Over 100k ADA holders’ profits multiply by 30% as Cardano price rallies to $0.35

- Cardano price enjoyed bullishness on the back of XRP rallying by more than 70%.

- Over the last two months, the number of mid-term holders has seen a rise of 100k.

- The mid-term holders that are enjoying gains at the moment stood strong through the 30% crash from the month before.

Cardano price, along with the rest of the crypto market, is enjoying a day of spectacular gains after a very long time now, thanks to Ripple token XRP being declared as “not a security” on Thursday. The bullish impact of the same can be felt by investors across the market but is of the most value to those who kept themselves patient and composed through the crash.

Cardano price rallies to month highs

Cardano price rise has put ADA back on investors’ watch that are attempting to reap the benefits of the market rally. The altcoin was among the ones to enjoy the most gains on Thursday as the crypto market cap crossed $1.25 trillion.

At the time of writing, Cardano price could be seen trading at $0.35, rising by more than 20.5% in 24 hours, up from $0.28. This single-day rally shamed the last 29 days as, over the past month collectively, the cryptocurrency only rose by 33.21%.

ADA/USD 1-day chart

This, however, means that the ones that held on to their assets through this bear market are now in a condition to mint some profits if they ever decide to sell. But in order to reach here, this cohort has been holding on to their ADA for nearly two months now.

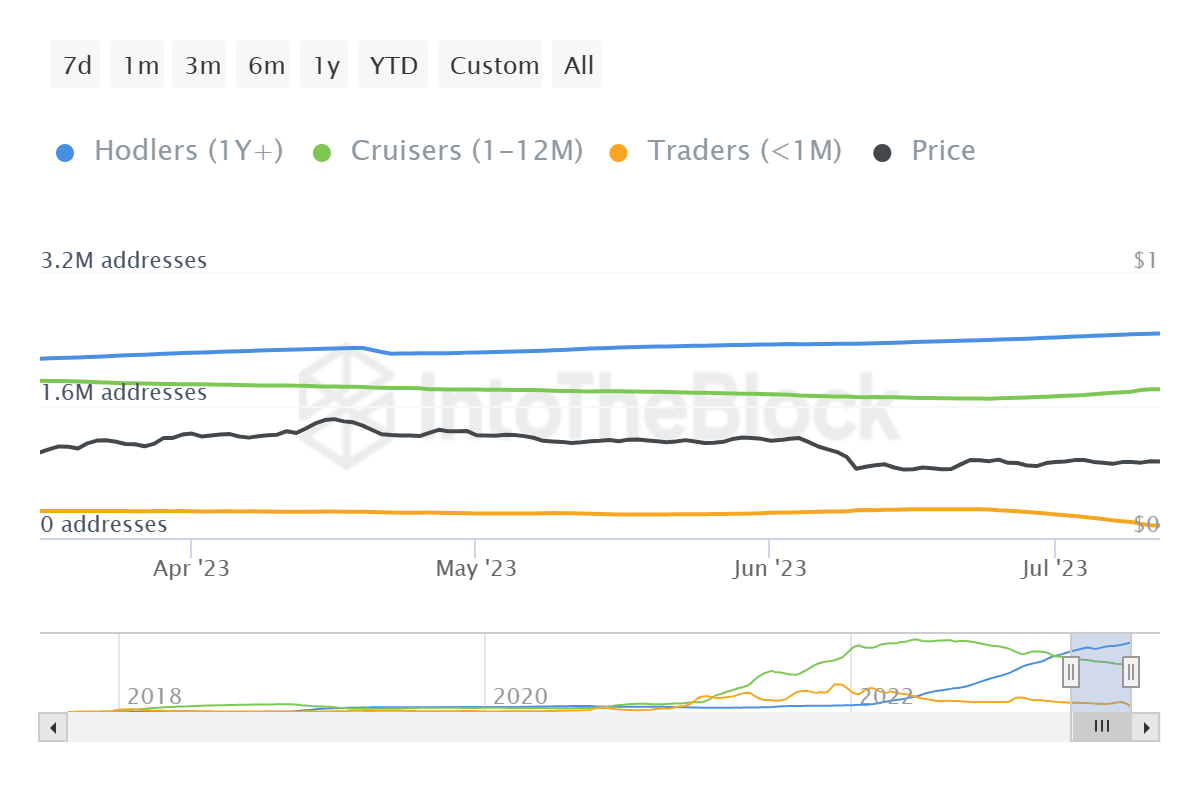

This behavior is evident by the change in the number of addresses that belong to the short-term and mid-term holder cohorts. Addresses in the former cohort tend to move their supply around in less than a month of acquiring it, while the latter are the ones that have invested in their tokens for more than a month but less than a year.

In the case of Cardano, the mid-term holders’ addresses have seen an increase of 100k from 1.7 million to 1.8 million over the past month. This means that their holding has been unmoved since at least May 14, which includes the 30% crash witnessed in that duration.

Cardano addresses distributed by time held

Fortunately, the rally over the past month has helped them recover these losses, and they have now set the tokens up for profits, provided the Cardano price doesn’t begin correcting. The Relative Strength Index (RSI) is yet to cross into the overbought zone above 70.0, post which potential correction would be inevitable. Investors should watch for this signal.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.