Can Cardano bulls trigger a 60% relief rally amidst a bearish backdrop?

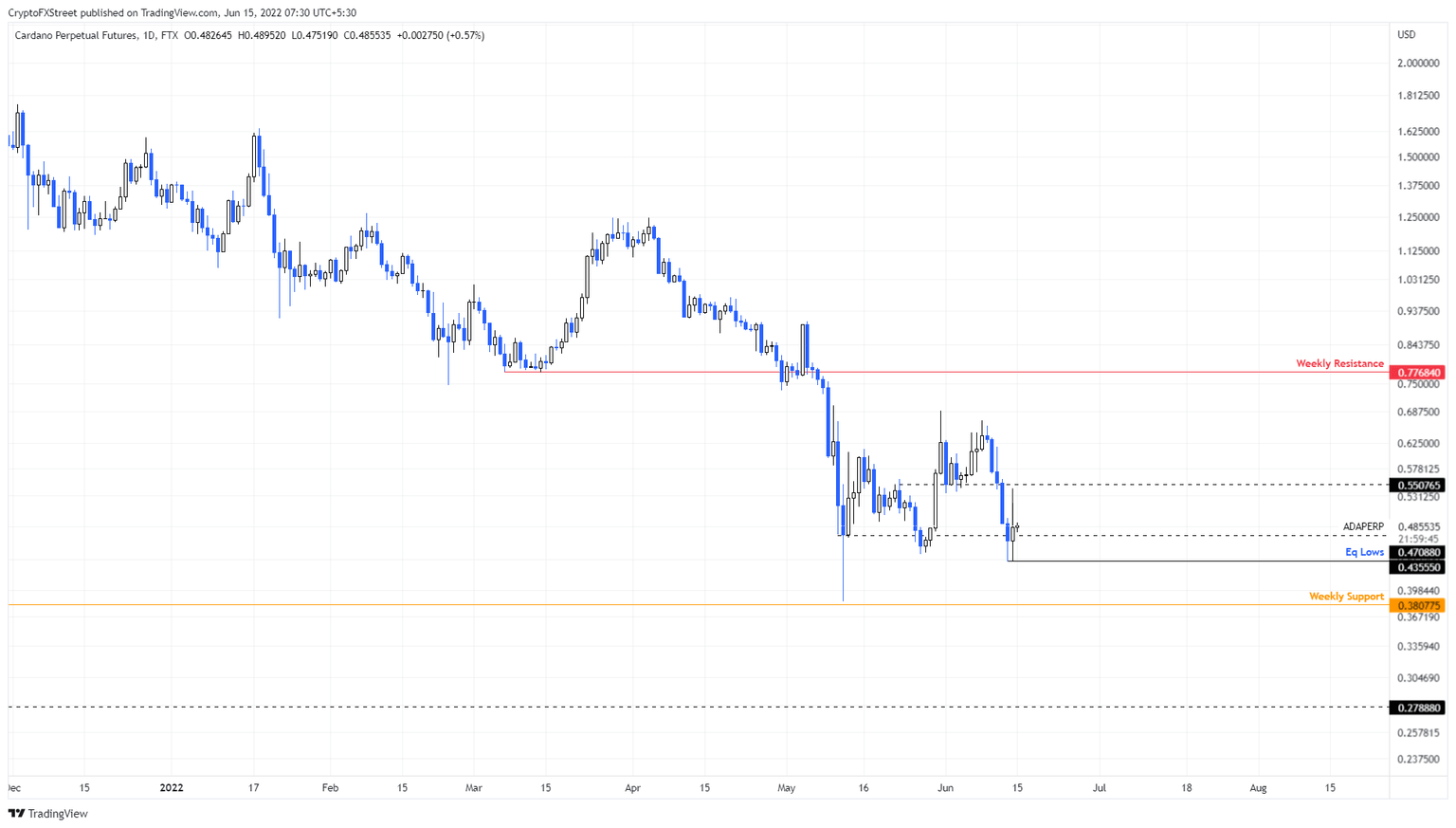

- Cardano price shows potential for a 60% run-up to retest the weekly resistance barrier at $0.776.

- The relief rally could stop prematurely if the buyers fail to flip the $0.550 hurdle into a support level.

- A daily candlestick close below the $0.380 support level will invalidate the bullish thesis for ADA.

Cardano price seems to be making quite a comeback after crashing violently over the past few days. This massive downswing is a common theme across all cryptocurrencies as the bear market rages on. However, for ADA, a relief rally seems to be incoming.

Cardano price ready for a quick bounce

Cardano price shows that it produced three daily candlestick closes around the $0.470 level between May 11 and June 14. Although not a textbook representation, this setup looks like a triple bottom, which is a bottom reversal pattern, often formed at the end of downswings.

Additionally, the sellers seem to be taking a break, allowing Bitcoin, Ethereum and other altcoins to bounce and recover a part of the losses. With these two supporting factors, Cardano price seems to be ready for a quick relief rally as well.

The upside objective seems to be roughly 60% away from the current level at $0.486, which is the weekly resistance barrier. However, climb to this barrier is not an easy task; ADA needs to flip the $0.550 hurdle into a support floor, which is a starting step.

Beyond this, Cardano price needs to muster enough bullish momentum to not just produce a higher high above the June 8 swing point at $0.66, but sustain it so ADA can climb up and retest the $0.486 level.

While the 60% returns might seem appealing, the journey to this level is a taxing one. Regardless, investors need to observe ADA closely.

ADA/USDT 1-day chart

On the other hand, if Cardano price produces a daily candlestick close below the weekly support level at $0.380, it will produce a lower low and invalidate the relief rally thesis. In such a case, Cardano price might crash 26% and revisit the $0.278 barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.