Cardano price tests main support for the fifth time as ADA fizzles out towards its bottom

- Cardano price has tested the crucial support at $0.2397 for the fifth time this year amid mounting overhead pressure.

- ADA could rise 5% to test the $0.2556 resistance confluence, especially if history is enough to go by.

- Meanwhile, on-chain data shows that over 90% of token holders are sitting on unrealized losses, giving the altcoin recovery period.

- A break and close below the critical support at $0.2397 would invalidate the bullish outlook.

Cardano (ADA) price has been stuck within range for the past several months, rising only to pull back to specific mean position. The oscillation has limited the upside potential for ADA, with its price stagnating around multi-month ranges.

Also Read: Cardano price could dip 5% amid growing overhead pressure

Cardano price tests crucial support

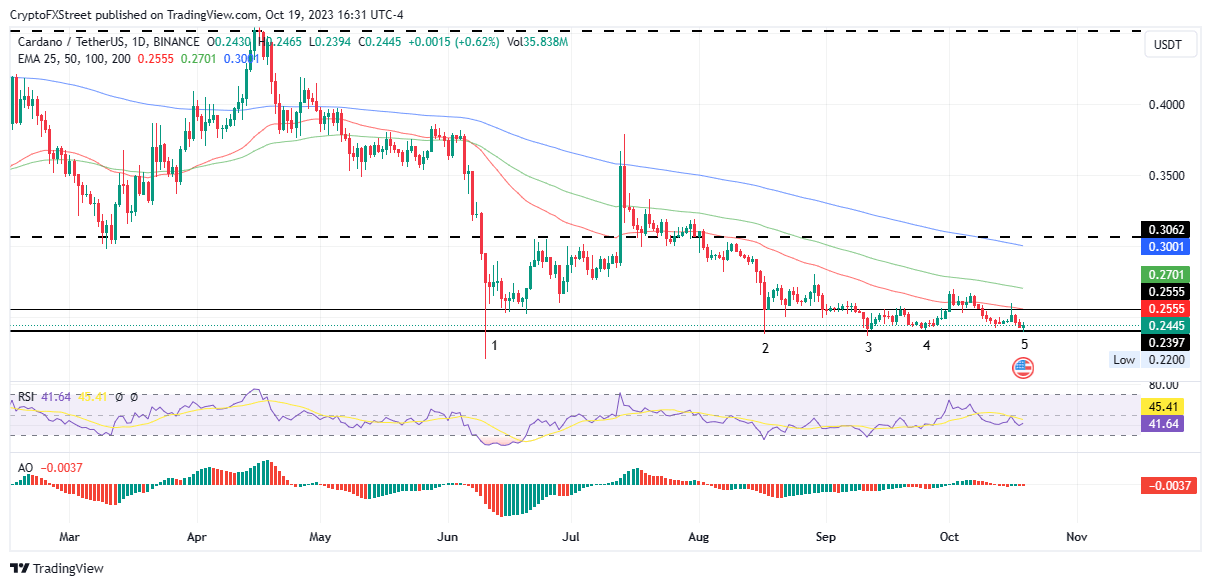

Cardano (ADA) price is testing the crucial support at $0.2397 for the fifth time this year, coming on the back of multiple pullbacks after attempted breakouts. It comes as overhead pressure builds for the altcoin, depicted by the 50-, 100-, and 200-day Exponential Moving Averages (EMA) at $0.2556, $0.2701, and $0.3001, respectively.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Based on the outlook below, Cardano price may be due to move north, potentially going 5% to confront the resistance confluence between the 50-day EMA and the horizontal line at $0.2556. This would require the $0.2397 support to hold.

Notably, it is a technical principle that the more times a support line has been touched, the greater its importance as a support level, and therefore the greater the chances of a bounce occurring. Hence, the anticipated 5% move north.

ADA/USDT 1-day chart

On-chain data shows majority of ADA holders are sitting on losses

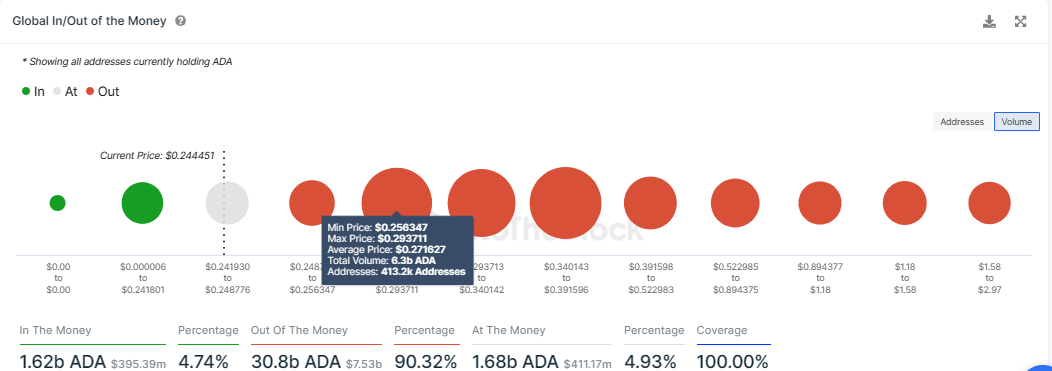

Based on data from IntoTheBlock’s Global In/Out of the Money (GIOM), up to 90.32% of ADA holders are sitting on unrealized losses (out of the money), while only 4.74% are sitting on unrealized profit (in the money). Meanwhile, almost 5% are breaking even (at the money).

The fact that Cardano holders are sitting on unrealized losses is slightly bullish. This is owing to the fact that investors tend to hold onto losses for longer than they should. With this, Cardano price has some time to recover.

ADA GIOM

Conversely, if Cardano price records a daily candlestick close below $0.2397, a major support level that has been touched five times thus far, it would likely lead to a very volatile move down. This is owed to the assumption that as support that has experienced multiple touches, when broken, tends to result in steep and volatile sell-offs.

If such a scenario presents, the downside momentum could see Cardano price tag the $0.2200 range low.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.