Chainlink price at risk of a 16% drop towards $16, but there is still hope

- Chainlink price is currently trading at $19.4 after a significant consolidation from its new all-time high of $23.76.

- The digital asset must defend a critical support level to avoid pulling back even harder.

-637336005550289133_XtraLarge.jpg)

Chainlink had a healthy consolidation period after a new all-time high that has turned into a steeper correction than what the bulls expected. LINK lost the $20 psychological level and it’s on the verge of a massive pullback towards $16.

Chainlink price must defend this level to avoid a huge pullback and resume its uptrend

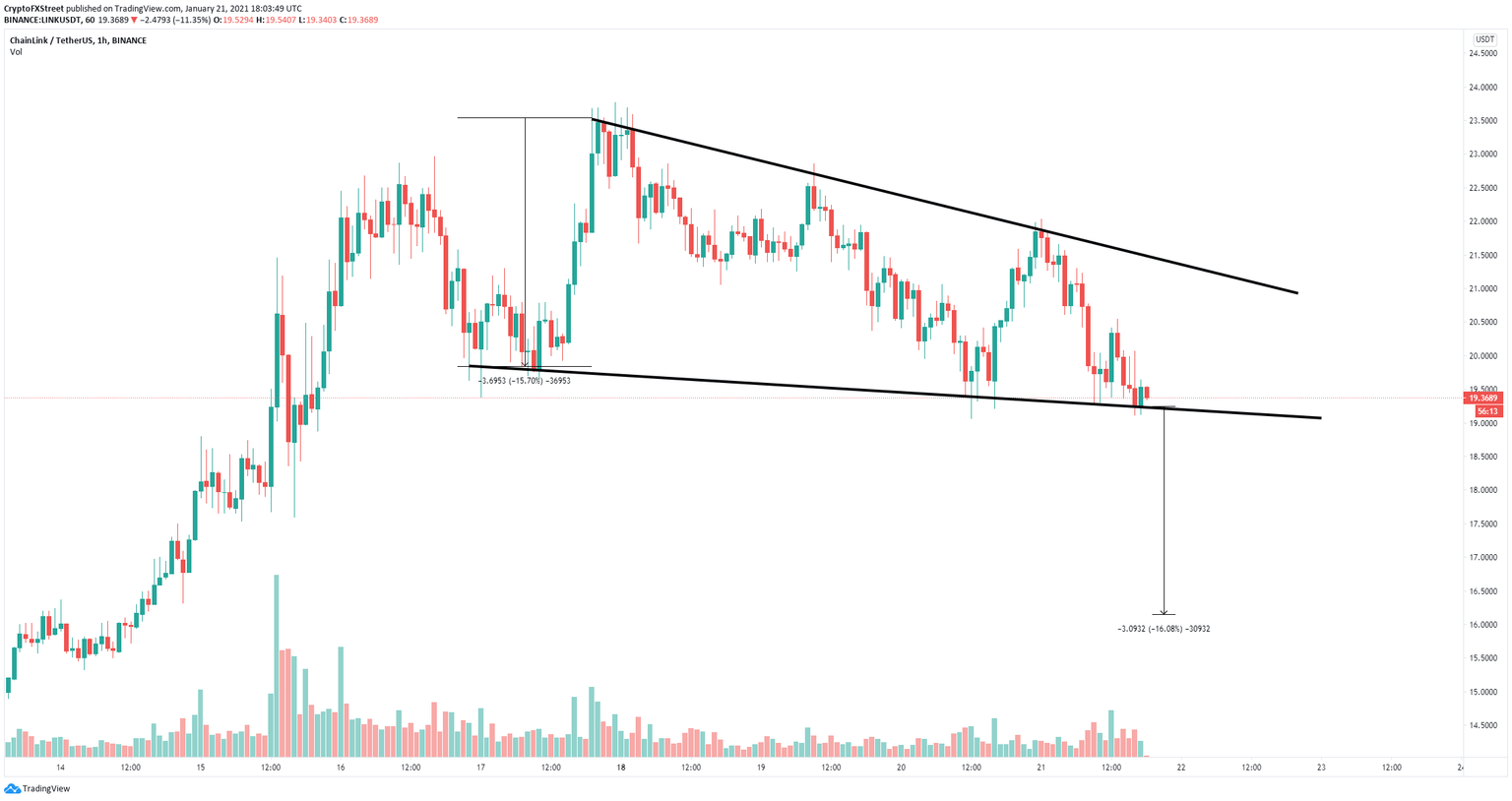

On the 1-hour chart, the digital asset has been trading inside a descending wedge with the support level located at $19. A clear breakdown below this point would push Chainlink price down to $16 in the longer term.

LINK/USD 1-hour chart

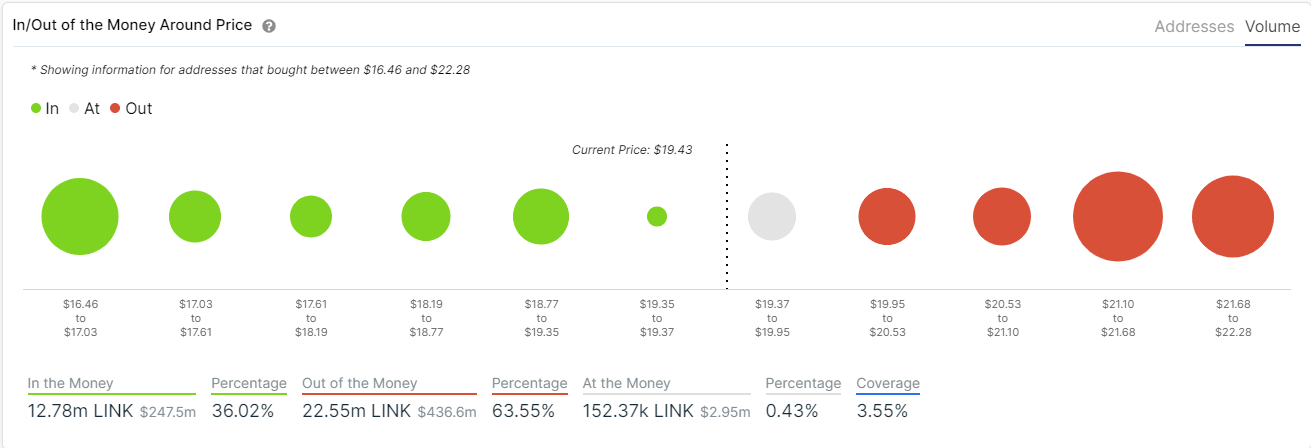

The In/Out of the Money Around Price (IOMAP) chart seems to confirm this theory as it shows the most significant support area to be located between $16.4 and $17. It also indicates that above $20, bulls will find a lot of barriers before a potential new all-time high.

LINK IOMAP chart

However, since bulls haven’t lost the $19 support level just yet, a rebound from this critical point has the potential to drive Chainlink towards the top of the pattern at $21.2 which coincides with the first massive resistance area according to the IOMAP model.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.