Cardano price could fall to $1.00 before seeing more gains

- Cardano price sees strong Fibonacci extension support levels at $1.00 and $0.88.

- ADA price volume is increasing in the bears’ favor.

- An invalidation for the bullish narrative will be a close at $1.16.

Cardano price action is likely to continue falling into lower Fibonacci targets amidst the current downslide.

Cardano price is in a dangerous correction until further notice

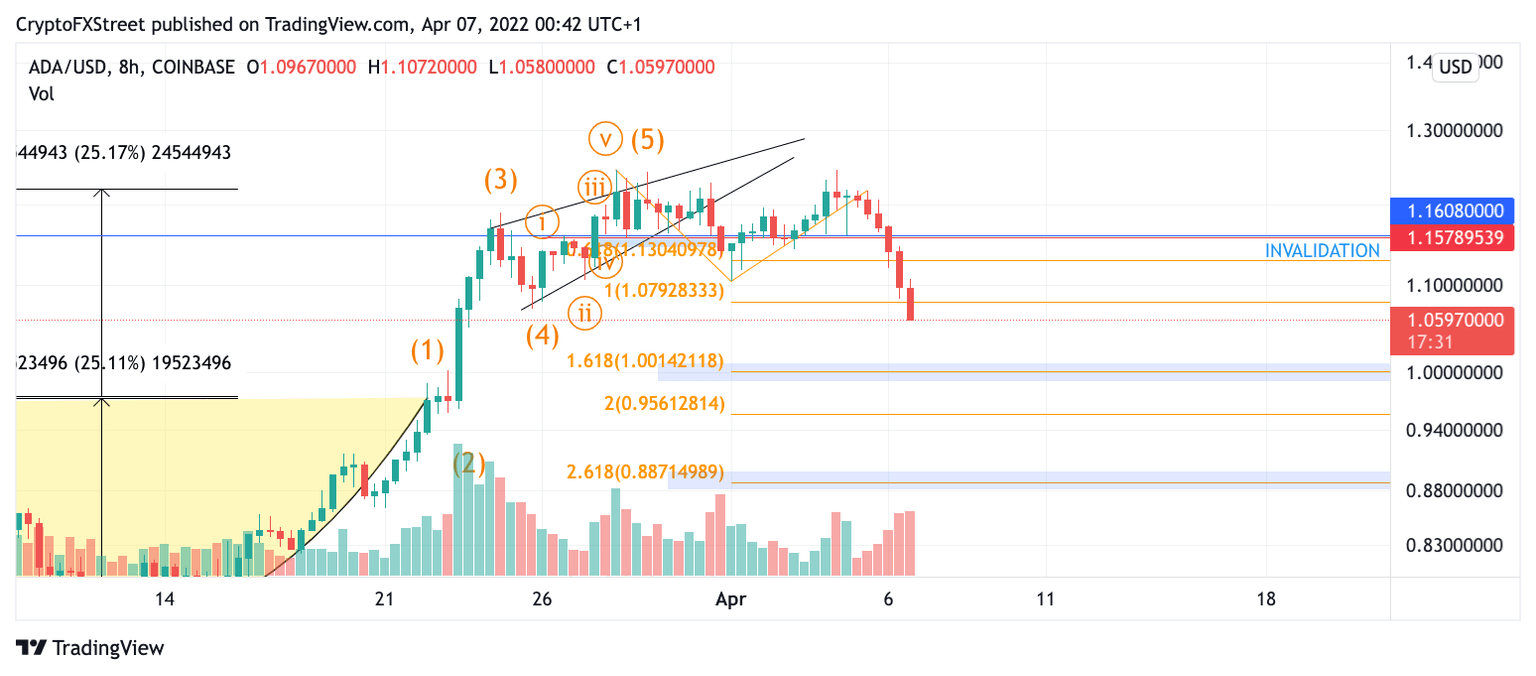

Cardano price action fooled analysts last week as the Ethereum Killer breached the bullish trade setups. ADA price is currently trading at $1.07 and looking more bearish as time passes. A Fibonacci projection indicator points to the $1.00 support for Cardano price at the 161.8% ratio. However, traders should consider waiting for ADA price to establish distinguishable chart patterns in this region before attempting to catch the falling knife.

Cardano price spells for more selloffs on the volume indicator as well. There is an uptick in volume on the 8-hour chart as the bears have breached the 100% Fib extension level. If the bulls cannot find support at the $1.00 zone, the next target will be at the 261.8% Fib extension level at $0.88.

ADA/USD 8-Hour Chart

Invalidation for the bearish setup is a closing candle above $1.16. If this were to occur, the bulls could then load up and aim for the Cardano price to reach the $1.35 region, resulting in a 27% increase from the current ADA price.

FX Trading Revolution - Your Revolutionary Forex Source

Author

FX Trading Revolution Team

FX Trading Revolution

The FX Trading Revolution website is a free independent FOREX source, and was founded to provide true and unbiased information about FOREX trading.