Coinbase stock trading volume skyrockets, outpaces Bitcoin, Ethereum after Binance capitulation

- Coinbase stock is up almost 300% in 2023, outpacing Bitcoin and Ether's growth of 130% and 75%.

- Among the drivers for the surge is skyrocketing trading volumes, Q4 numbers stand out with one month to go.

- It comes amid expectation that Coinbase could be the frontrunner after the legal troubles of its industry peer Binance.

Coinbase (COIN) stock has been in an uptrend since late October. COIN stock has gained strength as the US-based exchange gained favor while the sun set on its industry peer and market rival Binance.

Also Read: Coinbase seen as clear frontrunner after Binance, Changpeng Zhao capitulate to US DoJ

Coinbase stock skyrockets

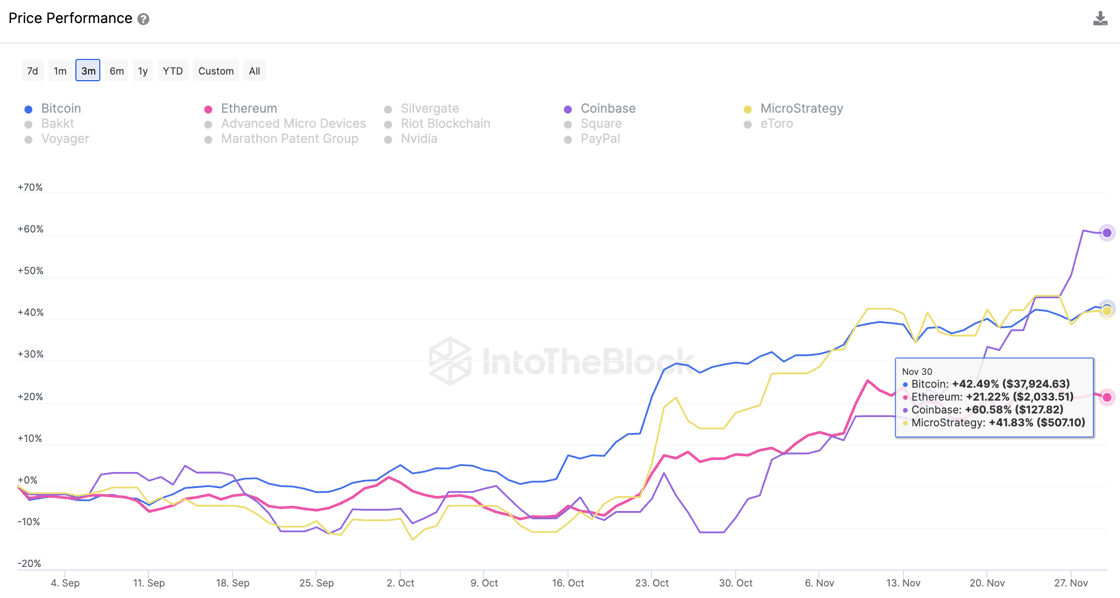

Coinbase was touted as the clear chalk, betting favorite, or in simple terms, the best bet. This follows Binance’s and former CEO Changpeng Zhao’s (CZ) capitulation to the US Department of Justice (DoJ). Evidence of this has been reported by on-chain aggregator IntoTheBlock, showing that the exchange’s stock, COIN, is up 300% this year, outpacing both Bitcoin (BTC) and Ethereum (ETH), which are up 130% and 75% year to date.

Price performance: COIN, BTC, ETH, MicroStrategy

The data aggregator indicates that with the 300% value surge this year, trading volume has played a key role in driving the price. Fourth-quarter volumes have already surpassed what was recorded in the third quarter despite there being one full month to go before the final quarter ends.

