Can Cardano price surge 23% as markets attempt a recovery rally?

- Cardano price is currently trading at $0.33 following the 21.53% decline last week.

- A bullish outlook shows that ADA holders should make a move only after the price rises above $0.41.

- A breakdown from the immediate support level will leave Cardano slipping towards 22-month lows.

Cardano price, along with other cryptocurrencies, has been at the mercy of FTX as the crypto exchange-induced collapse continues to cause ripples. The third-generation cryptocurrency is currently recovering from the 21.53% fall in price noted over the last few days and looking to test its critical resistance at $0.41.

Cardano price prepares for a bounce

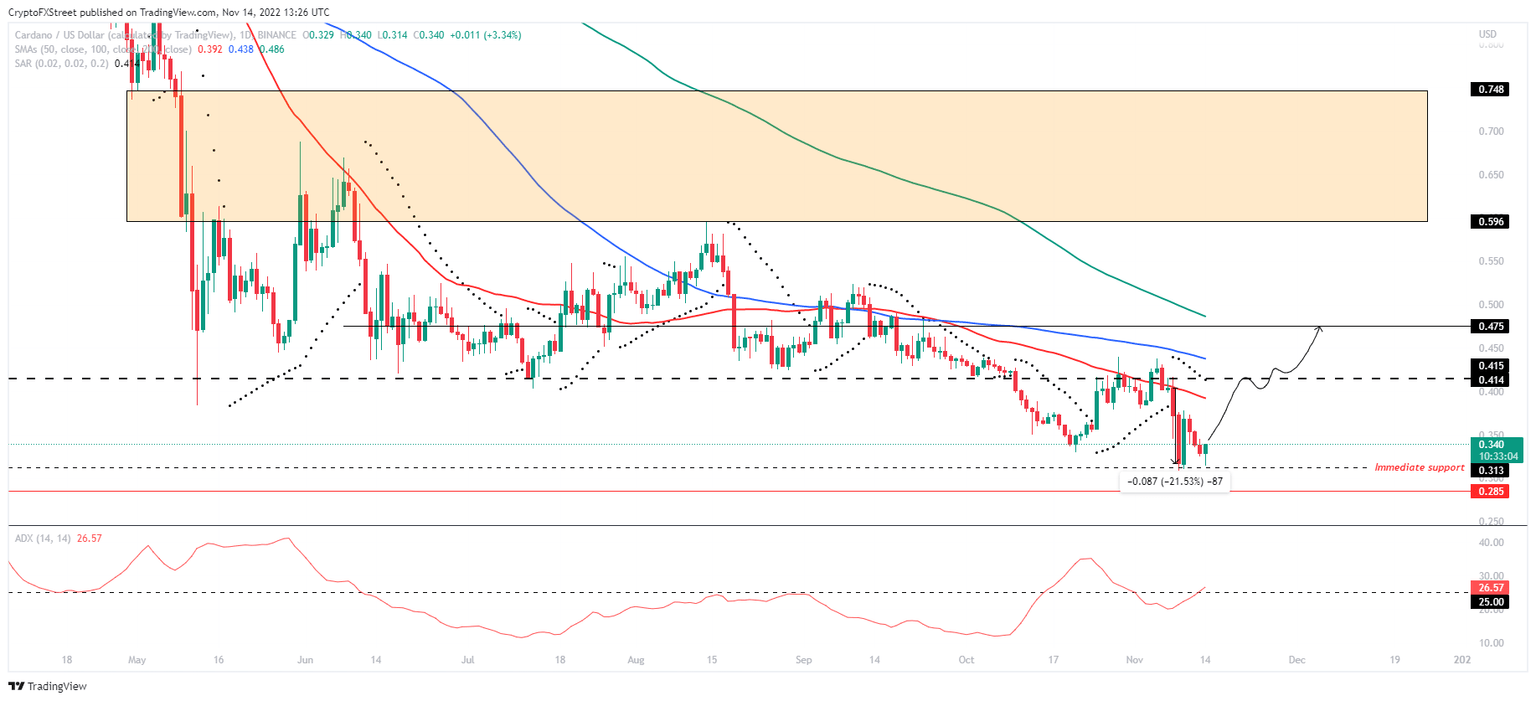

Cardano price is still in the lower low zone between $0.31 and $0.41, trading at $0.33. Over the last month, ADA has been struggling to breach past resistance and was almost able to before FTX collapsed. The ensuing panic led the market to crash, resulting in Cardano falling and tagging the immediate support at $0.31.

If ADA maintains its position between $0.31 and $0.41 with a notable spike in bullish momentum, a run-up to $0.47 could be likely. This move would represent a 23.81% gain for traders and would occur on the flip of the 50-day and 100-day Simple Moving Averages (SMAs) at $0.39 and $0.43, respectively, into support levels.

ADAUSD 1-day chart

On the daily timeframe, however, Cardano is still in a macro downtrend, indicated by the Parabolic Stop and Reverse (SAR’s) black dots, which are currently above price. This position of the said dots represents a dominant bear trend. The Average Directional Index (ADX) is under the 25.0 threshold, suggesting the downtrend, on a macro outlook, is here to stay.

ADAUSD 1-day chart

As a result, investors need to pay close attention to the immediate support levels at $0.31, a breakdown of which will invalidate the bullish thesis. Such a development could see Cardano price revisit the $0.28 foothold, which was last tagged almost two years ago.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.