Bitcoin whales go on buying spree despite Grayscale ‘unlockings’

- Grayscale Bitcoin Trust might increase the selling pressure behind the flagship cryptocurrency as it prepares for a massive unlocking period.

- Bitcoin whales have added more tokens to their holdings recently, suggesting a potential upswing before a sell-off.

- JPMorgan strategists asserted that BTC is not out of the woods yet.

Multiple technical factors suggest that the Bitcoin bull market has come to an end. Analysts at JPMorgan asserted that the downward price action is not over yet and defined the Grayscale Bitcoin Trust unlock period as a trigger for another leg down.

Whales buy the dip ahead of the Grayscale Bitcoin Trust unlock

Grayscale, the world’s largest digital currency asset manager, offers institutional investors exposure to Bitcoin by issuing shares of its Grayscale Bitcoin Trust (GBTC). With a total of $21.7 billion worth of assets under management, the investment firm has offered a 205% return based on the Market Price of its shares in the past 12 months.

When institutions purchase GBTC shares, there is a six-month lockup period that they have to go through before they can sell their holdings. Therefore, the shares of those investors who bought in January have started unlocking, but the most significant GBTC unlock period is scheduled for the third and fourth week of July.

Roughly 16,000 BTC are going to be unlocked in the second half of the month, which could lead to a spike in selling pressure as investors look to book profits.

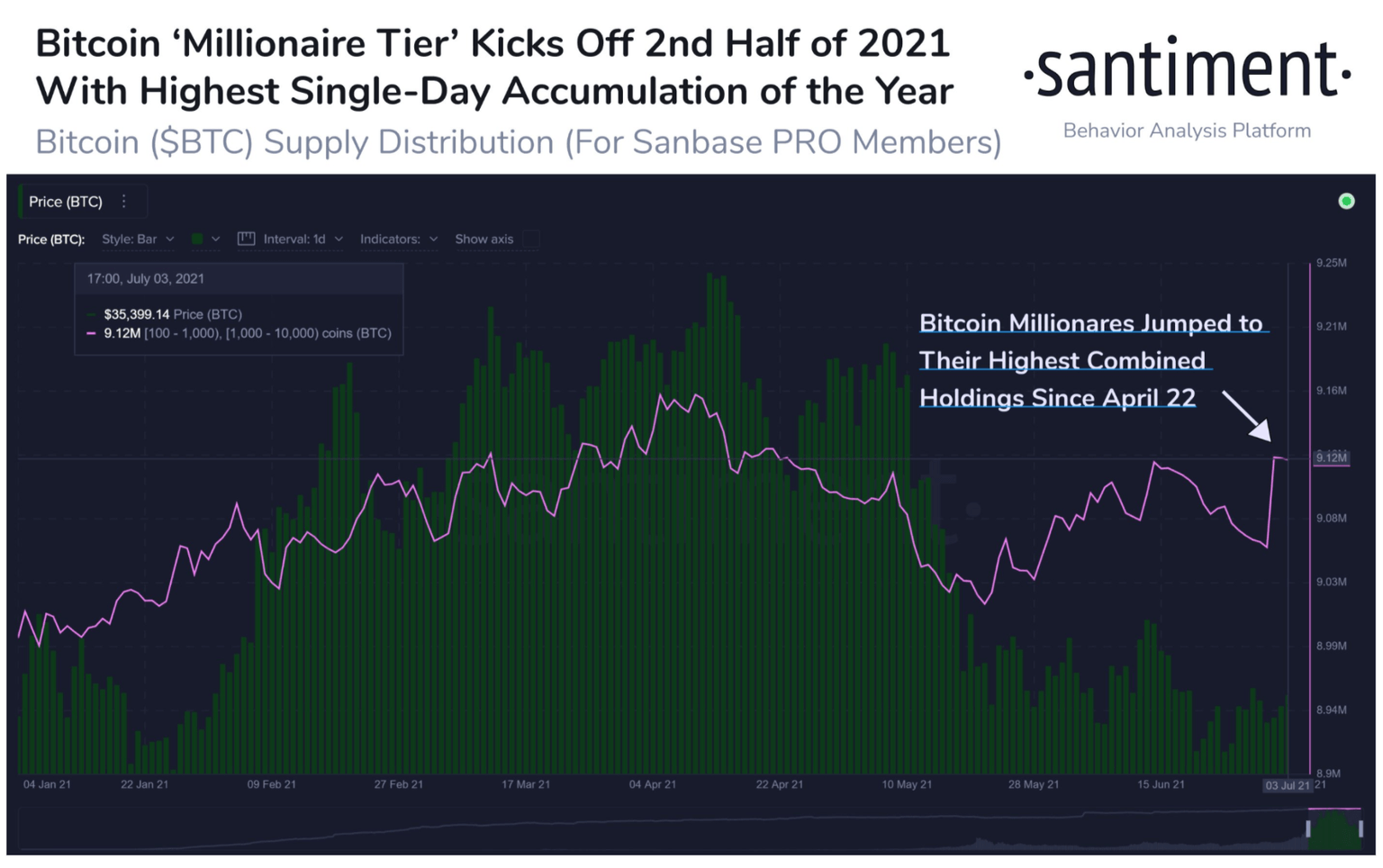

The fact that these institutional investors bought GBTC shares when Bitcoin was trading around $30,000 in January suggests that they will not be inclined to sell at a loss. Coincidentally, Santiment reported an uptick in the number of BTC tokens held by addresses with 100 to 10,000 BTC.

The behavior analytics platform stated that whales have “kicked off July with a 60,000 BTC accumulation spike,” which is the highest ever recorded since the beginning of the year.

Bitcoin Supply Distribution

It is worth noting that whales have a disproportionate impact on prices because of their enormous holdings and their ability to coordinate buying and selling activity. Thus, the sudden increase in the BTC purchase by high networth individuals could help push Bitcoin price higher so when GBTC shares are unlocked all of these market participants can sell at a profit.

Analysts at JPMorgan seem to agree with this theory. In a note to clients, the multinational investment bank’s lead strategist Nikolas Panigirtzoglou said that at least a portion of the GBTC holdings will be sold after the July unlocking period.

Despite this week’s correction, we are reluctant to abandon our negative outlook for Bitcoin and crypto markets more generally. So despite some improvement, our signals remain overall bearish.

Author

FXStreet Team

FXStreet