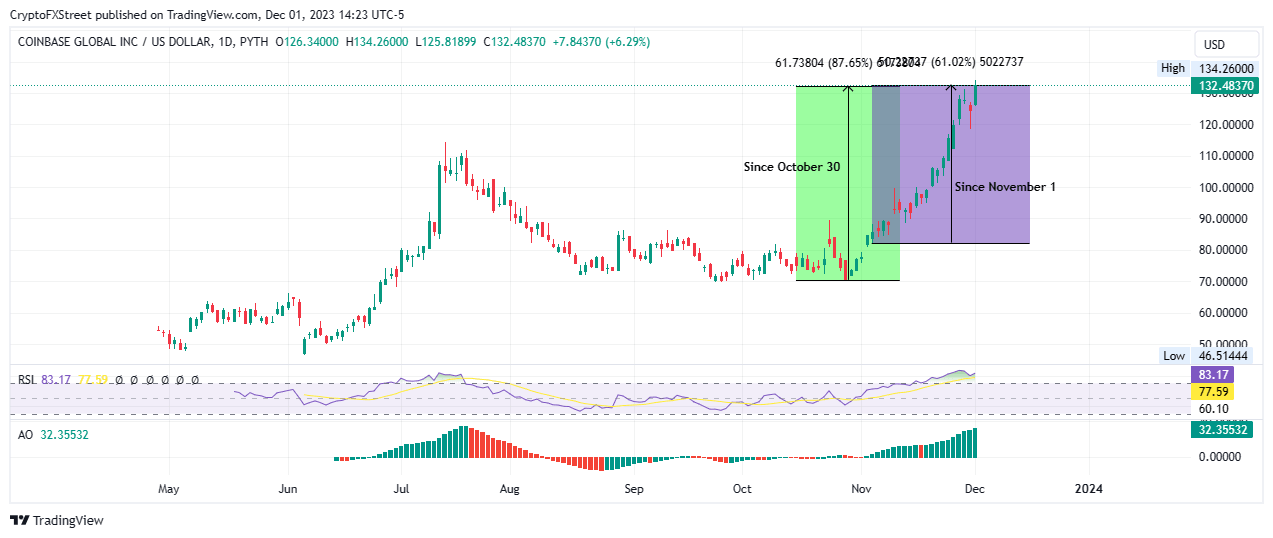

The COIN chart on TradingView corroborates this outlook, showing a steep climb in COIN’s share price in Q4. Specifically, it shows an 87% value surge since October 30 and a 61% rally since November 1.

COIN is already massively overbought, evidenced by the position of the Relative Strength Index (RSI) above 70. Nevertheless, the inclination of this momentum indicator shows that there could still be more upside potential.

Similarly, the Awesome Oscillator (AO) indicator is in positive territory with green-soaked histogram bars demonstrating that bulls have control of the COIN market.

TradingView: COIN 1-day chart

Coinbase CEO advertises the exchange at Binance’s expense

It should be noted that Coinbase CEO Brian Armstrong already pedaled the exchange following Binance’s bubble bursting on November 21, saying, “We now have an opportunity to start a new chapter for this industry…Americans should not have to go to offshore, unregulated exchanges to benefit from this technology.”

Armstrong touted the US as the rightful hub for crypto, highlighting that Coinbase believes in economic freedom and that the US democratic system will eventually get things right.

Since the founding of Coinbase back in 2012 we have taken a long-term view. I knew we needed to embrace compliance to become a generational company that stood the test of time. We got the licenses, hired the compliance and legal teams, and made it clear our brand was about trust…

— Brian Armstrong ️ (@brian_armstrong) November 21, 2023

Ripple lawyer John E. Deaton corroborated the allusion. He attributed the assumption to the fact that the exchange has been named in the surveillance sharing agreement (SSA) of multiple institutional players that have filed for spot Bitcoin exchange-traded funds (ETF) with the US Securities & Exchange Commission (SEC), as indicated on NASDAQ's 19b-4 form.

@coinbase will be a big winner. I expect to see BlackRock and Vanguard buy more. Btw, 90% of @GaryGensler’s $120M fortune is with Vanguard. See how this works, yet? https://t.co/WHWGNY4vQJ

— John E Deaton (@JohnEDeaton1) November 21, 2023

Nevertheless, Coinbase is not free of its own regulatory troubles. In a recent event, the exchange was found guilty of administrative offense and fined 1 million Rubles in Russia for non-compliance. This is aside from its ongoing contention with the SEC over securities law violations.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.