Breaking: Bitcoin price hits $50,000 for the first time in two years

Bitcoin (BTC) price hit $50,000 on Monday, a level last seen on December 28, 2021, more than two years ago.

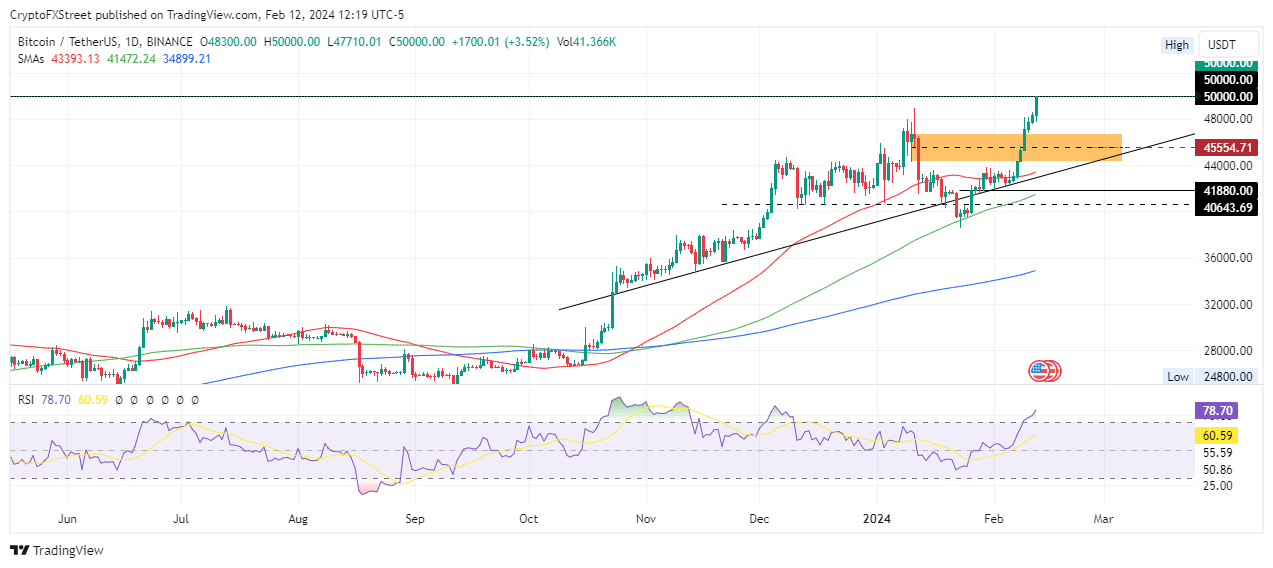

BTC/USDT 1-day chart

The new retest comes despite the Super Bowl disappointing the BTC community on Sunday night as a related commercial was not displayed. Nevertheless, Twitter founder and former chief executive Jack Dorsey did not disappoint. The Bitcoin maximalist showed up with a “Satoshi” T-shirt.

The $50,000 milestone also comes amid growing optimism for the BTC halving, expected around April 24, with approximately 10,000 blocks remaining until the event.

Meanwhile, the spot BTC exchange-traded funds (ETFs) narrative continues to drive markets. Reports indicate that assets under management (AUM) have broken a 30-year record in the first month of trading.

Specifically, VC investor Bitcoiner and entrepreneur Anthony Pompliano said in an appearance on CNBC that while there have been 5,500 ETF launches over the last 30 years, spot BTC ETFs have been able to beat all ETFs launched since.

Notably, none of the earlier ETFs were able to collect $3 billion of inflows during the first month of trading.

Wall Street appears to be buying BTC en masse with data showing purchases upwards of 12.5x more BTC per day than the network can produce. This leads to increasing demand and price.

Peter Schiff, a renowned economist and strategist says the turnout in Bitcoin price looks like a pump-and-dump scheme is going on with BTC and the spot ETFs. With this, he anticipates a "massacre" once hype around the Super Bowl and the Valentines celebrations dies off.

It looks like another classic pump-and-dump is going on with #Bitcoin and the @exchangeETF. The four-day conference kicked-off on Super Bowl Sunday and ends on Valentine's Day. There's a lot of hype surrounding the newly listed #BitcoinETFs. I wonder when the massacre will begin.

— Peter Schiff (@PeterSchiff) February 12, 2024

With the price surge, almost $116 million in short positions have been liquidated against almost $57 million in long positions.

BTC liquidations

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.