Bitcoin’s blockchain data indicates renewed institutional appetite but macro risks prevail

Bitcoin’s latest breakout above key resistance is backed by renewed interest from large investors, blockchain metrics show.

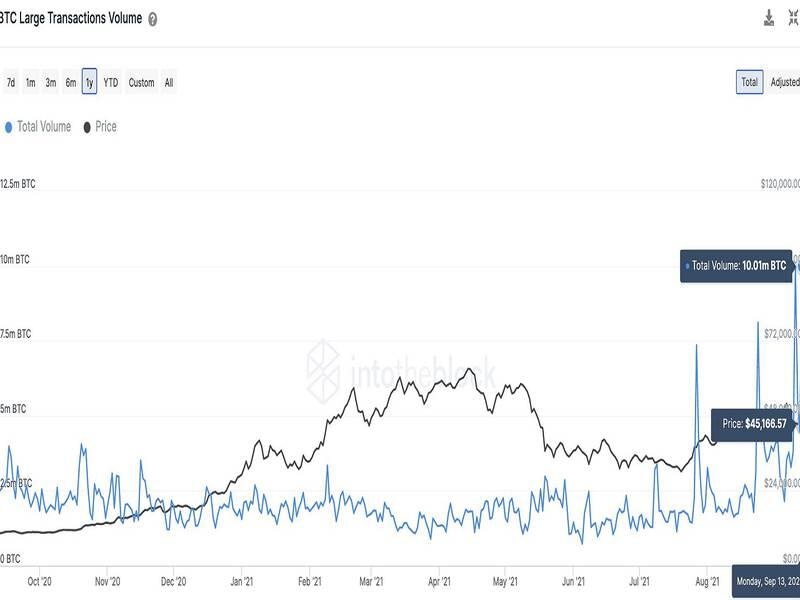

Per data tracked by analytics firm IntoTheBlock, aggregated daily volume measured in U.S. dollars from on-chain transactions, where each transaction was greater than $100,000, surged to a record $480 billion on Wednesday. In bitcoin terms, the so-called large transaction volume hit a two-year high of over 10 million BTC.

“Institutional activity for bitcoin is picking up momentum as the volume in transactions over $100,000 is setting new highs,” Lucas Outumuro, head of research at analytics firm IntoTheBlock, told CoinDesk in a Telegram chat.

While every large transaction does not necessarily represent purchases by institutions or high net worth individuals, the steady uptrend in volume since early August, coupled with the uptick in the balance held by whales and the price recovery, suggests renewed adoption by large investors.

Data tracked by Glassnode and tweeted by William Clemente, lead insights analyst at Blockware Solutions, shows whales or entities holding at least 1,000 BTC have accumulated more than 50,000 BTC this month.

Meanwhile, data shared by Santiment shows the supply held by millionaires list or addresses owning 10,000 to 100,000 coins has gone up 60,000 BTC in the past three days alone. IntoTheBlock’s Outumoru also confirmed a pick up in whale demand, saying “addresses with over 1,000 BTC are accumulating.”

With strong hands backing the recent rise above the 200-day moving average at $46,000, the path of least resistance appears to be on the higher side.

Macro risks prevail

Renewed accumulation by whales does not guarantee immunity from macro risks like the ongoing debt crisis at the Chinese property giant Evergrande.

Tether Ltd., the company behind the world’s largest stablecoin USDT, has denied rumors of holding Evergrande’s commercial paper as a reserve. However, cryptos may still feel the heat if the crisis spills over to global markets. That possibility cannot be ruled out given Evergrande’s position in China’s economy, the world’s second-largest.

“There are pockets of contagion in Chinese markets from Evergrande’s swoon. The property developer’s woes exacerbate an already softening housing market, which accounts for 28% of China’s economy,” Bloomberg’s Lisa Abramovich tweeted.

Per Reuters, China’s housing authority has notified major banks that Evergrande Group won’t be able to pay loan interest due Sept. 20. The shares in the cash-strapped property giant tanked to a decade low early today.

The futures tied to the S&P 500 are currently trading flat-to-negative, while bitcoin is changing hands near $47,900, representing a 0.5% drop on the day.

Aside from broader market sentiment, bitcoin traders could take cues from the U.S. retail sales number scheduled for release at 12:30 UTC. Per FXStreet, the data is expected to show consumer spending dropped by 0.8% month-on-month in August following July’s 1.1% contraction.

A weaker-than-expected figure would ease concerns of Federal Reserve dialing back stimulus and could lift asset prices higher.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.