Coinbase CEO says the exchange won't list Monero due to regulatory concerns

- Coinbase CEO Brian Armstrong said that the exchange will not list Monero (XMR) due to regulatory issues.

- He said that as privacy coins gain wider acceptance, Coinbase’s team would consider listing them.

- Huobi and Bithumb exchanges delisted XRM earlier following negative allegations.

- XMR/USD goes up by 14.10% over the last five days.

Brian Armstrong, the CEO of Coinbase, has said that the exchange will not be listing Monero (XMR) due to regulatory concerns. In a recent episode of “What Bitcoin Did” with Peter McCormack, Armstrong said that US regulators haven’t wholly accepted privacy coins such as Monero. He told McCormack that as privacy coins gain wider acceptance, Coinbase’s team would consider listing them:

I think with enough time and education, people will get comfortable enough with it. Privacy coins will become more mainstream over time I hope, and maybe more privacy solutions on Bitcoin too.

Monero is increasingly becoming the choice of cryptocurrency for fraudsters and hackers. According to an earlier Cointelegraph report, hackers responsible for a Ransomware attack on Argentina's largest telecommunications firm demanded $7.5 million in XMR (100,000 tokens). Earlier this year, popular exchanges such as Bithumb and Huobi announced that they would be delisting XMR as the token faced allegations that it was used for criminal acts.

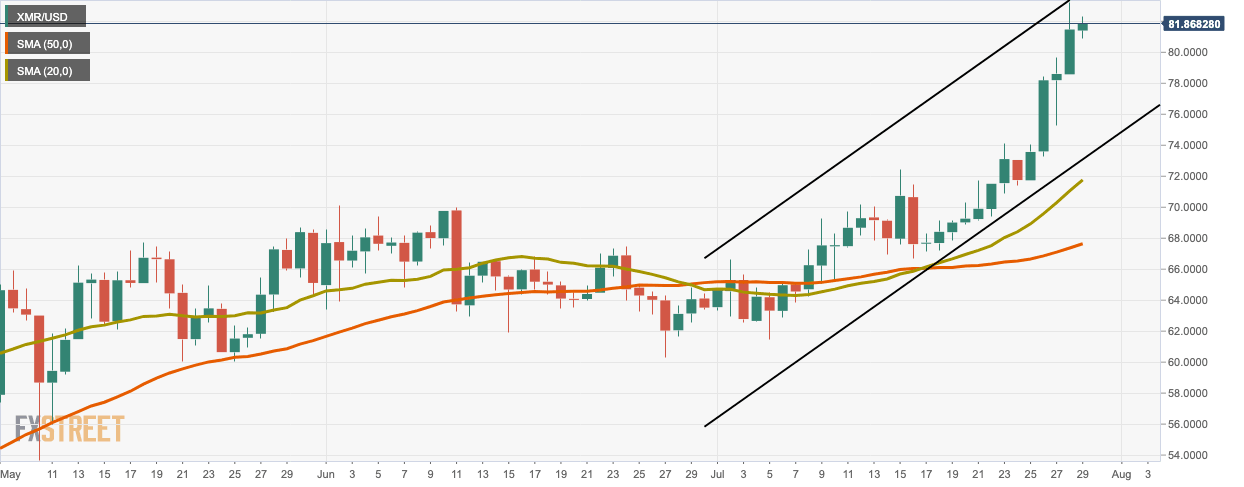

XMR/USD daily chart

There have been no negative effects on XMR/USD's price action. In fact, the price has managed to do five straight bullish days. During this time period, the price has jumped from $71.75 to $81.87, going up by 14.10%.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.