Chainlink Price Forecast: LINK remains bullish despite 34% pullback

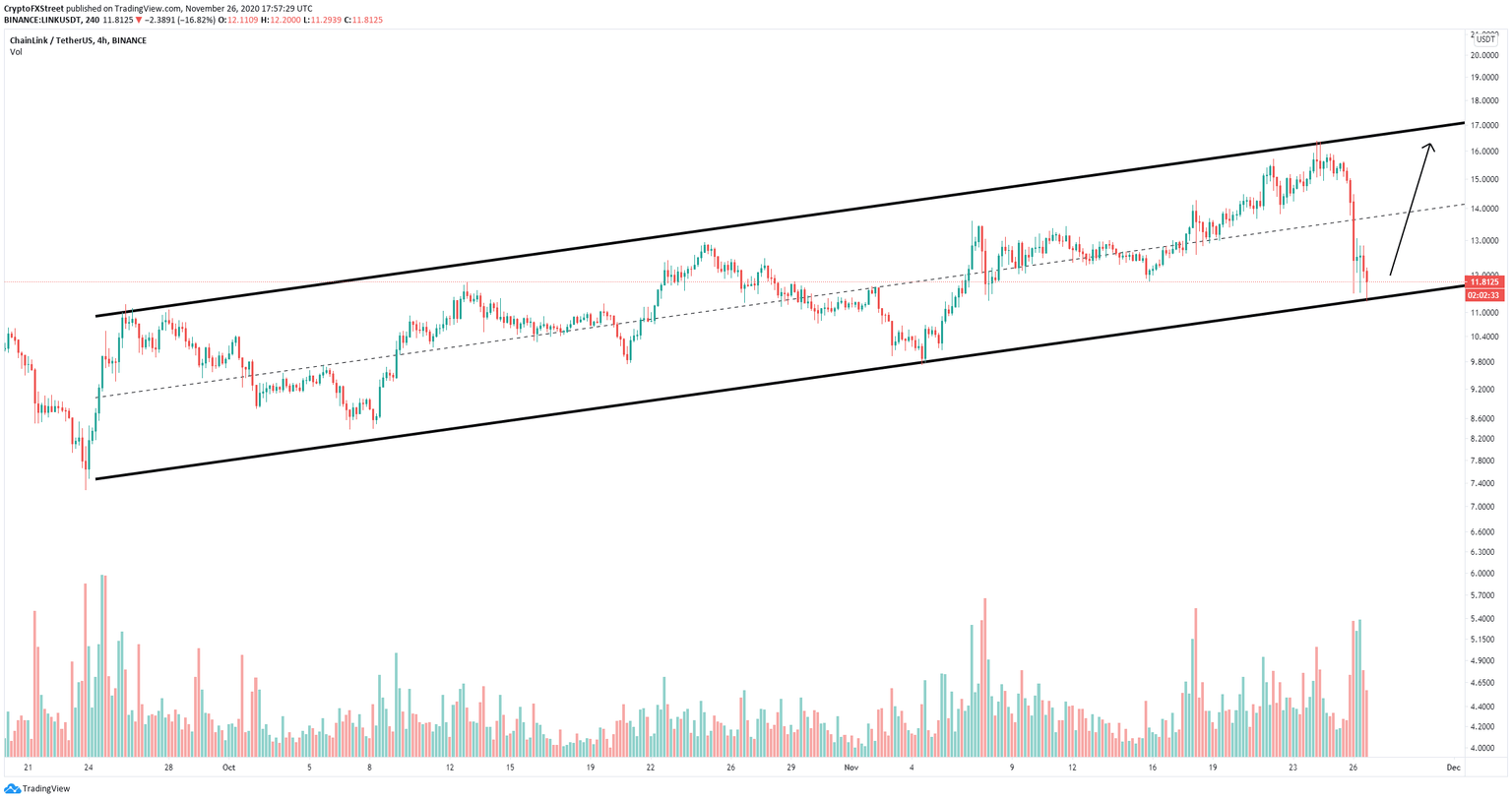

- Chainlink price is bounded inside an ascending parallel channel formed on the 4-hour chart.

- Despite the massive crash, LINK remains fairly bullish and could see higher highs.

-637336005550289133_XtraLarge.jpg)

Chainlink was trading at a high of $16.39 before plummeting towards $11.29, the lower boundary of an ascending parallel channel. LINK is currently trying to rebound towards the upper trendline of the pattern.

