Chainlink price rising by 8% in 24 hours, triggers profit-taking

- Chainlink price charting green candles over the last two days has led to a three-week high.

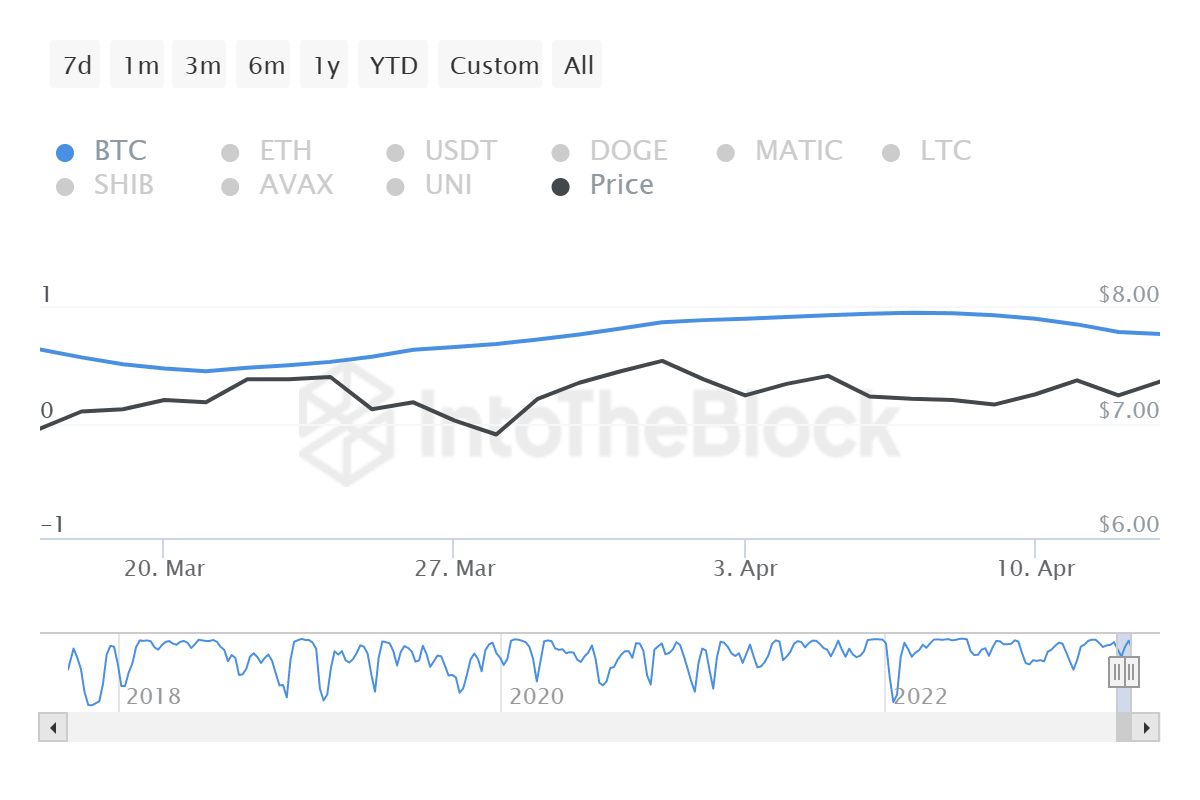

- LINK holds a correlation with BTC of 0.77, which means that the altcoin is likely to follow Bitcoin’s lead going forward.

- Investors could quickly turn to profit-taking as LINK stands to potentially mark a rally to $15.

-637336005550289133_XtraLarge.jpg)

Chainlink price broke out of its multi-week barrier during the intra-day trading hours on April 14. With multiple altcoins breaking out this week thanks to Bitcoin and Ethereum’s lead, it seems like profits might be on the way. And investors are not shying away from claiming them either.

Chainlink price rise could bring heavy selling

Chainlink price noted an 8% increase in price over the last 24 hours and the altcoin even reached $7.9 at its highest. This rise led to investors selling some of their holdings for profit as about 650,000 LINK worth over $5.06 million were moved back into the exchange wallets.

This reaction is not particularly surprising as LINK holders were bound to make a move since they had been accumulating throughout the month of March. In the span of 31 days, more than $95.3 million worth of tokens were acquired by investors who were preparing for a potential rally.

Chainlink supply on exchanges

According to analyst Michael Van de Poppe, Chainlink price is susceptible to a rally, and if the altcoin moves per expectations going forward, LINK could even shoot up to the range of $15 to $20.

#Chainlink starts to look great.

— Michaël van de Poppe (@CryptoMichNL) April 14, 2023

Bullish divergence on the daily chart implying that we're reversing from here.

Finally a breakout from the range to $15-20 to be occurring. pic.twitter.com/7c6oFpaWqS

The rally would have a lot to do with the biggest cryptocurrency in the world, Bitcoin itself. Since BTC has breached the $30,000 mark and it is forecasted to continue its rally, it could have an impact on LINK too. The altcoin holds a correlation coefficient of 0.77 with BTC, which suggests Chainlink could follow Bitcoin’s lead.

Chainlink correlation with Bitcoin

Furthermore, if the analyst’s prediction of the rally does come true, investors would be able to unlock more than 65 million LINK, which has been sitting in losses for a while now. A rally to $15 would thus generate an overall profit of nearly $500 million.

Chainlink GIOM

This could potentially trigger selling in the market, further substantiating the investors’ current sentiment of profit-taking.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B21.58.52%2C%252014%2520Apr%2C%25202023%5D-638170885689484269.png&w=1536&q=95)