Cardano price to suffer another setback as whales dump ADA, no bottom in sight

- Cardano price shows a lack of buying pressure that has resulted in an 8% slide.

- A breakdown of the $0.375 support level could knock ADA to tag the $0.359 to $0.348 bullish breaker.

- On-chain metrics denote the distress of holders and also depict whales’ selling spree.

- Invalidation of the bearish thesis will occur if ADA can reclaim the $0.420 hurdle into a support floor.

Cardano price has been on a steady downtrend in line with the overall market condition. Nevertheless, a closer look reveals that ADA has more to shed before any uptrend kick-starts.

Also read: Cardano bulls struggle to push ADA higher despite developments in Ethereum-killer token

Cardano price at inflection point

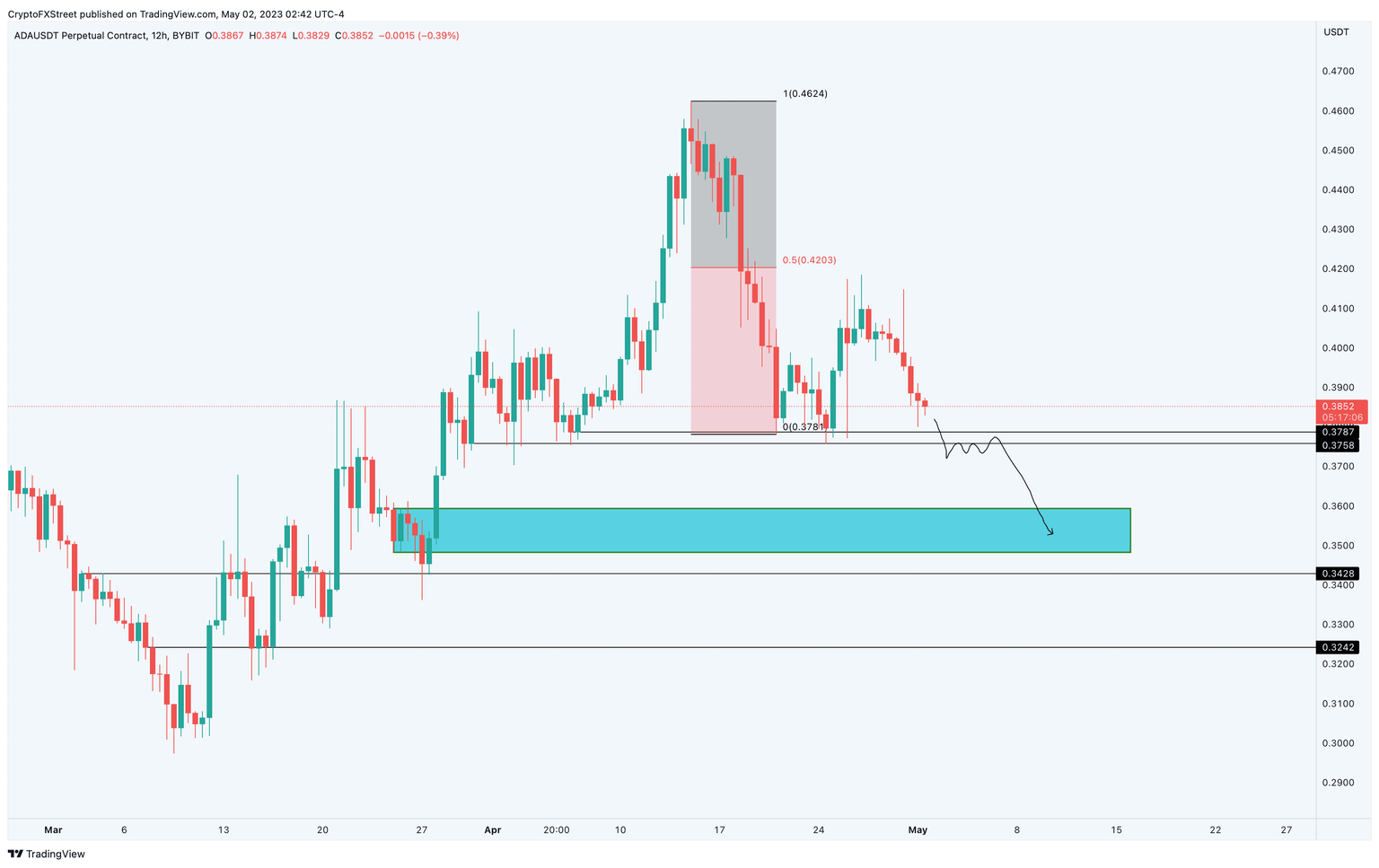

Cardano price dropped 18% between April 15 and 24 and attempted a recovery soon after. Failure to climb higher, ADA shed another 8% where it currently auctions at $0.385. Just below this level is a support structure, extending from $0.375 to $0.378, which is key to where the so-called “Ethereum killer” will head next.

A breakdown of this level could send Cardano price down to retest the $0.359-to-$0.348 bullish breaker. In total, this move would constitute a minor drop of 5% to 7%. A further spike in selling pressure that flips the $0.342 support level into a resistance level could trigger another down leg to $0.324.

ADA/USDT 1-day chart

Adding credence to the bearish outlook for Cardano price is the 30-day Market Value to Realized Value (MVRV). This on-chain metric is used to determine the average profit/loss of investors that purchased DOGE over the past month.

Based on ADA’s history, a deviation below the zero-line can be termed as “opportunity zone.” For Cardano, anywhere between -9% to -18% is where reversals tend to occur. Currently, the 30-day MVRV for ADA is hovering around -6.7%, suggesting that 6.7% of the investors that purchased the tokens in the past month are operating at a loss.

Therefore, investors should not hold their breath for a reversal anytime soon, at least not until the MVRV drops into the 9%-to-18% pocket.

ADA 30-day MVRV

Lastly, we have the Supply Distribution that shows that investors are dumping ADA at the current price levels. The number of addresses holding between 1 million to 10 million tokens have dropped from 2,479 to 2,431 in the last week. Likewise, addresses holding between 10 million to 100 million tokens have also declined from 426 to 405 in the last week.

This trend denotes that whales are also losing interest in the performance of Cardano price in the near future and are booking profits.

ADA Supply Distribution

An invalidation of the bearish thesis will occur if Cardano price can overcome the $0.420 hurdle and flip it into a support floor. In such a case, ADA will likely attempt a retest of the local top at $0.462.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B11.58.39%2C%252002%2520May%2C%25202023%5D-638186237881148576.png&w=1536&q=95)

%2520%5B11.58.50%2C%252002%2520May%2C%25202023%5D-638186237732924476.png&w=1536&q=95)