Chainlink price could be aiming for $17 again

LINK seems to be attempting to rebound from the lower trendline of the ascending parallel channel on the 4-hour chart. The crash was really steep which means there isn’t a lot of resistance to the upside.

LINK/USD 4-hour chart

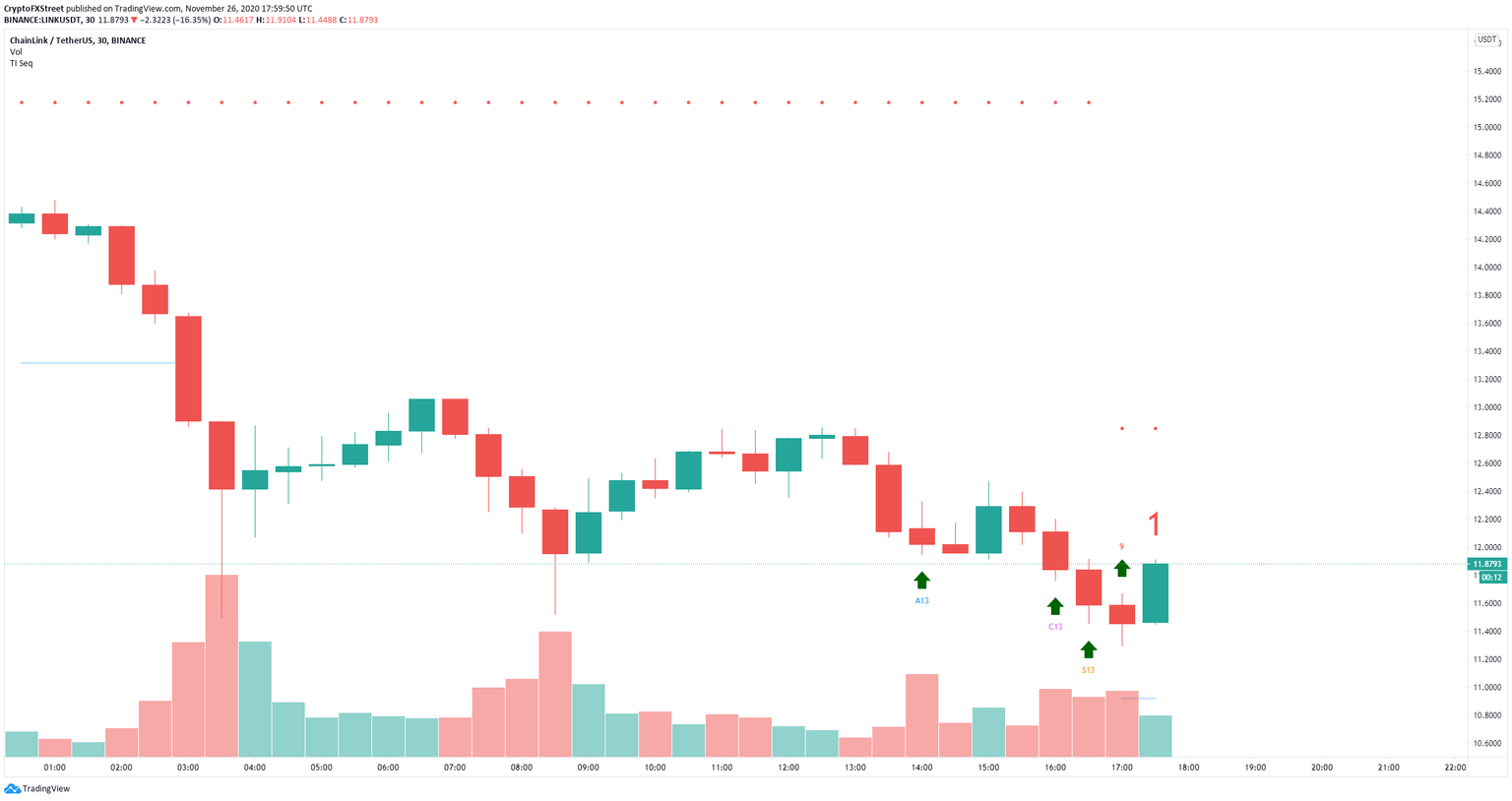

The TD Sequential indicator has just presented a buy signal on the 30-minutes chart which seems to be getting enough continuation at the moment. If the $13.22 high is broken, Chainlink price could jump towards the high of the pattern at $17.

