Cardano price to retest 200-DMA at $1.80 as ADA bulls lose conviction

- Cardano’s path of least resistance appears to the downside.

- ADA price eyes $1.80 again, as $2 offers stiff resistance to the bulls.

- Symmetrical triangle breakdown remains in play amid bearish RSI.

In an attempt to flip rival Ethereum, Cardano Foundation partnered with governments globally, working on blockchain solutions to solve real-world problems. The new partnerships make ADA blockchain one of the greenest in the crypto ecosystem.

These positive developments, however, have failed to impress ADA bulls, as Cardano price remains in a downside consolidative mode for the third straight day on Saturday.

ADA price licks its wounds after hitting the lowest levels in two months at $1.82 on Wednesday. Sellers continue to guard the upside at the $2 threshold, capping the recovery attempts in the fifth most favorite crypto coin.

The altcoin is feeling the pull of gravity once again, shedding over 1% on the day, currently trading just shy of the $2 level.

Cardano price remains exposed to downside risks amid bearish technicals

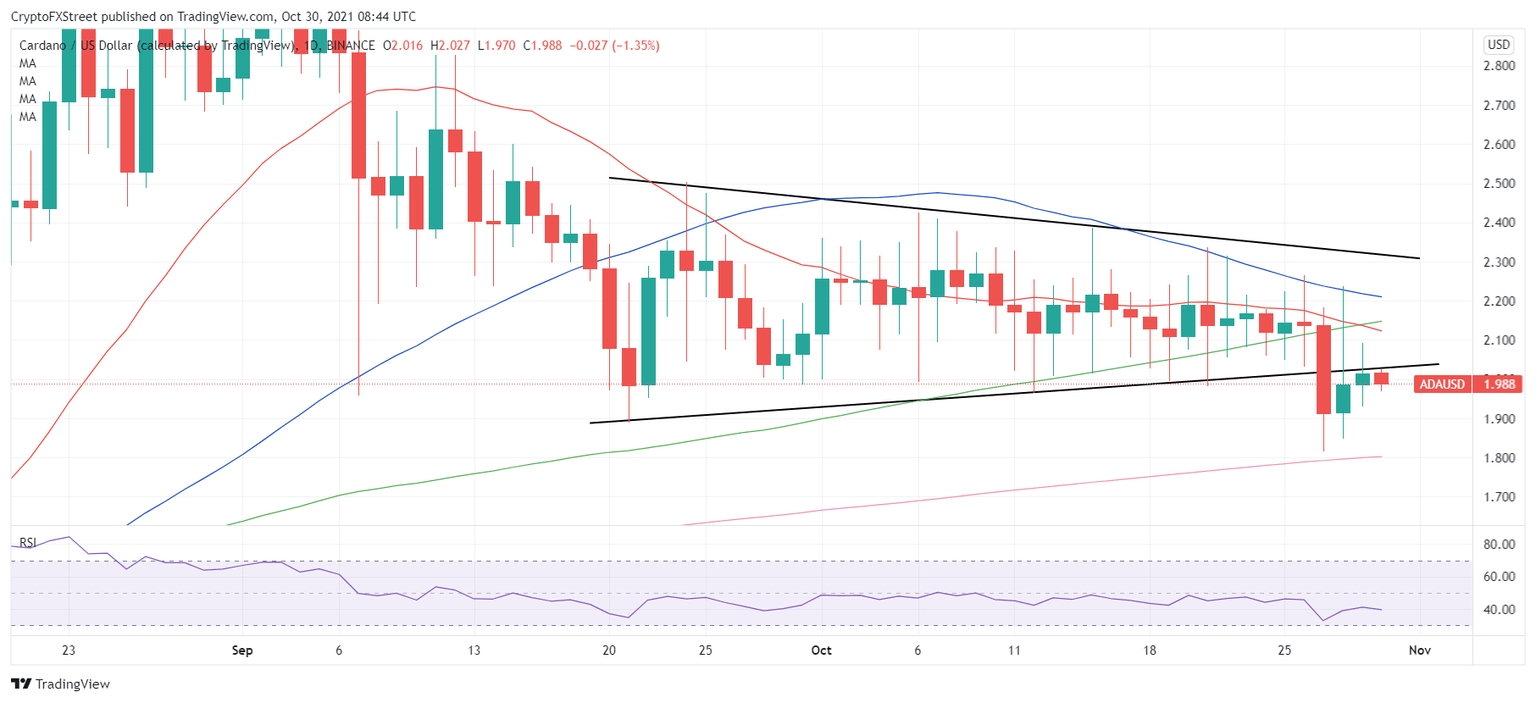

Cardano’s daily chart paints a bearish picture for ADA bulls, especially after the price confirmed a symmetrical triangle breakdown below the key $2 support on Wednesday.

The two-day rebound, thereafter, lost legs amid a persistently bearish 14-day Relative Strength Index (RSI). The leading indicator is seeing a fresh downtick while keeping its range below the midline, pointing to the looming downside risks.

ADA sellers look to retest the upwards-loping 200-Daily Moving Average (DMA) support at $1.80 to initiate a sustained downtrend.

The next line of defense for ADA bulls is aligned at the $1.50 psychological level, below which the pattern target measured at $1.39 could get challenged.

ADA/USD: Daily chart

Alternatively, ADA buyers need to find a strong foothold above the triangle support now resistance at $2.03 for the recovery to gain any meaningful traction.

The next stop for ADA bulls will be then seen at $2.13, where the 21 and 100-DMAs converge.

Powerful resistance at the downward-sloping 50-DMA at $2.21 will challenge the bearish commitments. Note that ADA price last closed above the 50-DMA barrier on September 18.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.