Chiliz rallies to six week high on the weekend as whales accumulate over 1.6 billion CHZ

- Chiliz rallied to $0.143 on Saturday, May 25, a near six week high for the sports blockchain token.

- Whale wallets have consistently accumulated Chiliz over the past eight days, scooping up 1.6 billion CHZ.

- Chiliz adds nearly 1% to its value on Monday, sustaining 18.45% gains from the week.

Chiliz (CHZ) climbed to a near six-week peak of $0.143 on Saturday, May 25. The sports blockchain token has observed a stark increase in whale wallet accumulation of CHZ.

Chiliz added nearly 1% to its value on May 27, and held on to the gains of 18.45% from the week, on Binance.

Chiliz sees surge in on-chain metrics, trade volume and supply distribution

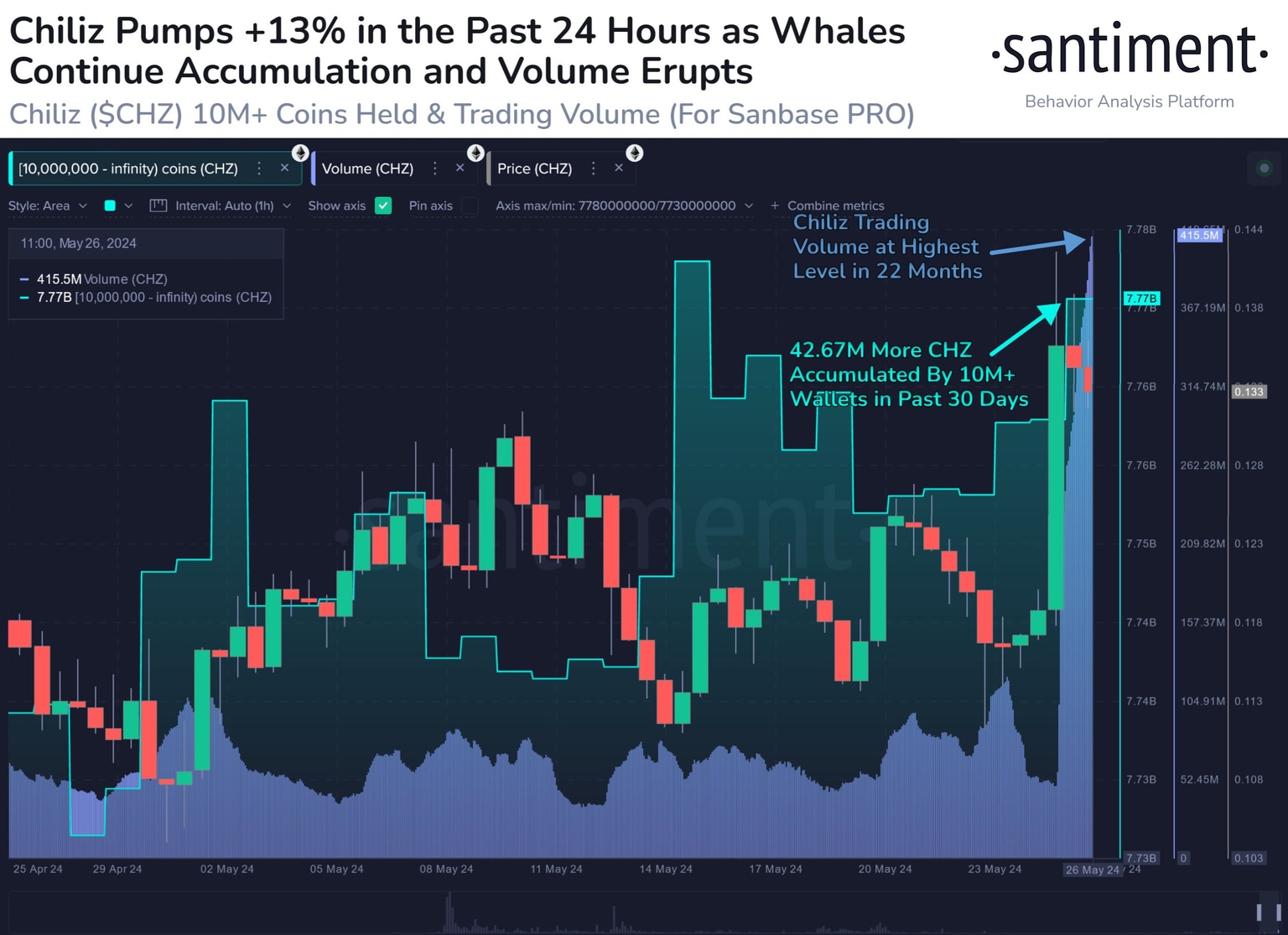

Data from crypto intelligence tracker Santiment shows that wallets in two segments, one holding between 10 million and 100 million CHZ tokens and the other holding between 1 billion and infinity Chiliz, have accumulated the sports blockchain asset in the past eight days.

Typically, whale accumulation supports a bullish thesis for an asset.

Between May 19 and 27,

- Whale wallets holding between 10 million and 100 million CHZ added 180 million CHZ

- Whale wallets holding between 1 billion and infinity tokens added 1.44 billion CHZ

The data is from the Santiment CHZ supply distribution chart, as seen below.

CHZ supply distribution

Analysts at Santiment noted a surge in trade volume, hitting the highest level seen in 22 months, alongside whale wallet accumulation, on Sunday, May 26. Higher trade volume indicates there is a higher number of CHZ’s buyers and sellers in the market, the sports blockchain token is gaining traction among market participants.

CHZ trading volume, price rallies alongside whale accumulation

Chiliz extended gains from the week, adding 1% to its value on Monday. At the time of writing, CHZ price is $0.1349 on Binance.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B09.32.46%2C%252027%2520May%2C%25202024%5D-638523855037683957.png&w=1536&q=95)