- BNB price declined nearly 4% over the weekend, as Binance FUD triggered capital outflows.

- Binance informed users that the exchange is moving assets between hot and cold wallets to meet withdrawal requirements.

- The exchange has resumed BTC withdrawals after a temporary halt earlier on Monday.

Binance, one of the largest cryptocurrency exchanges, temporarily halted BTC withdrawals twice in the past 24 hours. This has fueled Fear, Uncertainty and Doubt (FUD) among crypto market participants, and influencers are commenting that the exchange could be “going bust” soon.

Binance CEO Changpeng Zhao (CZ) addressed the FUD surrounding the massive exchange outflows and explained that funds are being moved between hot and cold wallets.

Also read: What the recent meme coin pump means for Bitcoin and Ethereum

Binance records massive exchange outflows

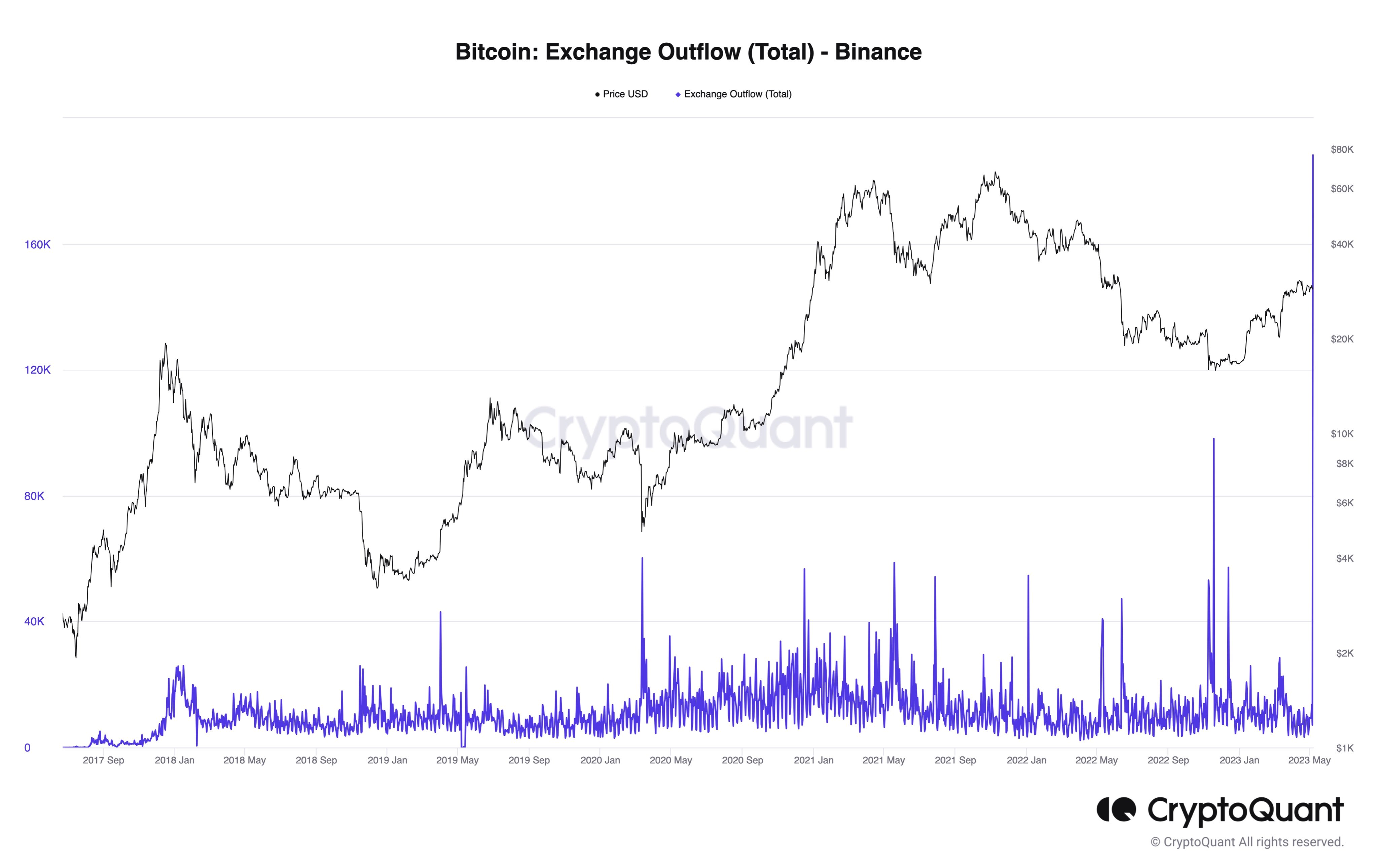

Crypto intelligence tracker Whale Wire reported the largest withdrawal in the exchange’s history, with over 162,000 Bitcoin leaving Binance’s wallets. This outflow is valued at upwards of $4.6 billion.

Bitcoin Exchange Outflow on Binance

Binance addressed the withdrawals and explained that the exchange is moving funds between its hot and cold wallets to facilitate the backed-up BTC withdrawals and there is no need for traders to be alarmed by mass withdrawals.

We’re aware that some data are showing a large volume of outflows from #Binance.

— Binance (@binance) May 8, 2023

This ‘outflow’ are actually movements between Binance hot and cold wallets due to the BTC address adjustments.

The largest exchange by volume announced a temporary halt of BTC withdrawals two times in the past 24 hours. Binance cited a large volume of pending transactions as the reason for the halt and shared updates with traders in its recent tweet:

We've temporarily closed #BTC withdrawals due to the large volume of pending transactions.

— Binance (@binance) May 8, 2023

Our team is currently working on a fix and will reopen $BTC withdrawals as soon as possible.

Rest assured, funds are SAFU.

At the time of writing, BTC withdrawals on Binance are available.

BNB price technicals show a long-term bullish scenario

BNB, the native token of Binance, is in an uptrend that started in June 2022. Since then, the token has formed higher highs and higher lows, climbing to a peak of $397.9 in November 2022.

