Bitcoin's proof-of-keys event kicks off on January 3

- Bitcoin owners will take their coins from cryptocurrency exchange accounts.

- BTC/USD reaction is likely to be muted.

On January 3, 2020, Bitcoin enthusiasts plan to launch a flashmob against insecure cryptocurrency exchanges. They call upon all Bitcoin holders to withdraw their coins from exchanges.

The event takes place every year with Bitcoin community demand and takes possession of all coins held by third parties on their behalf. The idea behind the event to show the real value of the ecosystem.

A Twitter user Rhythm that promotes this Proof-of-Key celebration wrote on Twitter

No one can censor it. No one can seize it. No one can freeze it. No one can tell you what to do or what not to do with your money. Bitcoin isn't a get rich quick scheme, it's a get free quick scheme.

Bitcoin's price reaction will be muted

Despite potentially large-scale Bitcoin movements away from the exchanges, Bitcoin price is unlikely to be affected as coins do not change the owners but migrate to a different place of storage.

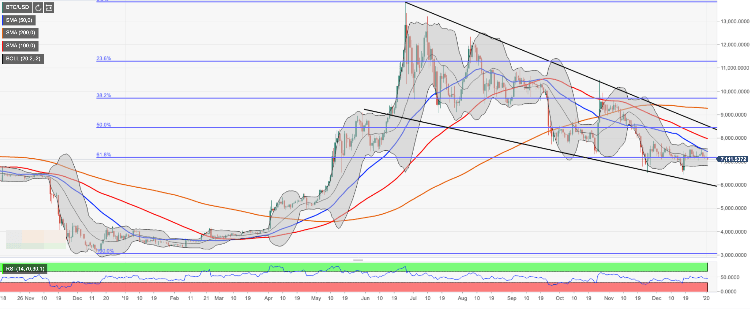

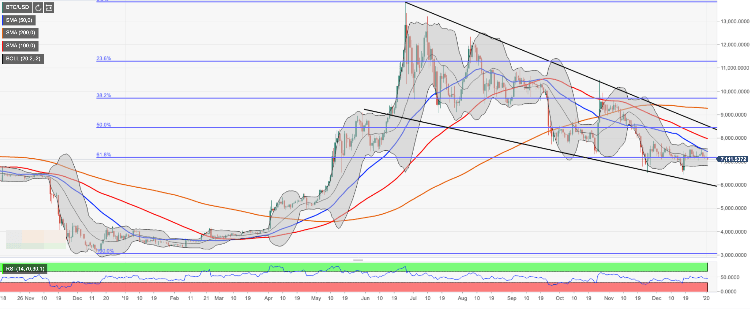

On January 3, 2019, BTC/USD barely moved, the history will be repeated in 2020. At the time of writing, BTC/USD is changing hands at $7,111, unchanged on a day-to-day basis.

The coin has started the year with mild bearish bias; however, it is still above $7,000. As long as this support remains unbroken, BTC/USD has a chance to resume the upside movement towards the upper boundary of the recent consolidation range at $7,500. We will need to see a sustainable move above this handle for the upside to gain traction and take us towards a psychological $8,000. This resistance is reinforced by SMA100 daily and followed by $8,430 (50% Fibo retracement) and $8,550 (the upper boundary of the descending wedge).

The downside momentum may gain traction once $7,000 is broken. The next support is created by $6,800 ( the lower line of the daily Bollinger Band). It is followed by December low of $6,532 and a psychological $6,000.

BTC/USD weekly chart

Author

Tanya Abrosimova

Independent Analyst