Cardano price nearing June lows could extend the losses for more than 3.8 million investors

- Cardano price is trading at $0.27 after declining over the past week to hit $0.26.

- The daily average number of investors that conduct a transaction online is consistently falling, hitting a 13-month high this week.

- Over 86% of all ADA holders are facing losses; this could extend further and touch more than 3.8 million investors.

Cardano price is inching closer to a crucial support level, losing which would mark significant losses for the investors. Interestingly, the biggest impact of this would be felt by the very investors that are currently reluctant to make a move on the chain.

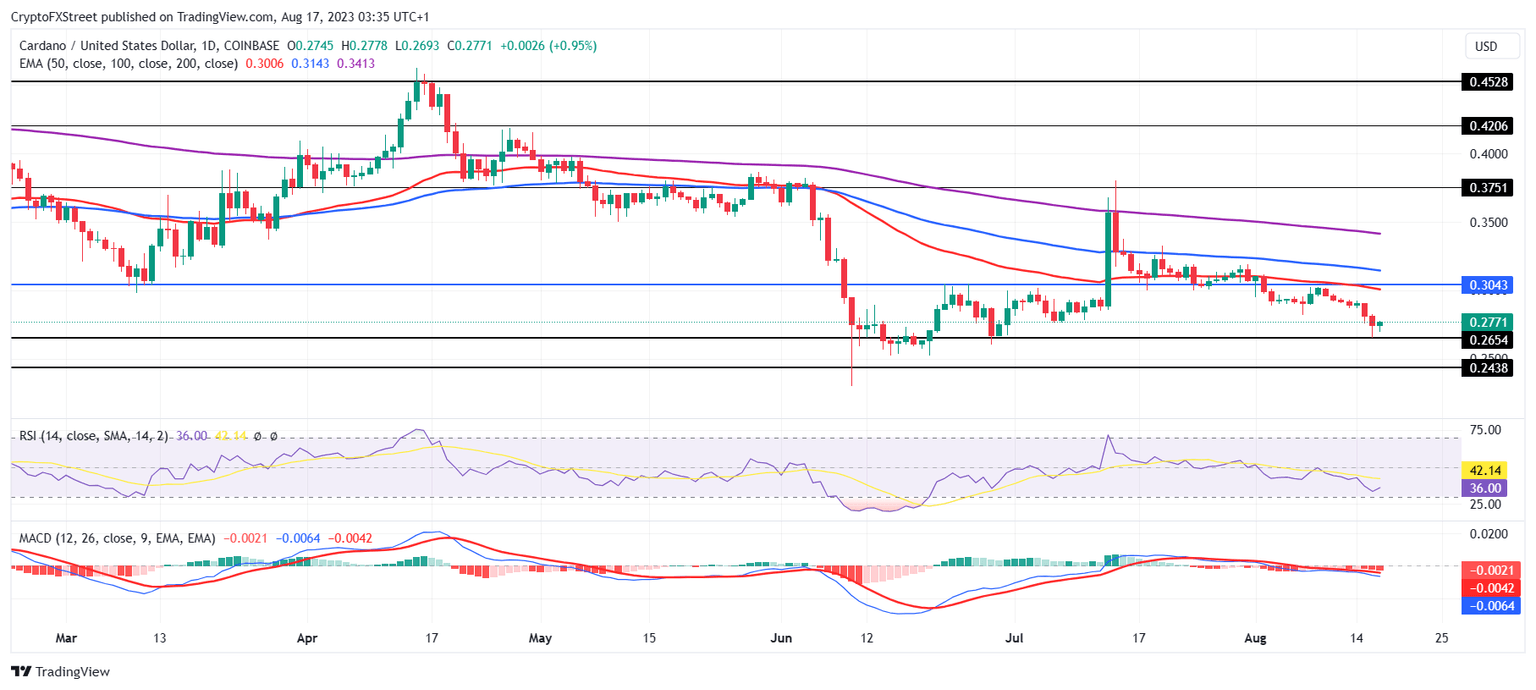

Cardano price close to key levels

Cardano price has been trending lower, posting red candlesticks over the past couple of days. In the past 24 hours, the altcoin even hit and bounced off the two-month-old support line at $0.26. This resulted in the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) flashing bearish signs, suggesting a further decline in ADA.

