Bittrex Global set to wind down operations following $24 million fine from the SEC

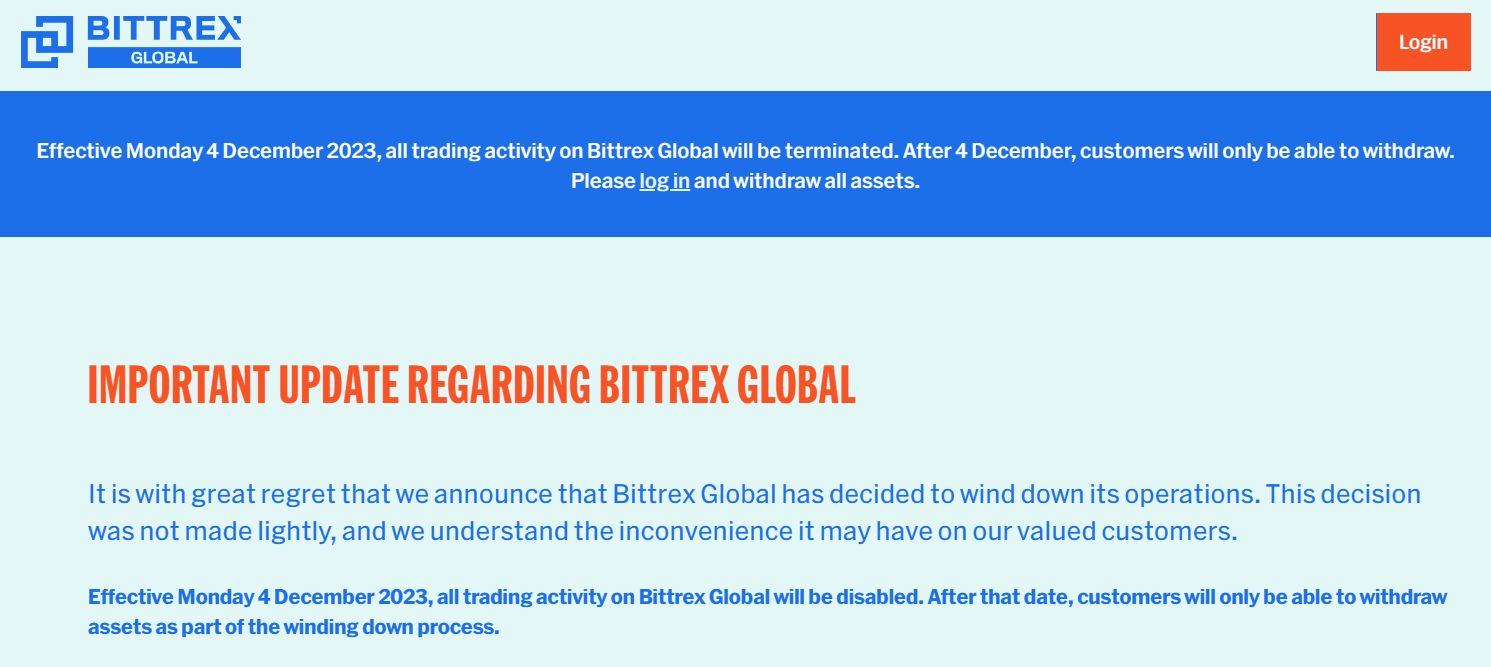

- Bittrex Global announced that it will be halting all trading activity on December 4, after which only withdrawals will be allowed.

- Earlier this year, the US arm of the exchange filed for bankruptcy after paying a $24 million fine to the SEC.

- Bittrex announced that the withdrawal of assets cannot be conducted in USD but only in EUR or other crypto assets.

Bittrex Global, a UK-based regulated cryptocurrency exchange, announced that it will be winding down operations in the next two weeks. The exchange that caters to users outside of the UK is the second entity of the Bittrex brand to shut down following the bankruptcy of its US arm.

Bittrex Global comes to an end

Bittrex Global announced on November 20 that the UK-based exchange will be shutting down its operations in the coming weeks. As part of the process, trading on the exchange will be halted on December 4, after which any user holding assets on the platform will only be allowed to withdraw them.

The exchange also warned users against depositing on the exchange, stating that “funds may be permanently lost as a result of the attempted transfer”. Furthermore, Bittrex Global notified users that their assets cannot be withdrawn in United States Dollars (USD). Instead, the users would need to convert their USD balance into either EUR or crypto in order to be able to withdraw the associated funds.

Bittrex Global announces shutdown

Bittrex was once among the topmost exchanges in the world before the emergence of other crypto exchanges, which raised the competition significantly. Back in 2018, this exchange alone accounted for 23% of the entire market share.

Earlier this year, the US arm of Bittrex filed for bankruptcy after the Securities and Exchange Commission (SEC) charged the platform with violating securities laws. As a result, the crypto exchange was fined $24 million, which Bittrex paid to settle the claims.

The recent bear market and regulatory crackdown have made it difficult for crypto-associated businesses to survive, the evidence of which can be seen in the bankruptcy of some companies in the past two years.

Read more - Bittrex to pay a stark $24 million fine amid SEC's ongoing enforcement push against crypto industry

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.