had a significant 200% rally to $26.55 on February 16.

- The digital asset is potentially bound for a short-term correction after such a run.

- A key indicator has presented a sell signal on the 4-hour chart.

Since the beginning of February, Cosmos price has increased by more than 200% reaching a potential local top of $26.55. The digital asset seems poised for a pullback considering the magnitude of the previous rally.

Cosmos price can dive towards $21.7 in the short-term

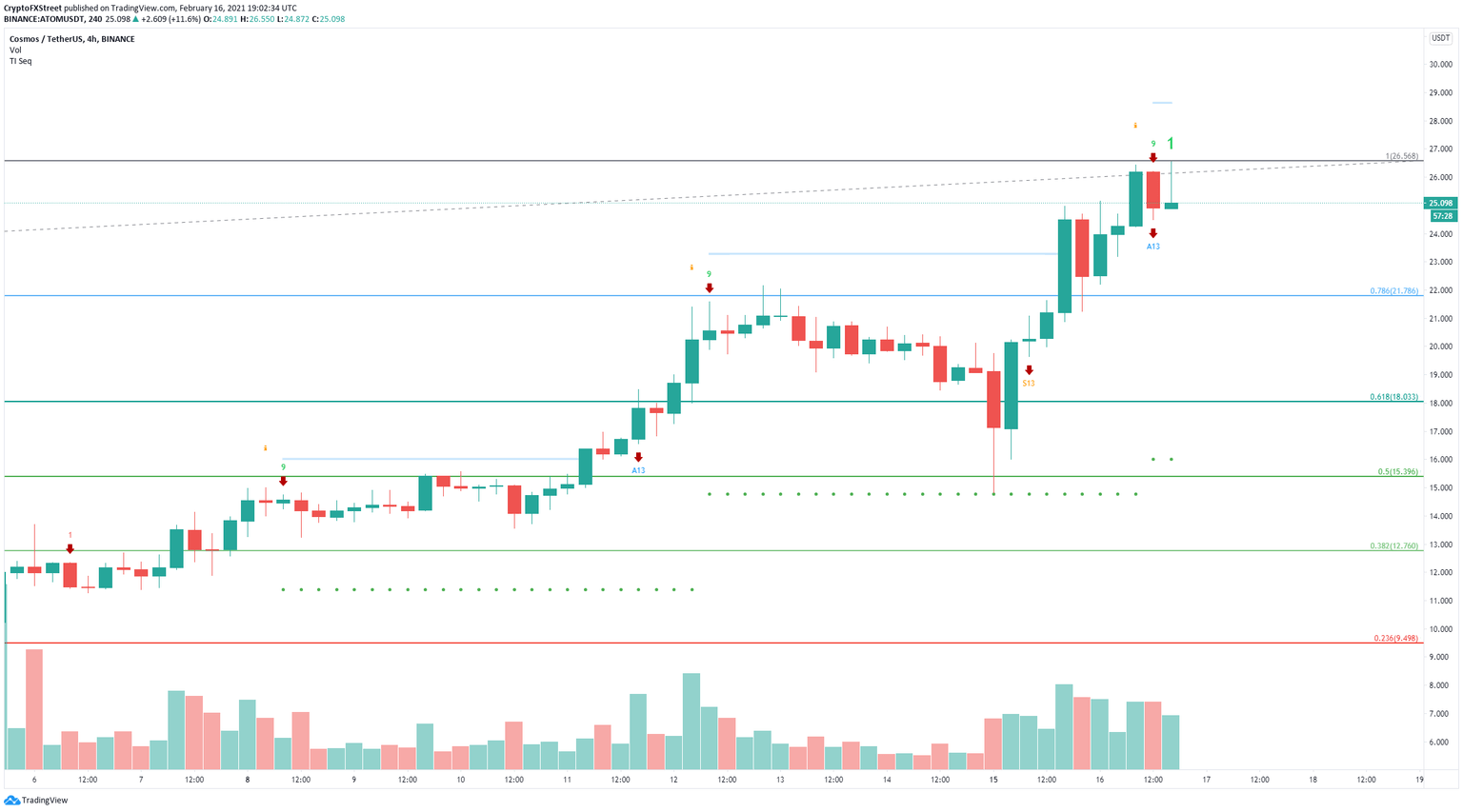

On the 4-hour chart, the TD Sequential indicator has just presented a sell signal at the top which indicates that Cosmos price could be poised for a correction. Using the Fibonacci Retracement tool, we can calculate several price targets for the bears.

ATOM/USD 4-hour chart

The nearest price target is $21.78 which is the 78.6% fib level followed by $18 at the 61.8% point. Losing both levels would drive Cosmos price down to $15.39 at the 50% Fibonacci retracement level.

ATOM/USD 4-hour chart

To invalidate the bearish outlook and sell signal, ATOM bulls must push Cosmos price above the high at $26.2 with a 4-hour candlestick close. A breakout above $26.55 would drive Cosmos up to $32.64, at the 127.2% Fibonacci level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.