Breaking: Bitcoin price dips, over $210 million in total liquidations after fake spot BTC ETF approval news

In a shocking revelation, the official X account of the US Securities and Exchange Commission (SEC) was hacked, releasing a fake Spot Bitcoin ETF approval announcement.

The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.

— Gary Gensler (@GaryGensler) January 9, 2024

Crypto executives call for SEC self-investigation

Reportedly, securities lawyers say the US SEC "will have to investigate itself for market manipulation after moving the price of BTC up and down following the hacked tweet that it had approved the first spot BTC ETF and then saying it was fake," with Charles Gasparino adding, "For the SEC not to approve tomorrow would be unprecedented; it has never rejected ETF applications that have gone as far as these."

Ripple CEO Brad Garlinghouse reiterated Gasparino's assertions about the SEC self-investigating.

Days like this remind me that 1/ the SEC should be investigating itself for multiple things 2/ crypto Twitter remains undefeated in memes.

— Brad Garlinghouse (@bgarlinghouse) January 9, 2024

Gemini co-founder Cameron Winklevoss supported, saying, "It would be great if the SEC would stop manipulating the Bitcoin market."

US Senator Bill Hagerty has also called for answers from the SEC, citing the need for accountability.

It remains to speculation, pending investigation, with ETF specialist Eric Balchunas saying, "The language sounds legit SEC-ish IMO vs a crypto knucklehead pulling a prank..."

It remains unclear how this affects the expected announcement, but an actual approval is expected on Wednesday with multiple speculators expecting a reaction. It may influence how the market will deliver, with traders and investors already exiting.

Cryptocurrency markets react

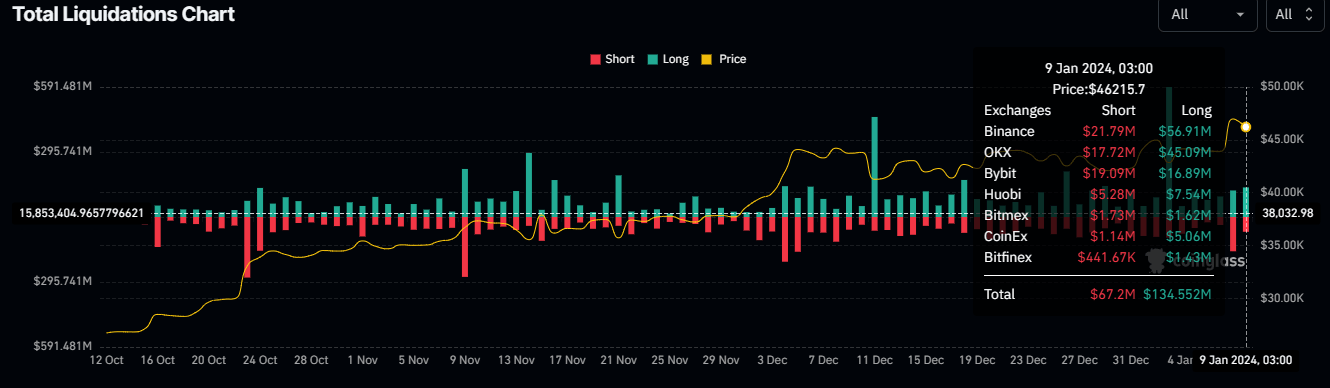

In the aftermath, over $210 million in total liquidations were recorded, comprising $135 million in long positions versus $67 million in shorts.

Total liquidations

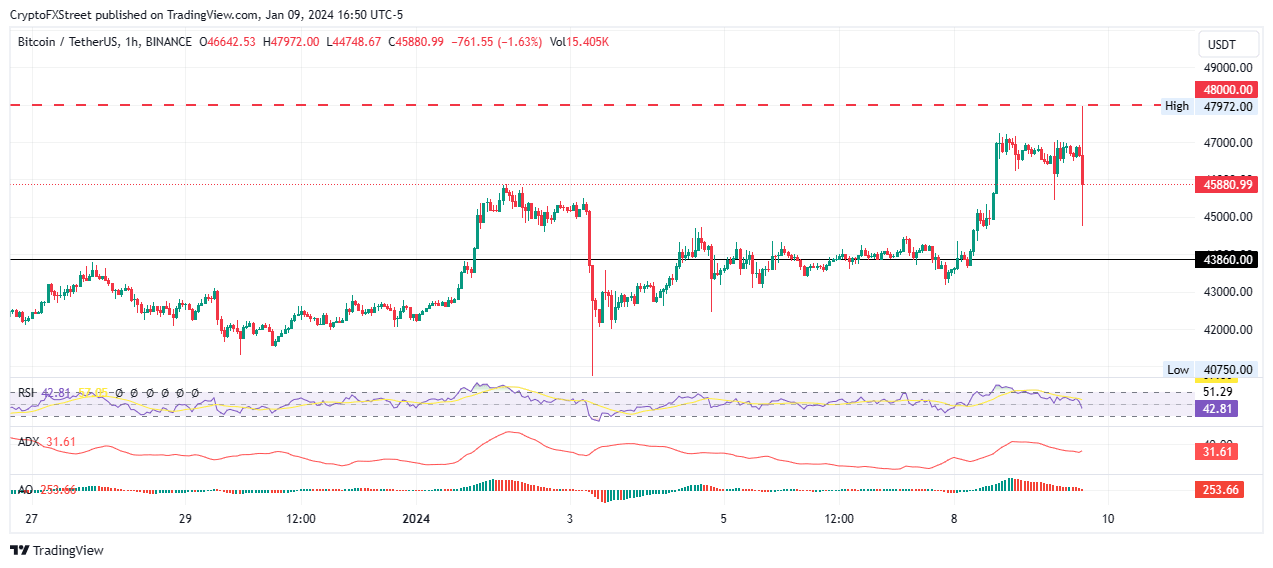

Bitcoin price dipped 5% in the immediate aftermath, to record an intra-day low of $44,748. The slump saw $33 million BTC longs liquidated alongside $24 million shorts.

BTC/USDT 1-hour chart

At the time of writing, Bitcoin price was trading at $45,880.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.