Compound’s “Gateway” launch could boost COMP price by roughly 70%

- Compound announced the launch of a new project, “Gateway,” running on the Ethereum Ropsten Testnet.

- Token holders will play a critical role in governing the new platform.

- COMP price might shatter a key supply barrier at $535 as speculation mounts.

Compound could experience a boost in utility and volatility after the release of a new cross-chain interest rate market.

Gateway to initiate cross-chain interest rate market

Compound announced “Gateway,” a substrate blockchain that will be governed by COMP token holders on the Ethereum network but will be upgradeable via Compound Protocol’s Governance mechanism, without the need for downtimes or hard forks.

Running on the Ethereum Ropsten Testnet, Gateway is essentially an open, distributed ledger for the cross-chain interest rate market. Participants will be able to use collaterals from different blockchains directly via Gateway.

The team behind the project added,

“Gateway will evolve into the backbone of a global interest rate market, capable of supporting any asset — including the wave of currencies, assets, and tokens yet to be created.”

Since the COMP token will play a key role in Gateway, it may encourage users to accumulate this cryptocurrency to be able to participate in the governance of the project. Such a potential spike in demand could have serious implications on Compound price.

Compound price on the verge of lift-off

Compound price has been rejected several times by a key level resistance at $535. But after the launch of Gateway, COMP may finally break through this hurdle as investors rush to exchanges to buy this altcoin to participate in the new project.

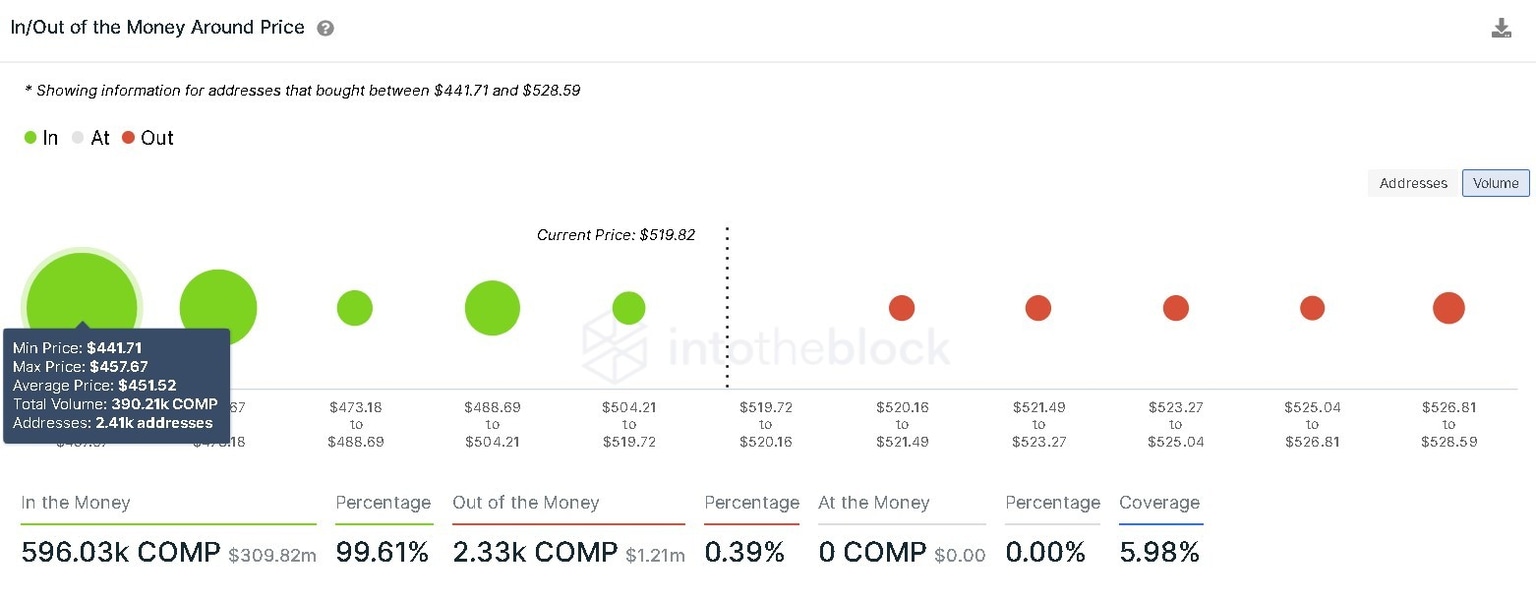

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows little to no resistance ahead of Compound price that may prevent it from advancing further if buy orders begin to pile up.

Therefore, a daily candlestick close above $535 could lead to a 35% upswing towards $736. If this bullish momentum persists, then Compound price could extend up to $915, which would be a 70% surge from $535.

Compound IOMAP chart

However, a rejection at the $535 or loss of bullish momentum may lead to a pullback to $451. The IOMAP cohorts show that 2,400 addresses hold 390,000 COMP tokens around this price level.

A daily candlestick close below this level could extend Compound price correction to the 50-day moving average at $360.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.