Cardano price buy signal offers 10% upside for day traders

- Cardano price has slid into a crucial support level after a 10% slide over the last two weeks.

- On-chain metric shows the so-called “Ethereum-killer” is very close to forming a local bottom.

- With bears cooling off, ADA could be ready for a quick recovery rally that pushes it close to $0.400.

Invalidation of the bullish thesis will occur if the altcoin flips the $0.342 support barrier into a resistance level.

Cardano price has shed a lot of weight over the last two weeks as the crypto markets succumbed to bearish pressure. While the long-term outlook remains murky, day traders are likely to get an opportunity to long ADA.

Read more: Cardano price to suffer another setback as whales dump ADA, no bottom in sight

Cardano price ready to make a move

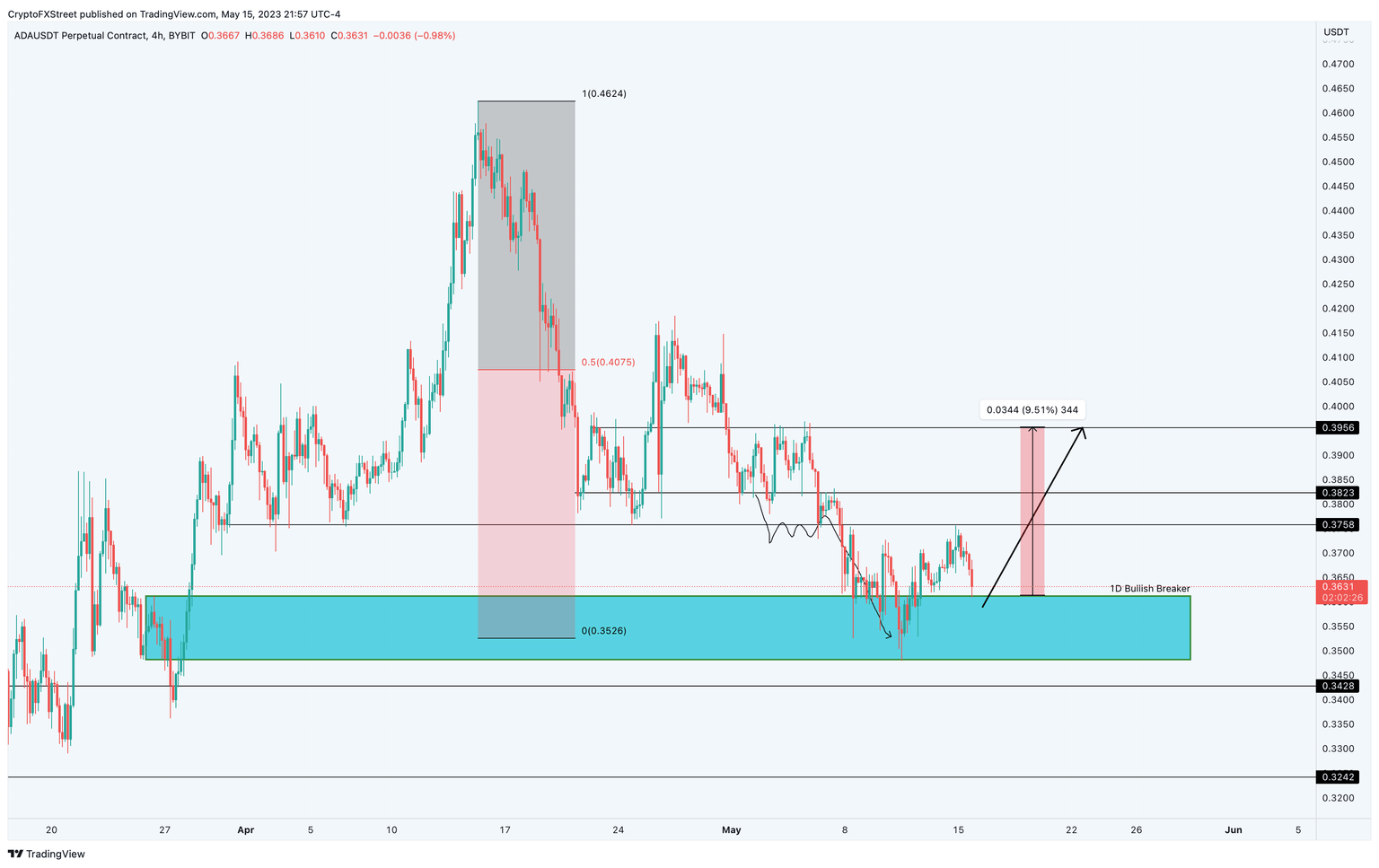

Cardano price dropped nearly 10% from $0.385 to $0.342 between May 7 and May 11. This drop was forecasted by our previous publication, which suggested that a local bottom could occur inside the bullish breaker, extending from $0.348 to $0.361.

As noted, Cardano price respected this zone perfectly and has recovered 4.30% at the time of this writing. With an ongoing pullback, traders have an opportunity to open long positions before ADA triggers a bullish move in less than twelve hours when the New York trading session kickstarts.

If this bullish development for Cardano price occurs, the targets include $0.375, $0.382 and $0.395. The last level is roughly 10% away from the current position where ADA currently trades.

ADA/USDT 1-day chart

Further adding credence to this bullish outlook for Cardano price is the 30-day Market Value to Realized Value (MVRV) model. This on-chain metric is used to determine the average profit/loss of investors that purchased ADA over the past month.

Based on Santiment’s research, a value below -10% indicates that short-term holders are facing losses and are less likely to sell. More often than not, this is where long-term holders accumulate. Hence, any move below -10% is termed an “opportunity zone.”

As Cardano price slid lower, the 30-day MVRV signaled an “opportunity zone” or bottom formation, which is in line with the technical outlook. Therefore, a surge in buying pressure is likely, considering this zone has been intact since June 2022 and consistently produced accurate local bottoms.

ADA MVRV 30-day

While the big picture for Cardano price looks optimistic, a sudden spike in selling pressure that pushes ADA to flip the $0.345 support level into a hurdle will invite sustained selling. This move would invalidate the bullish thesis for the so-called “Ethereum-killer” and kick-start a 5.65% slide to $0.324.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B07.21.46%2C%252016%2520May%2C%25202023%5D-638198017896938919.png&w=1536&q=95)