Chainlink price readies for 10% gains as LINK staking v0.2 priority migration goes live

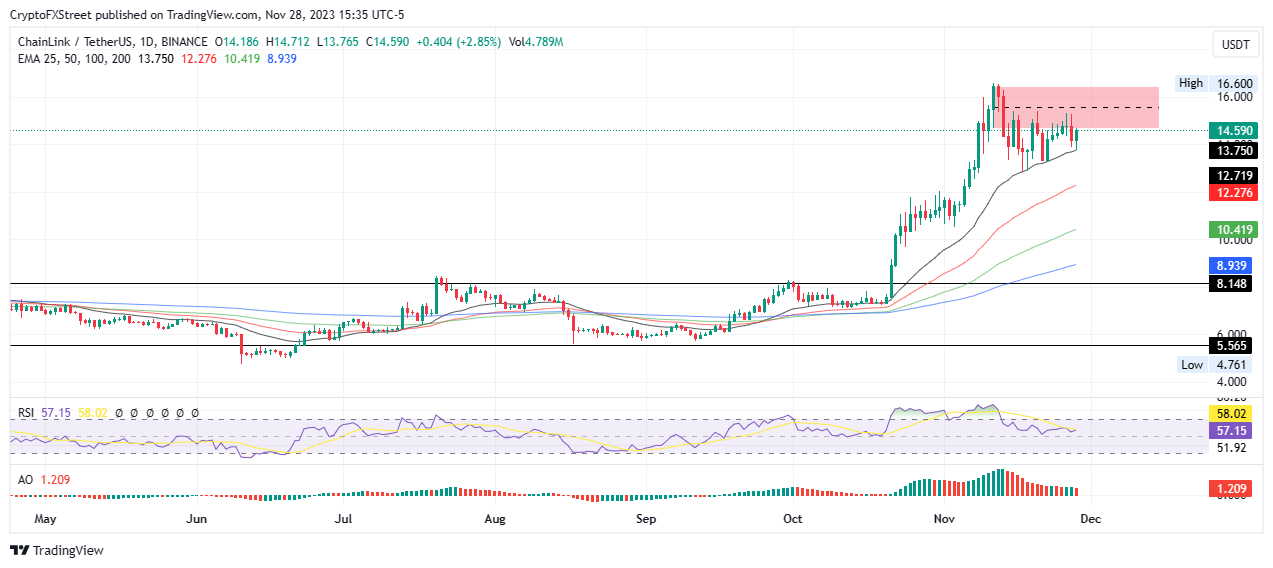

- Chainlink price has found support at the 25-day EMA at $13.748, coming on the back of the v0.2 priority migration launch.

- The migration brings greater flexibility for stakers, improved security guarantees, modular architecture, and dynamic rewards mechanism.

- LINK could climb 10%, testing the midline of the supply zone, or extrapolate the gains to the $16.600 range high.

- The bullish thesis will be invalidated upon a daily candlestick close below the 25-day EMA at $13.748.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) price remains bullish, despite broader market volatility after the shake-up resulting from the Binance exchange’s regulatory troubles and the exchange-traded funds (ETFs) narrative. In the latest, the LINK token bullishness led to a bounce above a crucial support, steered by optimism from the launch of the chainlink staking v0.2 priority migration.

Chainlink staking v0.2 goes live

Chainlink (LINK) v0.2 migration has gone live, with the upgrade introducing a staking platform that ensures stakers enjoy greater flexibility. It also delivers improved security guarantees, a modular architecture, and a dynamic rewards mechanism.

#Chainlink Staking v0.2 is officially live on mainnet ⬡

— Chainlink (@chainlink) November 28, 2023

Starting today, existing v0.1 stakers have a nine-day window to migrate their staked LINK and accrued rewards to the 45M LINK v0.2 pool, with guaranteed access before Early Access begins.

https://t.co/pcFAVXct3L

Marking the latest upgrade to the protocol's native staking mechanism, the v0.2 upgrade launch kicks off with a nine-day “Priority Migration” period for existing v0.1 stakers. During this time, these stakers are allowed to move their staked LINK tokens as well as rewards to v0.2.

The upgrade aims to enhance access to a broader scope of participants steadily. Notably, Early Access and General Access will begin between December 7 and December 11 respectively.

Chainlink price eyes 10% gains amid migration hype

Chainlink (LINK) price is sitting atop the 25-day Exponential Moving Average (EMA), which is providing support at $13.750. Broadly, the trajectory of the EMAs to the north, coupled with that of the Relative Strength Index (RSI), shows the north is the path with the least resistance.

Increased buying pressure could see Chainlink price foray into the supply zone, which stretches from $14.691 to $16.477. To confirm the continuation of the move north, LINK price must break and close above the midline of the aforementioned order block above $15.576.

In a highly bullish case, Chainlink price could extend a neck higher, flipping the supply zone into a bullish breaker as it extends to test the $16.600 range high. Such a move would denote a 13% climb above current levels.

The RSI supports the bullish thesis, deviating to the north to show momentum is rising. If this trajectory continues, it would soon cross above the signal line (yellow band), a move that has historically panned out as a buy signal, with a bold move north following.

Also, the Awesome Oscillator (AO) remains above the midline in the positive territory, showing the bulls are heading the LINK market. These add credence to the bullish thesis.

LINK/USDT 1-day chart

On the flipside, if profit booking abounds, Chainlink price could easily slip below the 25-day EMA at $13.750. This could expose it to the 50-, 100-, and 200-day EMAs for support at $12.276, $10.419, and $8.939 levels respectively. If these buyer congestion levels fail to hold, LINK market value could revisit the early October highs at $8.148, potentially plunging back into the consolidation phase above $5.565.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.