Breaking: Ethereum price breaks $1,600 in unstoppable rally targeting $2,000

- Ethereum price has just broken $1,600 across all exchanges.

- The smart-contracts giant aims for a price target of $2,000 in the long-term as most on-chain metrics are in his favor.

- The digital asset has been underperforming in comparison to Bitcoin which doubled its previous all-time high of December 2017.

Ethereum has just reached a market capitalization of $183 billion for the first time ever after surpassing $1,600 across all major exchanges. ETH bulls aim for at least $2,000 in the short-term and up to $3,123 which is the 261.8% Fibonacci Level that Bitcoin touched after its last rally.

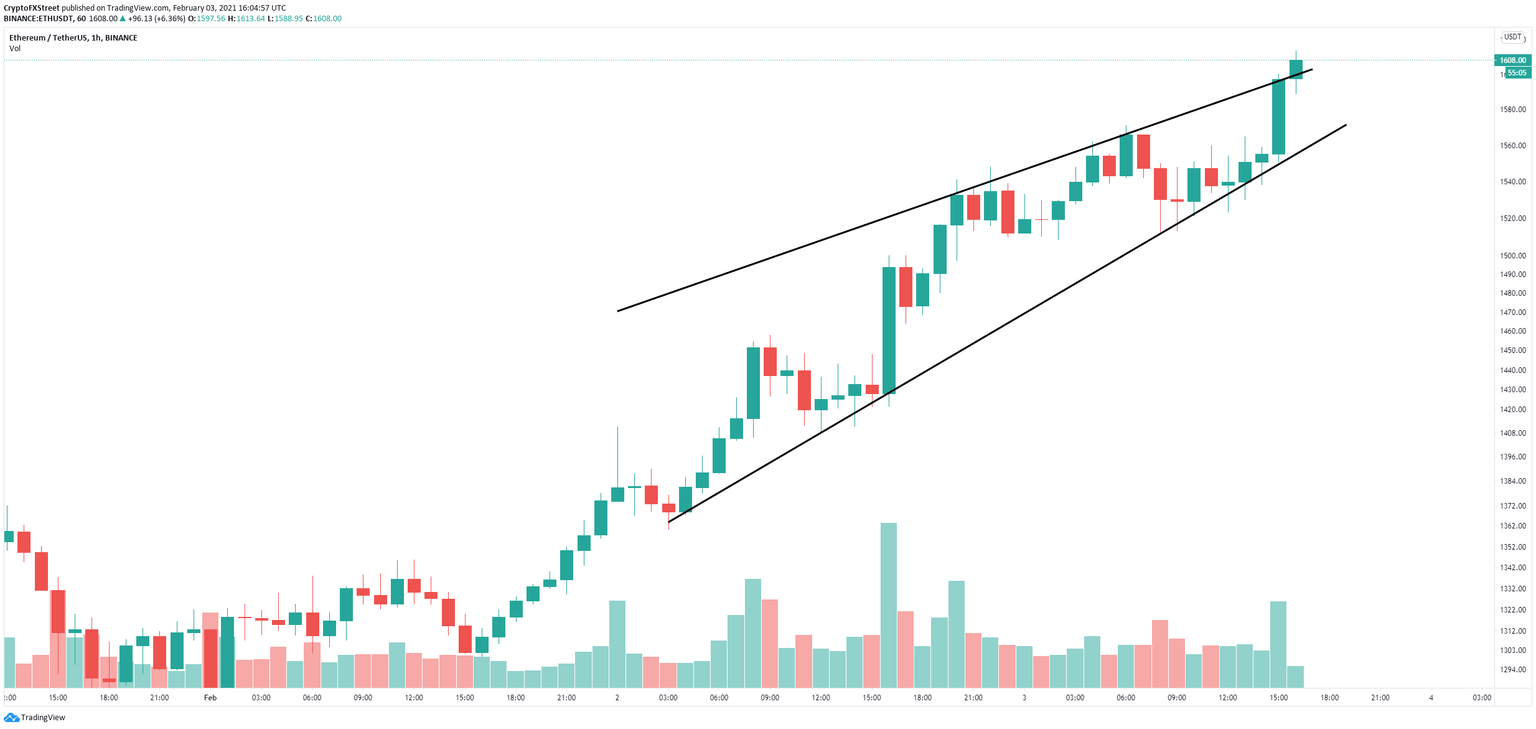

Ethereum price breaks $1,600 but could see a pullback

Ethereum price was trading inside an ascending wedge pattern formed on the 1-hour chart. The digital asset broke out of the pattern and is seeking continuation towards $1,700 which is the initial price target determined by substracting the top of the pattern with the bottom and adding it to the breakout price.

In our last article, we have discussed how difficult it will be for Ethereum to hit $2,000 as the digital asset is facing some short-term resistance. Several on-chain metrics suggest ETH is poised for a pullback first before another leg up.

Author

FXStreet Team

FXStreet