Cardano price rallies with surge in DEX volume and new meme coin launch

- Cardano price climbed nearly 8% since Friday alongside a spike in transaction volumes of decentralized exchanges.

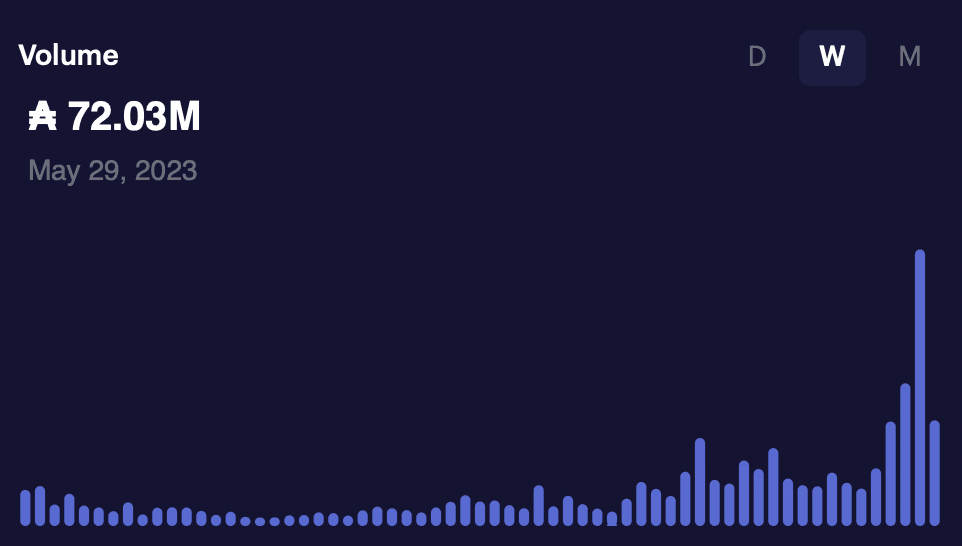

- Cardano-based DEX Minswap’s transaction volume grew from $10 million to $72 million from May 1 to 30.

- The launch of SNEK and BANK meme coins contributed to the rising Cardano network activity.

Cardano-based decentralized exchange Minswap registered a large spike in transaction volume since the beginning of May. Between May 1 and 30, transaction volume surged from $10 million to $72 million.

The launch of two meme coins SNEK and BANK on the Cardano blockchain contributed to the rise in network activity on the Ethereum-killer chain.

Also read: Shiba Inu eyes recovery as holders pull more than 44 trillion tokens off exchanges

Cardano-based DEXes and meme coins fuel ADA price rally

The Cardano blockchain registered a rise in its transaction volume in May. Transaction volume on Minswap, the largest DEX on the Ethereum-killer blockchain, climbed from $10 million at the beginning of May to $72 million on Tuesday.

Minswap transaction volume

Minswap is currently the largest DEX on the Cardano blockchain by Total Value Locked (TVL). The exchange holds upwards of $175 million worth of assets. A significant spike in activity on Minswap, therefore, influences the Cardano blockchain.

Launch of meme coins on Cardano and impact on ADA

SNEK, a meme coin with a 24-hour trade volume of $8 million, was launched on Cardano-based DEXes Sundaeswap and Minswap. Since its launch, SNEK price climbed 268.71%. Market participants engaged in trading SNEK contributed to the rise in transaction volume on Minswap.

Since their launch, both SNEK and BANK prices have climbed, with a combined market capitalization of $80 million as of Tuesday.

The flurry of activity from DEX transactions and meme coin launches fueled a rally in Cardano. The Ethereum-killer token climbed from $0.3535 on Friday to $0.38 at press time, an increase of 7.5%.

The Ethereum alternative is likely to continue rallying higher with the rising popularity of DEXes and meme coin launches on their platforms.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.