Chiliz Price Prediction: CHZ at risk of major drop according to technicals

- Chiliz price had a massive 277% explosion in the past week thanks to fan tokens.

- The digital asset faces strong selling pressure in the short-term according to various indicators.

- Whales have been selling significant sums of CHZ tokens in the past several days.

Chiliz had one of the biggest breakouts in the crypto market on March 11, jumping by 277% in just 48 hours. The digital asset is down 33% since the peak and could be poised for more downside action as it still faces a lot of selling pressure.

Chiliz price at risk of falling lower

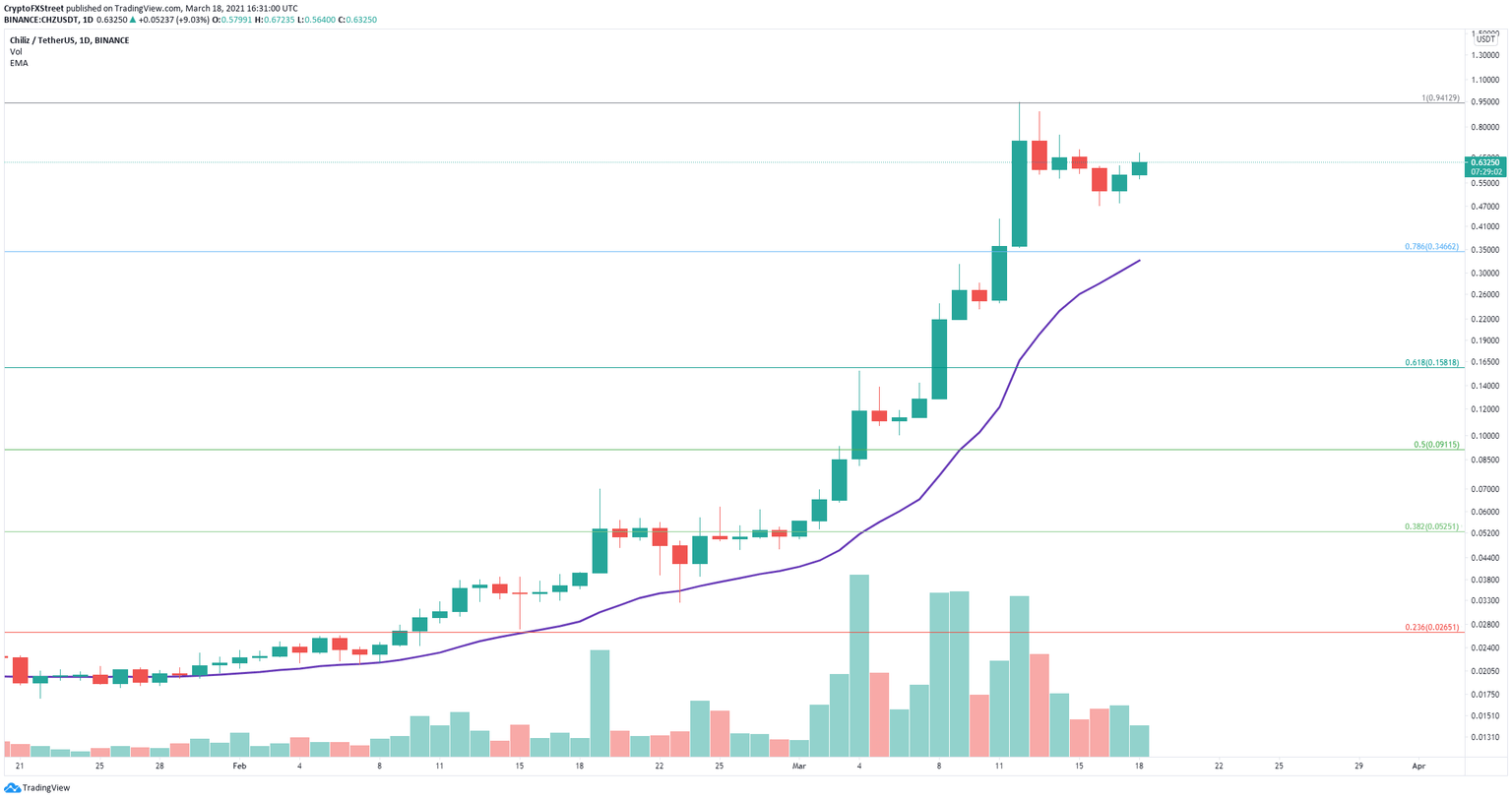

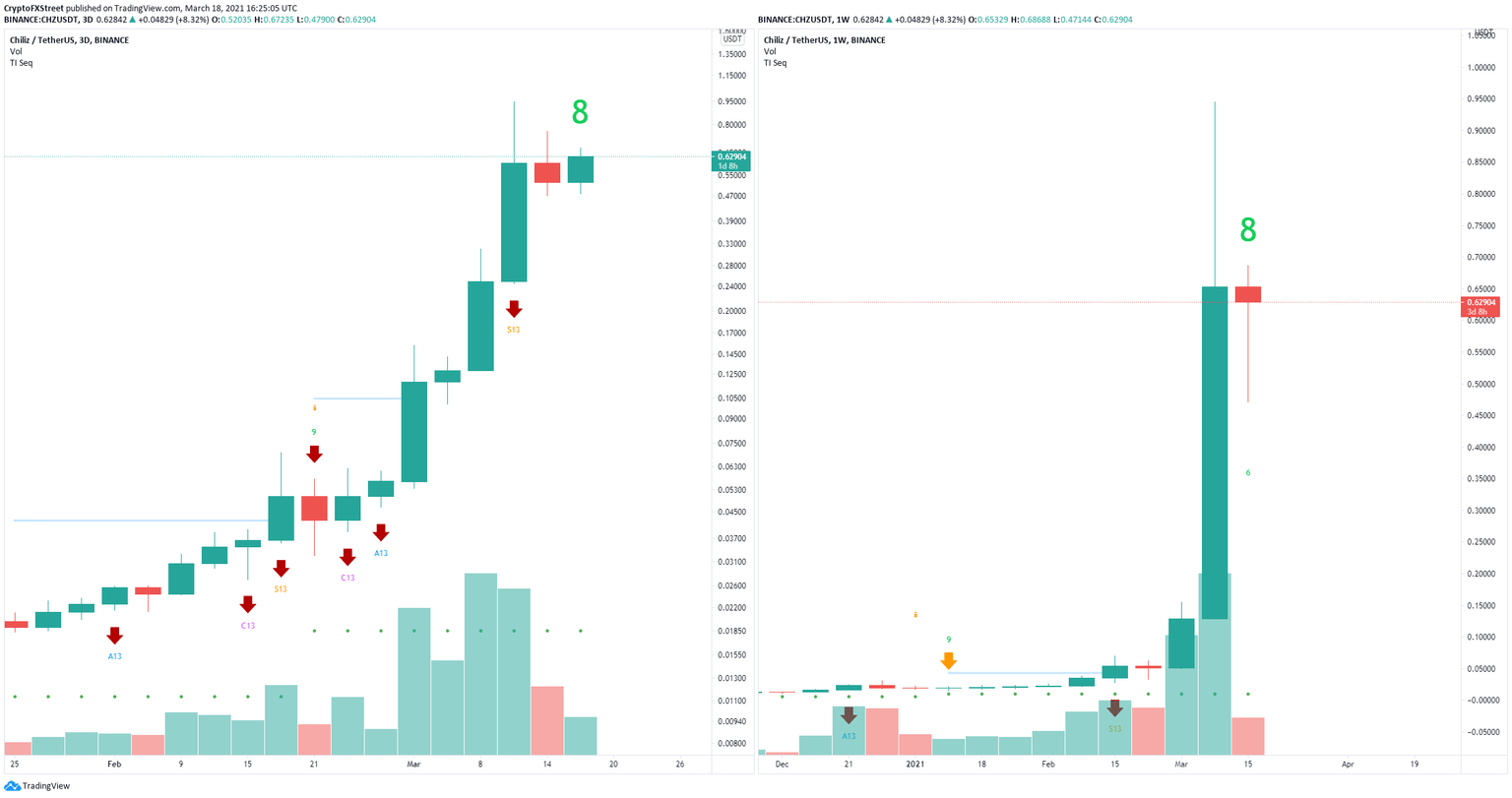