ADA/USD 1-day chart

The price action, however, more so than the broader market cues, is dependent on the investors as well. Interestingly, one of the biggest concerns in the case of ADA is its investors since they have been scaling back in terms of performance for some time now.

The number of addresses conducting transactions on the network has seen a consistent decline. In the past week, this figure fell to a low of 27k, marking a 13-month low for the “Ethereum killer”. When active addresses head lower, it usually means that investors are either spooked or waiting for the bearish wave to pass. Either way, ADA could continue to stagnate.

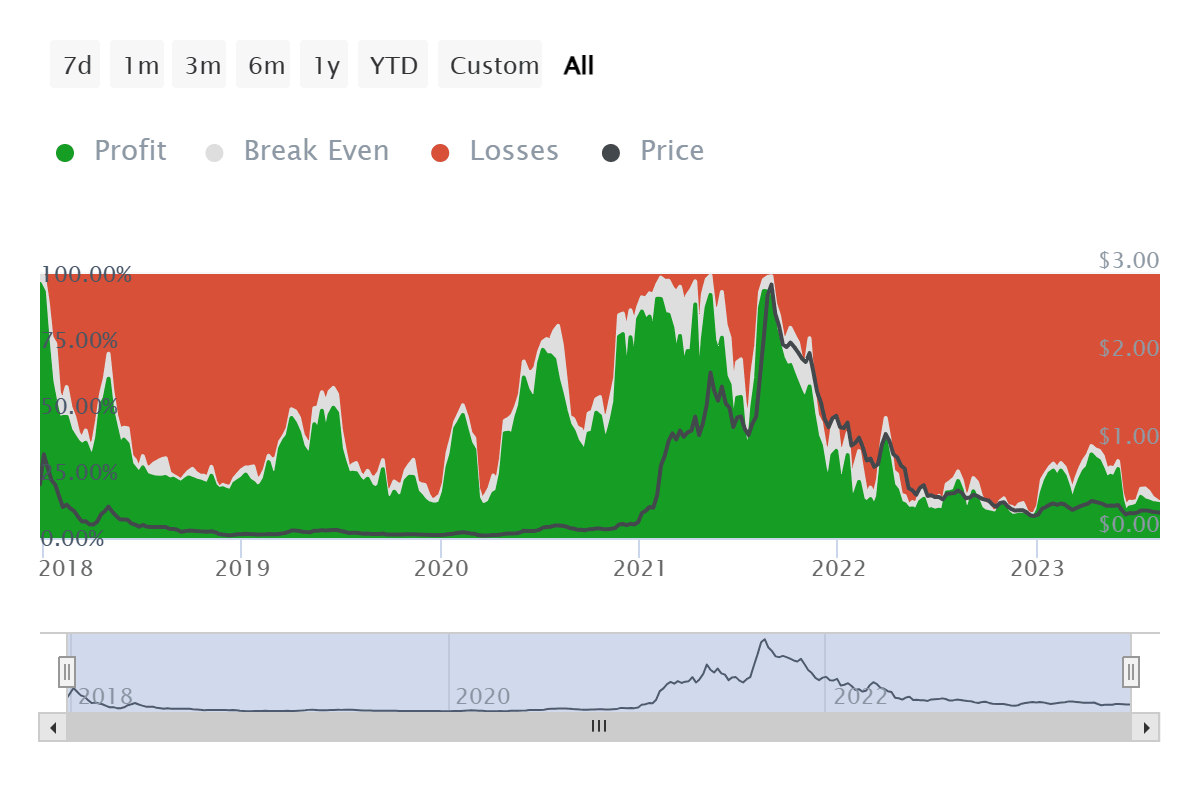

Cardano active addresses

However, this could very soon turn even more bearish if the investors do not change their behavior. Consequently, the already suffering investors will fall deeper into losses and drag a couple thousand more people along with them. At the time of writing, ADA investors at a loss stood at 3.8 million, representing over 86% of all holders.

Cardano investors at a loss

This could increase going forward should Cardano's price fail to note a considerable recovery.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B08.05.29%2C%252017%2520Aug%2C%25202023%5D-638278371729563964.png&w=1536&q=95)