LINK/USD 30-minutes chart

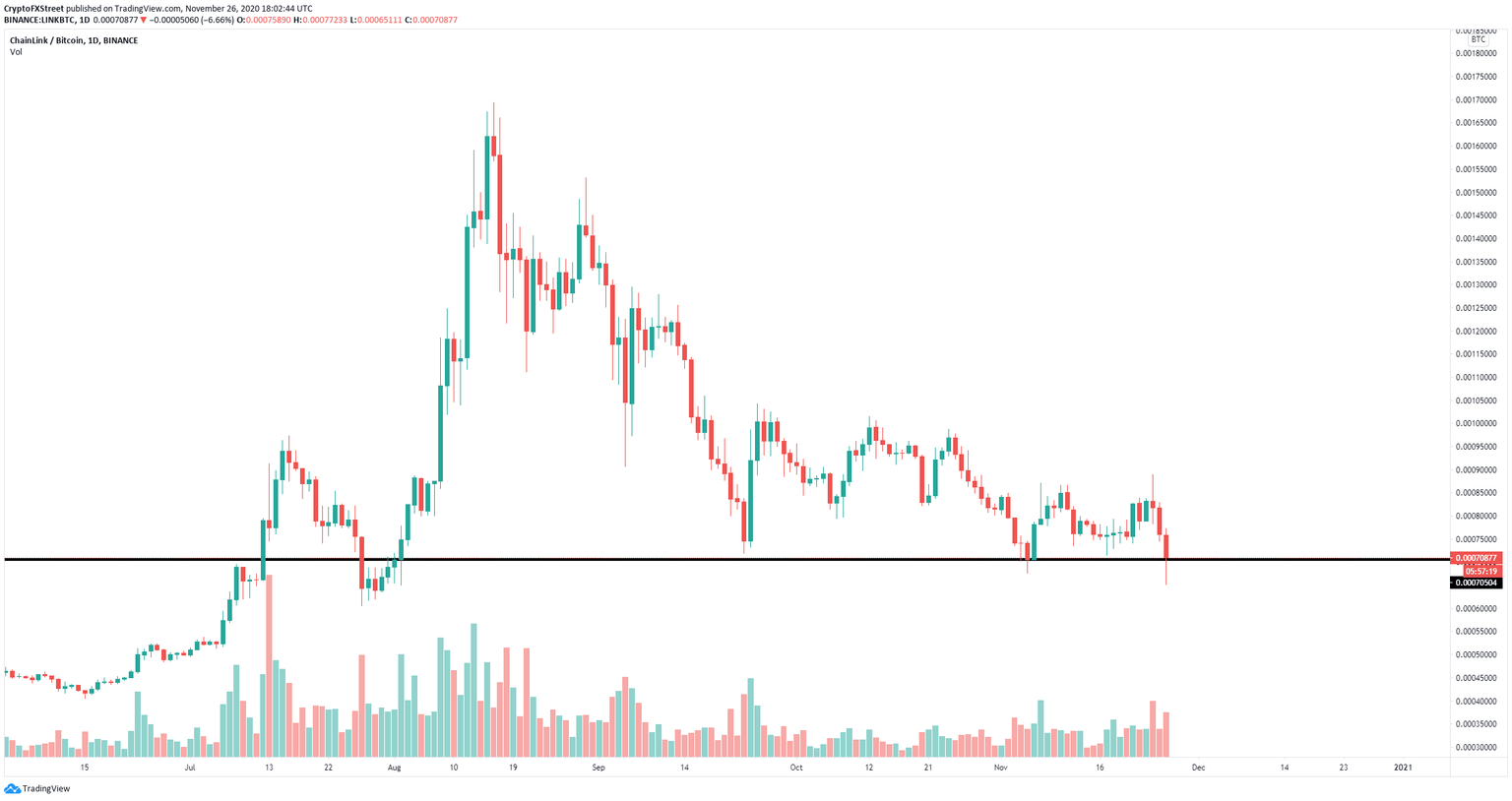

Additionally, so far LINK bulls have defended a critical support level at 71,000 satoshis on the LINK/BTC daily chart. This level has been thoroughly tested in November and on September 23.

LINK/BTC daily chart

A breakdown below the crucial LINK/BTC support level of 71,000 satoshis and the lower boundary of the ascending parallel channel will quickly push Chainlink price towards the psychological level at $8.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.