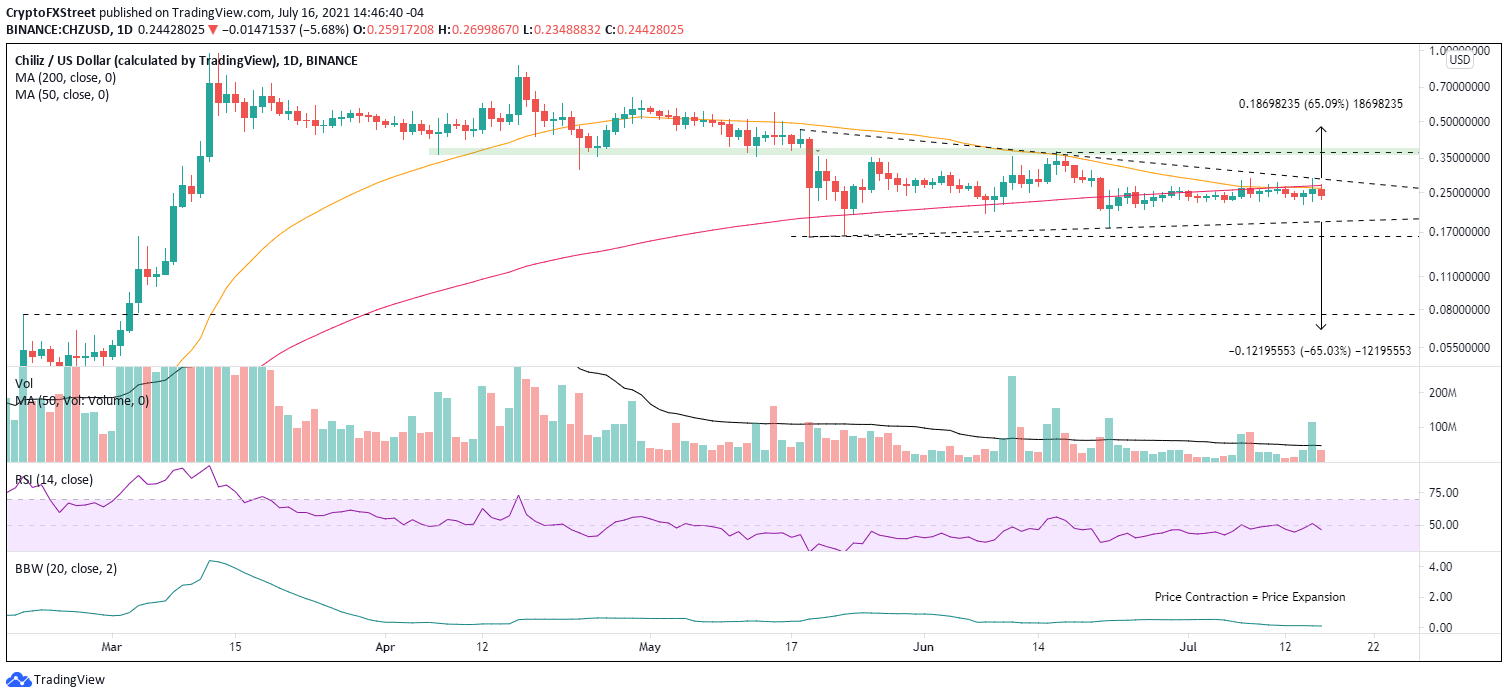

Chiliz Price Prediction: CHZ price structure dictates a 65% move

- Chiliz price continues to coil, framing a symmetrical triangle pattern.

- CHZ is struggling with the resistance provided by the strategically important 200-day simple moving average (SMA).

- A bearish Death Cross pattern triggered on July 13, amping the downward pressure on the altcoin.

Chiliz price has coiled since the May 19 low, particularly since the sharp drop on June 21, pushing the Bollinger Band Width (BBW) down to the lowest level since October 27, 2020. The magnitude of the price contraction suggests that the resolution of the developing symmetrical triangle pattern will be impulsive and definitive. At the same time, as long as CHZ is controlled by the magnet effect of the 200-day SMA, the outlook is neutral.

Chiliz price churn tormenting the long-term investor

Chiliz price has transacted in a very tight range along the 200-day SMA since June 23, avoiding the new drops to test the June 22 lows that have dominated most altcoins’ price action. The result of the tightening CHZ range has been the formation of a large symmetrical triangle, with a projected measured move of 65%.

A decline of 65% would place Chiliz price at $0.065, erasing a large portion of the 2021 gains. Points of credible support are the May 19 low of $0.163, the 50-week SMA at $0.161 and the February 19 high of $0.076. The intersection of the May 19 low and the 50-week SMA will be exceptional support and may prevent a larger CHZ decline. If that is the case, it will represent a minor drop of 13% from the symmetrical triangle’s lower trend line.

Suppose Chiliz price can overcome the persistent resistance of the 200-day SMA at $0.268 and break out from the symmetrical triangle. In that case, CHZ will discover resistance at the June 16 high of $0.372, which harmonizes with price congestion going back to April 7. If the price area is discarded, the digital asset can pursue the measured move price target of $0.474. Still, the rally would leave Chiliz price well below the all-time high of $0.975 printed on March 12.

CHZ/USD daily chart

With the Bollinger Band Width (BBW) showing notable price contraction on a relative basis, the probability of the pattern resolution taking an impulsive tone is high. It will be the first time in weeks that longer-term investors, bullish or bearish, have an opportunity to participate in a sustainable CHZ move that offers portfolio-changing returns.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.