- Bitcoin has had another stellar week with over 18% of gains.

- Halving expectations and monetary stimulus feed bullish sentiments.

- BTC/USD needs to settle above $10,000 to avoid short-term correction.

Bitcoin bulls have done a good job this week, however, the major aim of $10,000 remains unconquered so far. Will we see a new high of 2020 before the halving? The market sentiments say yes, the technical picture is not so straightforward.

Halving frenzy enters the final stage

Now that the halving is just four days away, the excitement mixed nervousness drives the cryptocurrency prices to new highs and create a sense of FOMO (Fear of Missing Out). The number of daily active Bitcoin addresses surpassed 1 million and reached the highest level since June 14, 2019, according to the statistical data provided by Intotheblock. While the volatility stays below the recent high, many traders are positioning ahead of the block reward reduction that is expected to become one of the most bullish events in recent Bitcoin’s history.

Buy the rumor sell the fact?

While there are many diverse forecasts and expectations of how Bitcoin will behave after the halving, the vast majority of experts believe, that the event may result in an immediate short-term correction within “buy the rumor sell the fact scenario”.

According to Henry Elder, Director of Investment Strategies at Wave Financial Group, the correction may be intensified due to the sense of uncertainty on the global markets.

Investor optimism around the halving has pushed bitcoin back above the psychologically important level of $10,000 per coin, a 150% increase over the 2020 low. This is likely a “buy the hype, sell the news” scenario, as halvings are typically followed by a price correction before the subsequent bull run. The likelihood of a correction here is amplified by the general sense of uncertainty pervading all markets at the moment.

The expert believes that the current economic environment mires the pre-halving picture as the looming recession and massive economic disruptions may lead to risk-off sentiments, which caused a sharp Bitcoin collapse in the middle of March.

Rosy long-term expectations

However, in the long-run Bitcoin is forecasted to embark on a sustainable growth path that will lead to new historical highs. The price expectations vary from $50,000 to $1 million by 2024, based on the assumption that Bitcoin’s mass adoption will gain traction in the upcoming months and years. The growing demand amid decreasing supply will create a deficit and ensure the price increase.

Moreover, Bitcoin is also touted as a hedge against inflationary monetary policies carried out by global central banks. Recently a prominent investor Paul Tudor Jones said that he would add his flagship fund as an inflation hedge and store of value.

BTC/USD: Technical picture

Bitcoin has gained over 14% on a weekly basis and posted the second big green candle on a weekly chart. The first digital coin tested area above $10,000 for the first time since the end of February as the market is entering the last phase before the halving. Since the start of the year, BTC price increased by 40%, though it is still below the highest level of 2020 reached $10,511 on February 13.

BTC/USD weekly chart

The local support is created by 38.2% Fibo retracement for the downside move from July 2019 high to December 2019 low on approach to $9,300. This barrier served as resistance during the previous week and is likely to slow down the sell-off in case of the bearish correction. However, a more important backstop is created by weekly SMA50 ($8,800) and the lowest level of the week at $8,550. Once it is out of the way, the sell-off is likely to gain traction with the next focus on $8,300-$8,200 area, which includes 23.6% Fibo retracement for the downside move from July 2019 high to December 2019 low and 61.8% Fibo retracement for the downside move from February 2020 high as well as daily SMA100 and SMA200.

On the upside, once the price is above $10,000, the recovery may be extended towards $10,150 with 50.0% Fibo retracement for the downside move from July 2019 high to December 2019 low. A sustainable move above this area will open up the way to the highest level of 2020 at $10,511 and to the psychological $11,000.

BTC/USD daily chart

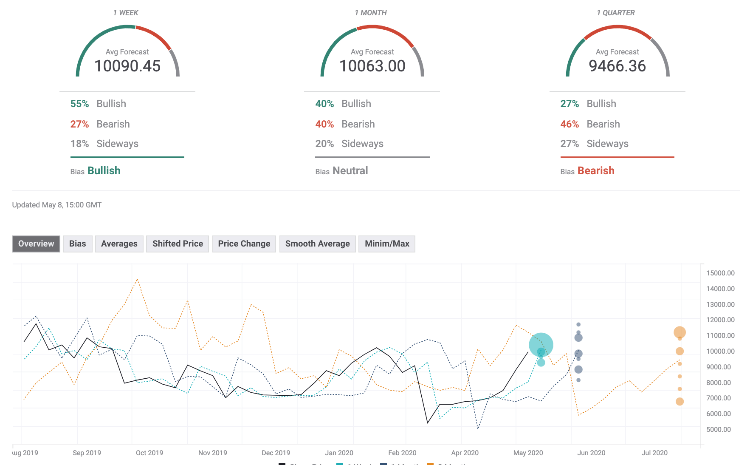

The Forecast Poll showed a significant improvement in price expectations since the previous week. While the weekly forecast turned bullish, monthly and quarterly expectations remained less optimistic. It means that the market does not believe ina huge and sustainable price jump after the halving. The price expectations on all time-frames except quarterly are above $10,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto traders brace for short-term volatility with $2.4 billion options expiry on Friday

Bitcoin and Ethereum options market looks bullish on Friday, according to data from intelligence tracker Greeks.live. The firm said it has identified two Bitcoin calls that show an underlying bullish sentiment among market participants.

XRP recovers from week-long decline following Ripple’s response to SEC motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Lido adds 4% gains as protocol rolls out first step towards decentralization

Lido takes the first batch of simple DVT validators to live, a step taken to decentralize the protocol. Lido leveraged technology to expand the protocol to multiple node operators, inviting both solo and community stakers.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

-637245473983663817.png)

-637245473817269760.png)