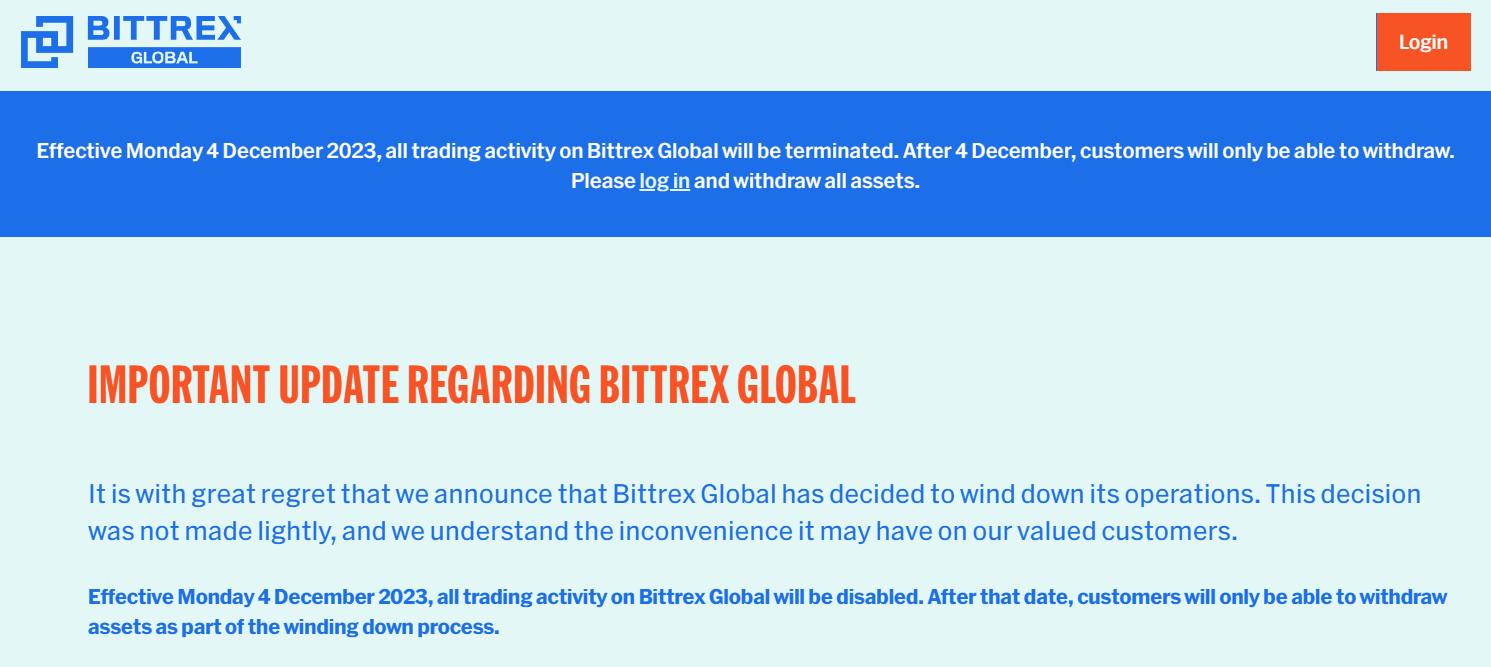

- Bittrex Global announced that it will be halting all trading activity on December 4, after which only withdrawals will be allowed.

- Earlier this year, the US arm of the exchange filed for bankruptcy after paying a $24 million fine to the SEC.

- Bittrex announced that the withdrawal of assets cannot be conducted in USD but only in EUR or other crypto assets.

Bittrex Global, a UK-based regulated cryptocurrency exchange, announced that it will be winding down operations in the next two weeks. The exchange that caters to users outside of the UK is the second entity of the Bittrex brand to shut down following the bankruptcy of its US arm.

Bittrex Global comes to an end

Bittrex Global announced on November 20 that the UK-based exchange will be shutting down its operations in the coming weeks. As part of the process, trading on the exchange will be halted on December 4, after which any user holding assets on the platform will only be allowed to withdraw them.

The exchange also warned users against depositing on the exchange, stating that “funds may be permanently lost as a result of the attempted transfer”. Furthermore, Bittrex Global notified users that their assets cannot be withdrawn in United States Dollars (USD). Instead, the users would need to convert their USD balance into either EUR or crypto in order to be able to withdraw the associated funds.

Bittrex Global announces shutdown

Bittrex was once among the topmost exchanges in the world before the emergence of other crypto exchanges, which raised the competition significantly. Back in 2018, this exchange alone accounted for 23% of the entire market share.

Earlier this year, the US arm of Bittrex filed for bankruptcy after the Securities and Exchange Commission (SEC) charged the platform with violating securities laws. As a result, the crypto exchange was fined $24 million, which Bittrex paid to settle the claims.

The recent bear market and regulatory crackdown have made it difficult for crypto-associated businesses to survive, the evidence of which can be seen in the bankruptcy of some companies in the past two years.

Read more - Bittrex to pay a stark $24 million fine amid SEC's ongoing enforcement push against crypto industry

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

VanEck sees Bitcoin reaching $61 trillion market cap, Marathon buys $100 million BTC

Bitcoin declined by 1% on Thursday following asset manager VanEck's forecast that the top digital asset will reach a $61 trillion market capitalization by 2050.

Ethereum Classic price sets for a rally following retest of key support

ETC edges higher by 2.3% and trades around $22.60 at the time of writing on Friday after testing a key support area the day before. On-chain data showing increased account growth suggests a bullish move ahead. Ethereum Classic price faced rejection by the daily resistance level of $25.13 earlier this week.

Celebrity meme coins lose their shine

Celebrity meme coins report by Jupiter Slorg on Thursday shows that these tokens have been in deep waters since early July after experiencing heavy growth in June. In a recent analysis, Jupiter Slorg revealed that celebrity meme coins are down by an average of 94% from their all-time highs.

Ripple gains 5%, Mark Cuban says Kamala Harris’ nomination could affect SEC lawsuit

Ripple (XRP) made a comeback above key psychological resistance early on Wednesday. Crypto traders are optimistic after the Ethereum Exchange Traded Fund (ETF) launch. Entrepreneur and investor Mark Cuban recently shared his comments on how Kamala Harris’ nomination to the Presidential elections could influence crypto regulation.

Bitcoin: Will BTC manage to recover from recent market turmoil?

Bitcoin recovers to $67,000 on Friday after finding support around $63,500 a day before. Still, BTC losses over 1.50% on the week as Mt. Gox persists in transferring Bitcoin to exchanges.