Can Shiba Inu price rally by 100% now that Bitcoin has given a green signal

- Shiba Inu price coils up inside a bottom reversal pattern, hinting at a 38% upswing.

- A flip of the $0.0000329 hurdle will trigger this run-up to $0.0000454.

- A daily candlestick close below the $0.0000211 support level will invalidate the bullish thesis for SHIB.

Shiba Inu price has been coiling up inside a bottom reversal pattern for nearly three months, hinting at an explosive breakout. This consolidation is likely to result in an exponential run-up that more than doubles the market value of SHIB.

Also read: Dow Jones futures look to close out the week positively

Shiba Inu price counts down before skyrocketing

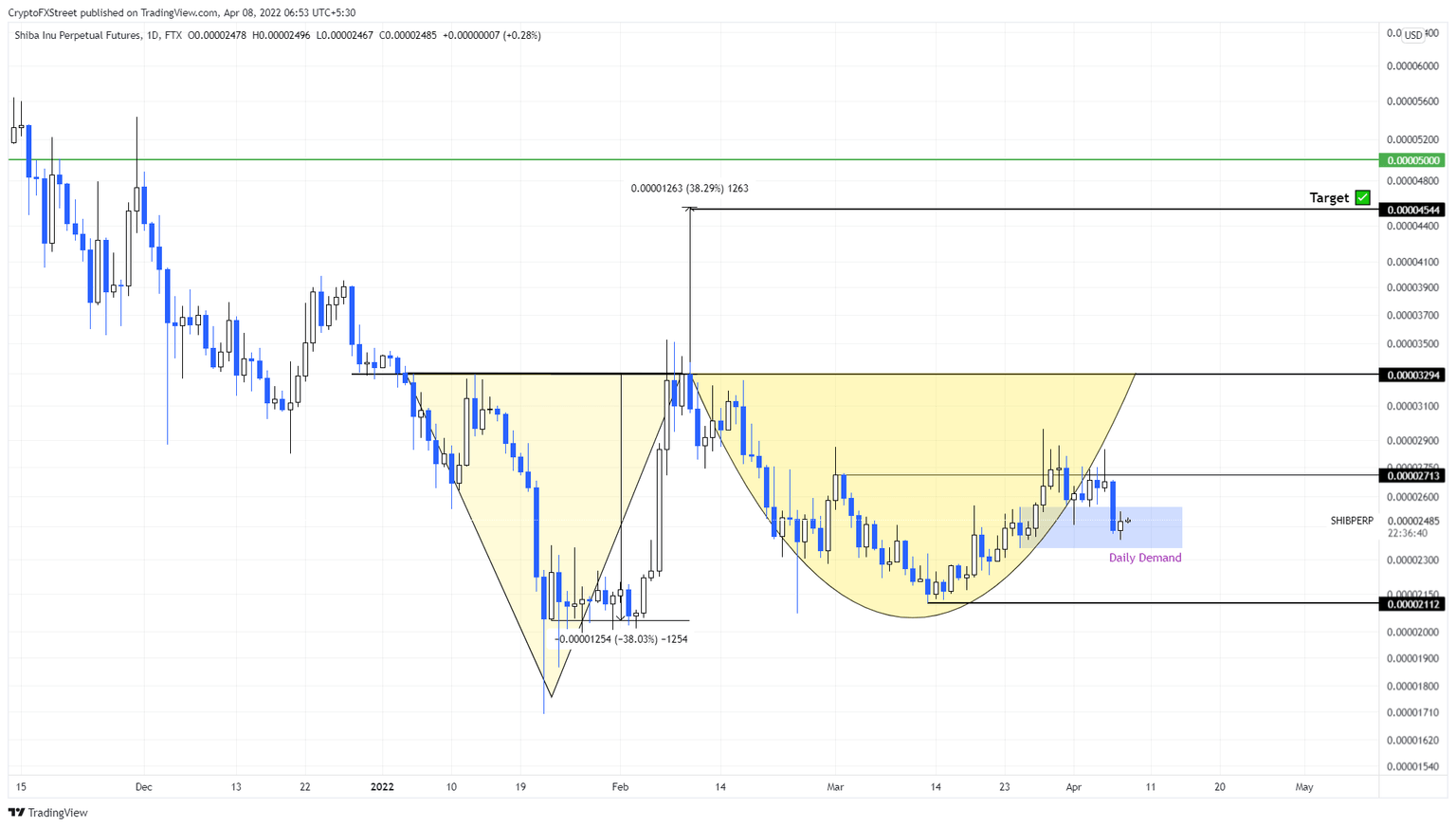

Shiba Inu has set up an Adam and Eve pattern due to its price action from January 5 to February 8. The pattern contains two distinctive swing lows, one of which is a V-shaped valley known as “Adam” and the other one is a rounded bottom formation referred to as “Eve”.

As mentioned in a previous article, the second half of the pattern is incomplete and is hovering above the $0.0000235 to $0.0000255 demand zone. Therefore, interested investors can have a headstart and accumulate prior to its explosive move.

This technical formation forecasts a 38% upswing, determined by measuring the depth of the valley and adding it to the breakout point at $0.0000329. This gives a price objective of $0.0000454.

From the current position at $0.0000248, this run-up would amount to an 83% gain. However, for this potential upswing to occur, SHIB needs to overcome the immediate hurdle at $0.0000271 and flip the neckline at $0.0000329.

A daily candlestick close above this level will trigger the rest of the run-up to $0.0000454. While this move is apparent, a highly bullish outlook could see SHIB extend the bull rally to tag a round level at $0.0000500. From today’s lowest point at $0.0000251, this run-up would constitute a 102% gain for Shiba Inu price and its holders.

SHIB/USDT 1-day chart

Regardless of the bullish outlook from a technical perspective, a daily candlestick close below the $0.0000211 support level would create a lower low and invalidate the bullish thesis for Shiba Inu price. This development will skew the odds in the bears’ favor and could potentially trigger a crash to $0.0000094.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.