Cardano price eyes 22% upswing as ADA bulls make a comeback

- Cardano price retraced roughly 20% after it tested the $2.30 resistance barrier.

- The pullback allowed the overheated market to cool down, suggesting a 20% run-up is likely.

- If ADA produces a lower low below $1.72, it will invalidate the bullish thesis.

Cardano price is sticking to the rounded bottom formation as it continues to slowly scale higher. The recent run-up seems to have come undone, but the bullish thesis remains intact and investors can expect ADA to continue its uptrend.

Cardano price prepares for a bullish onslaught

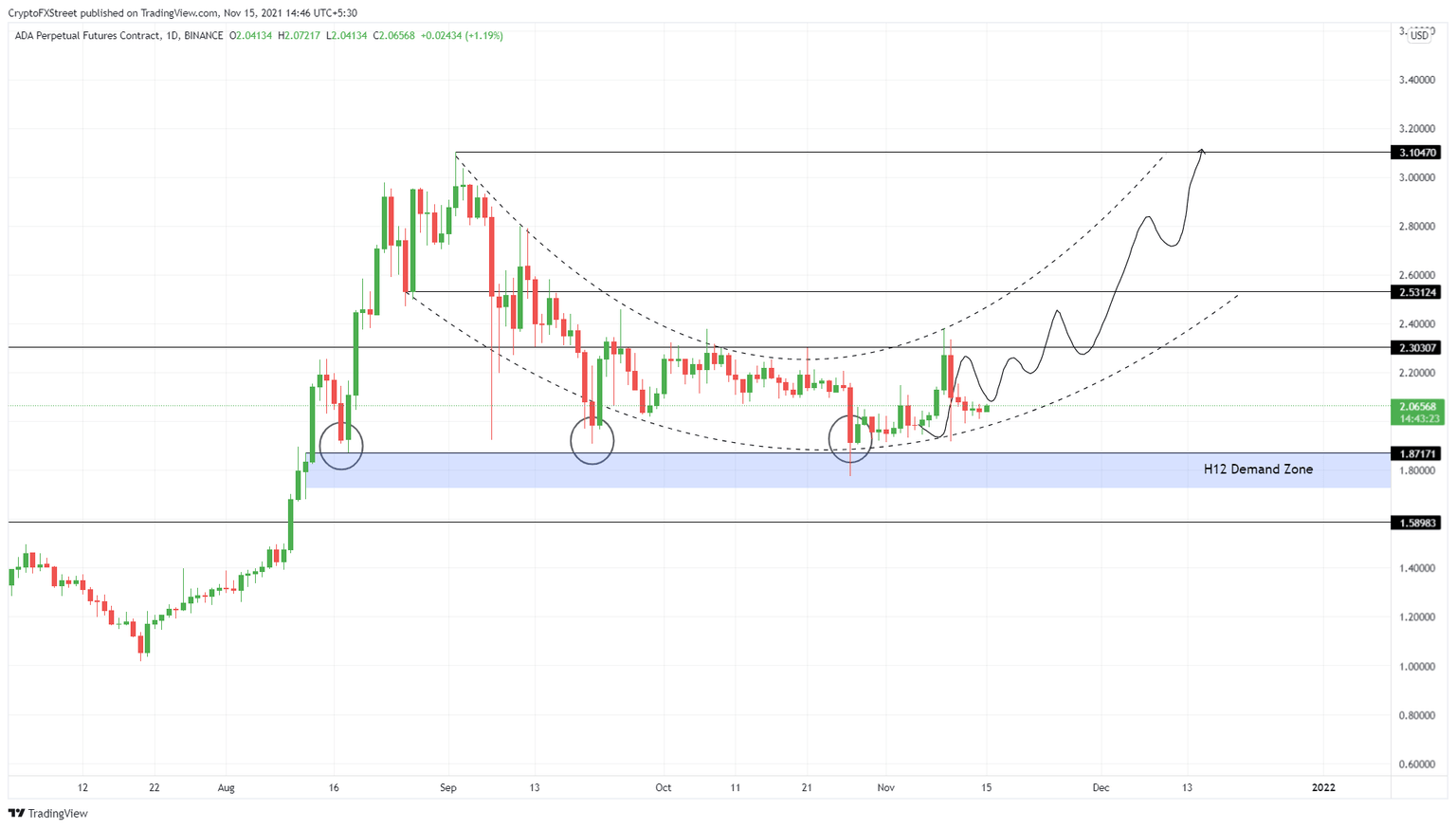

Cardano price reversed its nine-week downtrend after setting up a bottom on October 27. This move indicated the start of an uptrend and a potential rounded bottom formation in play. Cardano price rose 22% between November 6 and November 9, then after tagging the $2.30 resistance barrier ADA fell back to retest the demand zone, ranging from $1.72 to $1.81.

Going forward, investors can expect Cardano price to continue its ascent. This time, however, ADA is likely to breach the $2.30 barrier and make a run for the $2.53 hurdle, roughly 22% away from the current price.

This minor upswing is likely to face a pullback after revisiting the $2.53 barrier. However, if Cardano price flips it into a support floor, investors can expect the so-called “Ethereum-killer” to make way for $2.82.

Beyond this ceiling, ADA could even retest the all-time high at $3.10, constituting a 50% ascent.

ADA/USD 1-day chart

While things are looking up for Cardano price, a retest of the $1.72 to $1.81 demand barrier will weaken it. If ADA pierces through this barrier and produces a daily close below $1.72, it will invalidate the bullish thesis by producing a lower low.

In this situation, Cardano price could explore lower and retest the $1.58 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.