Cardano Price Prediction: These ADA whales timed the bottom in March can they do it again?

- Cardano price has been in a downtrend, losing bulls' support, trading at $0.328.

- The W bottom pattern hints at a 6.7% upswing to $0.367, but the uptrend can extend to $0.367.

- A daily candlestick close below $0.299 will invalidate the bullish thesis for Cardano.

Cardano price has been following the broader market’s bearish cues making it difficult for the price to breach its immediate resistance level. However, certain cohorts of ADA holders are indicating a possible shift in trend, which might be appealing to bullish traders.

Cardano price has whales' support

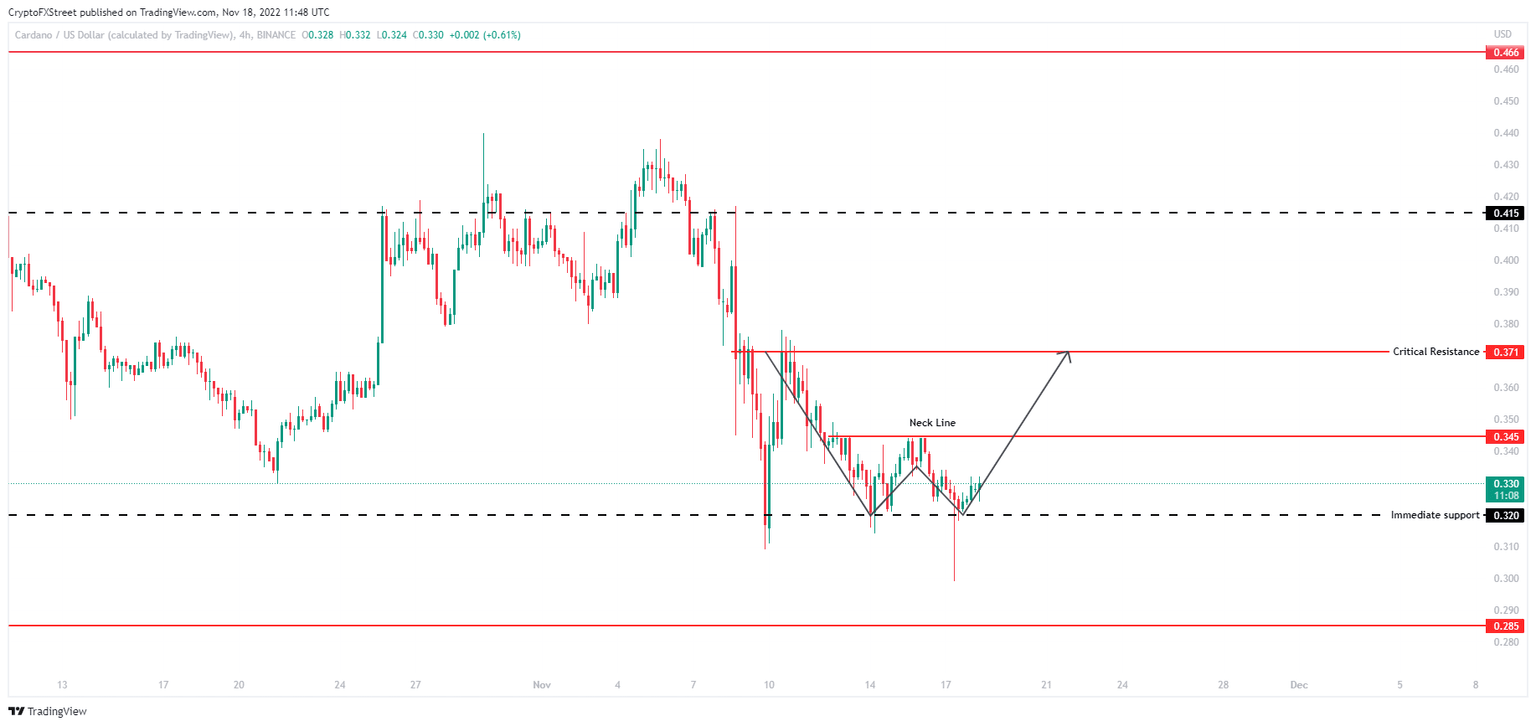

Cardano price has been attempting recovery for days now but has so far failed to breach its immediate resistance at $0.345. Following the failed attempt, ADA retraced lower to retest the support level at $0.320, forming a double bottom, also known as the 'W' pattern. This price pattern is usually indicative of a trend reversal and the beginning of a potential uptrend which is what is expected from the so-called “Ethereum-killer”.

Currently trading at $0.330, Cardano price will look to tag the resistance level at $0.345, which marks the neck line of the double bottom pattern. Flipping this resistance level into a foothold will be crucial for the altcoin to break higher and revisit the $0.371 barrier. This move would constitute a 12% gain when measured from the current position.

ADAUSD 4-hour chart

Interestingly, whales holding between 100,000 to 1,000,000 ADA have started accumulating again, which is a proxy of these smart money investors. The last time these whales started buying ADA was between late February and early March when Cardano price dropped 30%. During this period, the number of these investors spiked by 5.3% from 21,630 to 22,800, and the so-called “Ethereum-killer” rallied 50% in the next three weeks.

Since the same cohort has started accumulating again after a 30% slump in Cardano price, investors can expect a similar outlook to play out.

Cardano whales accumulating

Adding credence to the bullish outlook for Cardano price is the 52% spike in the active addresses interacting with the ADA blockchain over the last five days.

The last time active addresses spiked roughly 120% was in July, which was immediately followed by a 24% upswing in Cardano price.

A spike in active addresses generally denotes that these investors are interested in ADA at the current price level and are likely to accumulate. Hence, the surge in these interactions over the last five days, from 76,000 to 116,000, indicates a potential inflow of capital.

Therefore, sidelined buyers need to be aware of an incoming rally for Cardano price.

Cardano active addresses

Nevertheless, if the broader market bearish cues intensify, Cardano price could still resume its downtrend and tag the $0.320 support level. A breakdown of this barrier will create a lower low, skewing the odds in bears’ favor and invalidating the bullish thesis.

If this outlook comes to pass, ADA could slide lower due to the increased selling pressure and revisit the $0.288 foothold

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B15.51.46%2C%252018%2520Nov%2C%25202022%5D-638043697613327904.png&w=1536&q=95)

%2520%5B15.52.13%2C%252018%2520Nov%2C%25202022%5D-638043697447375648.png&w=1536&q=95)