The TD Sequential indicator has presented two green ‘8’ candlesticks on the 3-day and weekly charts. These are usually followed by sell signals; however, that’s not yet confirmed, but it’s still notable.

CHZ Sell Signals

Perhaps the most concerning metric in the short-term is the decline in the number of whales which have been profit-taking. Since March 13, the number of large holders with 1,000,000 to 10,000,000 tokens dropped by 23. Similarly, the amount of whales with at least 10,000,000 coins also dropped by seven.

CHZ Holders Distribution chart

Validation of both sell signals mentioned above has the potential to drive Chiliz price down to $0.346 which is the 78.6% Fibonacci retracement level and the 26-EMA on the daily chart. Before this point, there is a strong support area between $0.50 and $0.47.

CHZ daily chart

However, it’s also important to note that CHZ bulls face weak resistance ahead despite the current selling pressure.

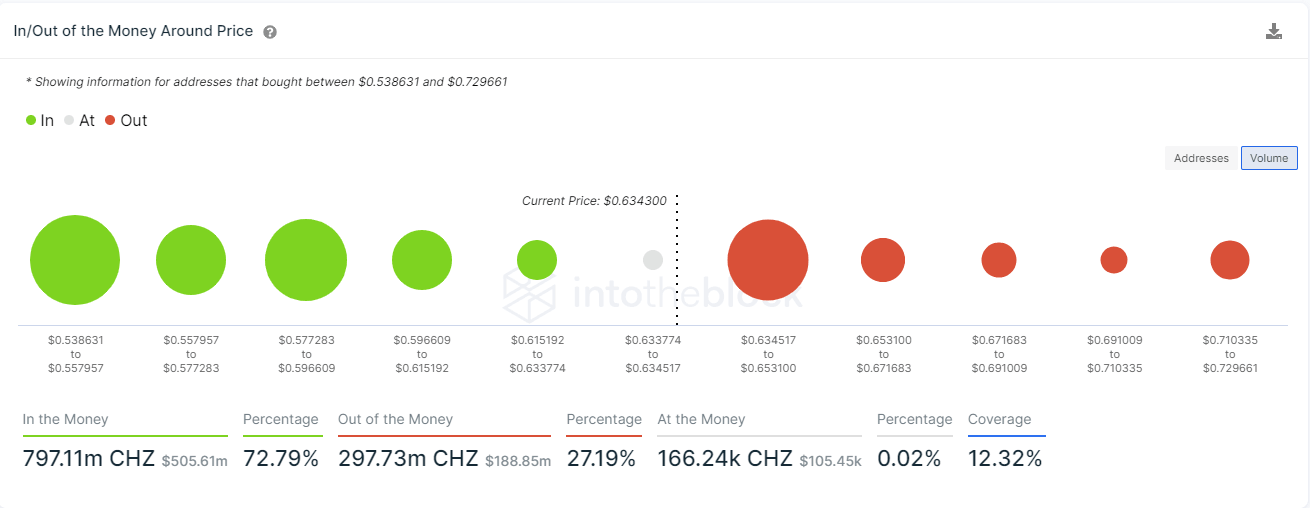

CHZ IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows only one critical resistance area between $0.0634 and $0.0653 where 4,130 addresses provided over 220 million CHZ in volume. A breakout above this key point would push Chiliz price towards $0.073.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B17.26.30%2C%252018%2520Mar%2C%25202021%5D-637516830391145778.png&w=1536&q=95)