Chainlink Price Prediction: LINK remains indecisive, but 20% move likely

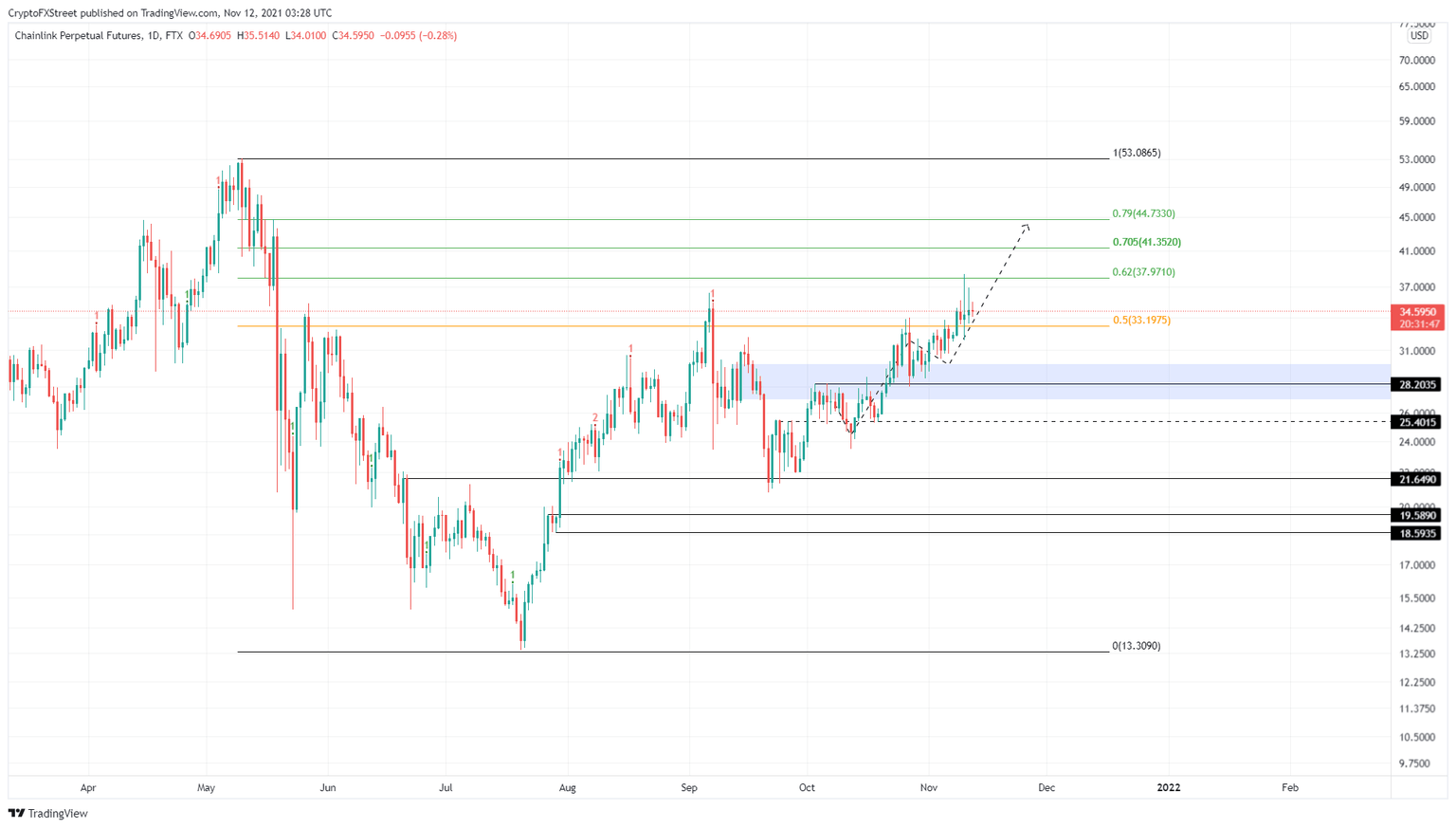

- Chainlink price is currently hovering above the 50% Fibonacci retracement level at $33.19 with no directional bias.

- Investors can expect LINK to make a 20% move depending on how the $33.19 support level holds.

- A breakdown of the $25.40 demand barrier will trigger further descent.

-637336005550289133_XtraLarge.jpg)

Chainlink price is facing massive pressure from both camps, resulting in indecisive moves. Currently, LINK is hovering above a crucial barrier but has no directional bias whatsoever. Therefore, market participants can expect the altcoin to reach for the immediate barriers.

Chainlink price remains uninteresting

Chainlink price seems to be facing pressure from buyers and sellers, leading to a series of candlesticks with small bodies and massive wicks. However, one upside to this situation is that Chainlink price has produced a daily close above the 50% Fibonacci retracement level at $33.19.

This move suggests that Chainlink price is on an uptrend, and the odds are tilted toward a bullish move. However, for this bullishness to manifest, LINK needs to stay above $33.19. In this situation, a potential spike in buying pressure is likely to trigger a 20% upswing to $41.35, coinciding with the 70.5% Fibonacci retracement level.

In the case that the buying pressure persists, Chainlink price could extend its run-up to the next level at $44.73.

LINK/USDT 1-day chart

While the upswing narrative rests on the fact that Chainlink price needs to hold above $33.19, a lower low below it will imply that a correction is possible. This move will drive LINK to the demand zone that ranges from $27.01 to $9.79.

This area of support harbors a stable foothold at $28.20, constituting a 20% downswing from the current position. Here, Chainlink price could give the upswing narrative another chance. However, if the buying pressure fails to make a comeback, LINK could revisit the $25.40 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.