There is a support zone formed between $264.7 and $304.5. BNB spent a large chunk of time in this zone. Therefore, once BNB price breaks out of the zone, it indicates a continuation of its upward trend.

BNB price is currently above two of its long-term Exponential Moving Averages (EMA), the 50-day and 200-day EMAs. The immediate resistance faced by BNB is at $338, a key resistance level for the past year, equal lows at $360, 38.2% Fibonacci level at $379.9, the November peak at $397.9, and equal highs at $397.9.

If BNB price drops below its two long-term EMAs and enters the support zone, the bullish thesis will be invalidated.

BNB/USD 1D price chart

A definitive close below the ascending trendline could signal a bearish trend reversal in the exchange’s native token.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

OpenAI parts ways with cofounder and chief scientist Ilya Sutskever

OpenAI cofounder Ilya Sutskever is exiting the firm for reasons not disclosed yet. Jakub Pachocki replaces Sutskever, taking the baton after running many of OpenAI’s most important projects, Altman says. Reportedly, Sutskever played a key role in the November ouster of CEO Sam Altman.

Sonne Finance suspends all Optimism markets after over $20 million exploit

With PeckShield attributing the attack to a time-locked contract, Sonne Finance has suspended all Optimism markets, adding that the Base market is safe. Noteworthy, Sonne Finance is the first platform to launch a lending protocol on Optimism.

Bitcoin Price Outlook: Will GameStop stock resurgence have downstream effect on BTC and alts?

Bitcoin continues to glide along an ascending trendline on the four-hour time frame. Meanwhile, the GameStop saga that has resurfaced after three years distracts the market, with speculation that it could inspire risk appetite among traders and investors.

Ethereum bears attempt to take lead following increased odds for a spot ETH ETF denial

Ethereum is indicating signs of a bearish move on Tuesday as it is largely trading horizontally. Its co-founder Vitalik Buterin has also proposed a new type of gas fee structure, while the chances of the SEC approving a spot ETH ETF decrease.

Bitcoin: Why BTC is close to a bottom

Bitcoin (BTC) price efforts of a recovery this week have been countered by selling pressure during the onset of the American session. However, the downside potential appears to have been capped.