Shiba Inu eyes recovery as holders pull more than 44 trillion tokens off exchanges

- Shiba Inu supply on exchanges declined by nearly 45% between March and May.

- Around 44.5 trillion SHIB tokens were removed from exchange wallets, reducing the circulating supply of the meme coin.

- SHIB network activity marked on May 26 the highest increase in new addresses created on a daily basis.

The reserve of Shiba Inu tokens across cryptocurrency exchange platforms has consistently declined between March and May. SHIB holders have pulled 44.53 trillion tokens off exchanges, reducing the circulating supply and thus the selling pressure on the second-largest meme coin.

Also read: Dogecoin retakes meme coin throne as Shiba Inu, Pepe mania fades

Shiba Inu reserves on exchanges decline

Dogecoin-killer Shiba Inu’s reserves across crypto trading platforms declined 33% between March and May. Based on data from crypto intelligence tracker Santiment, there were 88.36 trillion SHIB tokens on crypto exchanges as of May 30, sharply down from the 132.89 trillion in March.

%2520%5B13.43.27%2C%252030%2520May%2C%25202023%5D-638210355429008845.png&w=1536&q=95)

Shiba Inu supply on exchanges (represented by black line)

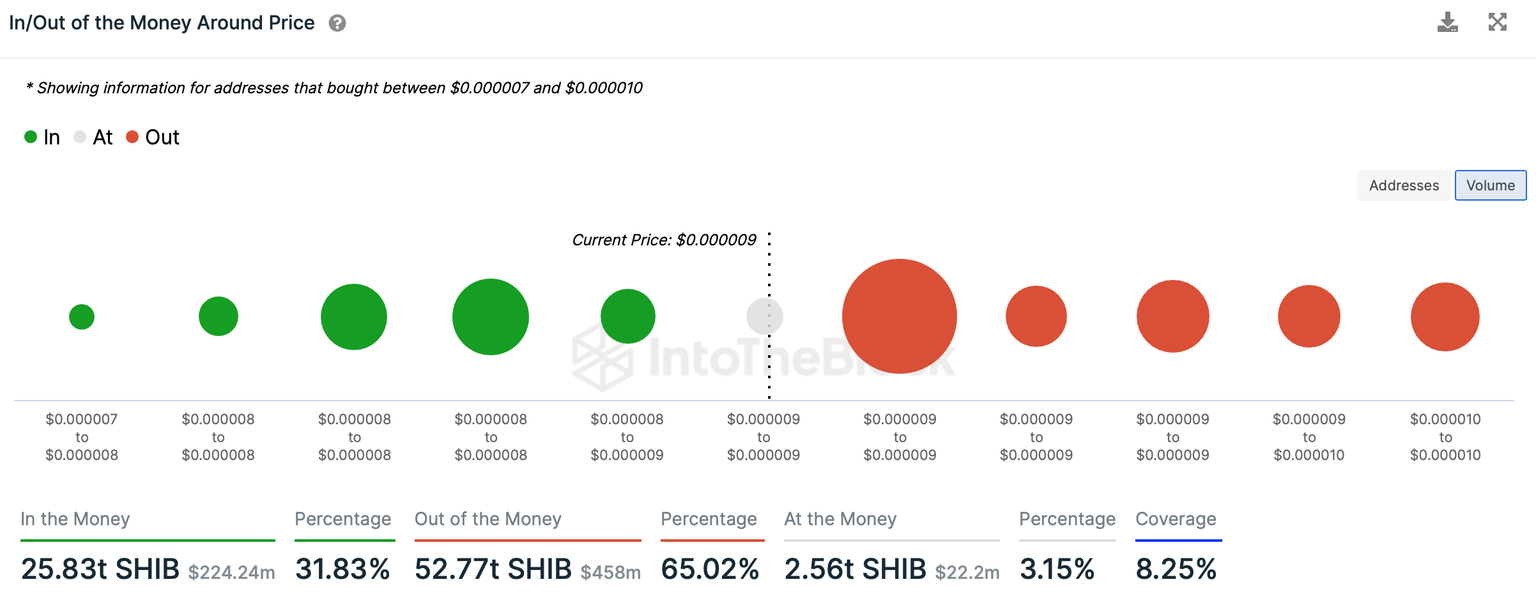

The chart shows the supply held by top addresses increased as exchange reserves declined. This implies that wallet investors and SHIB holders pulled the tokens off exchanges. These actions resulted in a decline in SHIB supply, easing off the selling pressure at a time when 65% of the wallet addresses holding Shiba Inu are underwater, meaning that they are sitting on unrealized losses. Shiba Inu price is $0.00000870 at the time of writing, meaning that 31% SHIB holders are profitable at the current price level.

Shiba Inu holders sitting on unrealized losses (out of the money)

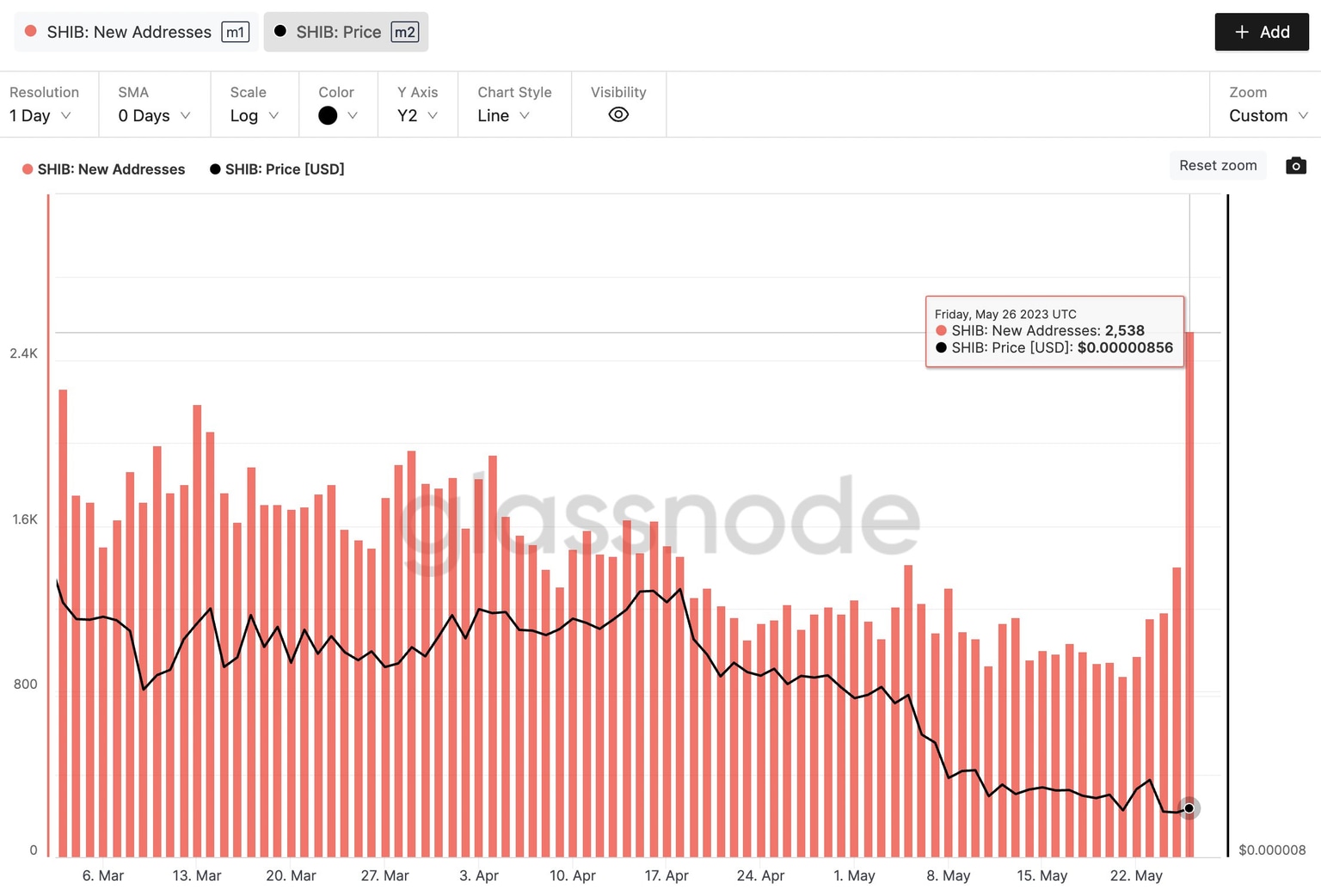

Moreover, there is an increase in Shiba Inu address activity on May 26. Rising address activity is likely to support a recovery in the meme coin’s price.

According to Glassnode data, 2,538 new Shiba Inu wallet addresses were created that day. This metric marks the daily largest spike in new addresses in the past three months.

Shiba Inu new addresses (plotted in red bars) against SHIB price (black line)

A decline in SHIB prices, coupled with less supply on exchanges and a large volume of new addresses created, are likely to act as a catalyst for the Dogecoin-killer price recovery in the short term.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.