Bitcoin price inches closer to $30,000 as Fed says this hours after PacWest Bancorp wrecks

- Bitcoin price rose to $29,000 on May 3 following PacWest Bancorp announcing the potential of a sale.

- The Federal Reserve stated that the banking system was “sound and resilient” hours before PacWest crashed by 50%.

- The Fed is expected to pause the interest rate hike after the 25 bps increase on May 3.

The second iteration of the banking crisis seems to be in effect as, in the span of a month, another bank is closer to being seized by the Federal Deposit Insurance Corporation (FDIC). This has had a rather positive impact on Bitcoin price.

Read more - Crisis in the United States - Banks down, Investors out - but Bitcoin price rises to $28,500

Bitcoin price enjoys the fall of the US banking system

Bitcoin price is proving why it is worthy of its “safe haven” status amidst the increasing problems in the US banking system. Despite the market-wide bearishness and the same being observed in the case of stocks as well, the crypto market continues to shine.

After First Republic Bank, PacWest Bancorp announced today that it is weighing options, including a potential sale. This led to a near 55% crash in the bank’s stock value before the ticker recovered by the end of the trading day.

The decline in PacWest Bancorp had a negative impact on other regional banks as well, some even declining by more than 25%.

US Regional Bank Stocks After Hours:

— The Kobeissi Letter (@KobeissiLetter) May 3, 2023

1. PacWest, $PACW: -60%

2. Western Alliance, $WAL: -30%

3. Metropolitan Bank, $MCB: -20%

4. Valley National, $VLY: -15%

5. HomeStreet, $HMST: -11%

6. Zions Bank, $ZION: -10%

7. KeyCorp, $KEY: -8%

8. Citizens Financial, $CFG: -5%…

Thus, while on the one hand, the banking sector suffers, on the other, the Federal Reserve says that the banking system is “sound and resilient”. Following the 25 basis points (bps) hike in the Federal Funds Rate on May 3, the agency, in a statement, seemed to be of the opinion that nothing was wrong with the banking sector.

This did not seem to sit well with most of the market, as participants pointed out the irony and absurdity of that statement given the last few weeks.

One bank failing doesn't mean the banking system is unsound. $SIVB

— Erik Voorhees (@ErikVoorhees) May 3, 2023

Two banks failing doesn't mean the banking system is unsound. $SBNY

Three banks failing doesn't mean the banking system is unsound. $FRC

Four banks failing doesn't mean the banking system is unsound. $PACW

Investors and analysts operating under the name of Wall Street Silver stated that they expected the bank to be closed by Friday and potentially sold off. Another notable commentator, The Kobeissi Letter, discussed why the bank might not be immediately bought out but follow the same process as First Republic Bank did.

PacWest, $PACW, is now down 60% after hours on news that they are looking for a potential buyer.

— The Kobeissi Letter (@KobeissiLetter) May 3, 2023

It is unlikely anyone will buy PacWest because of the precedent that the FDIC has set.

Why would a large bank buy a smaller bank before the FDIC seizes it?

If they wait for the…

However, it is expected that the Fed would pause the rate hike in lieu of the banking crisis, the probability of which for the next meeting is at 85% at the moment. This would slightly ease up borrowing, which has become pretty expensive over the last 14 interest rate hikes.

Amidst this chaos, Bitcoin price is sneaking closer to $30,000, trading at $28,946 presently. In addition to the green candlesticks, the cryptocurrency’s social dominance is also on the rise, which suggests that investors are gaining interest in the alternate currency.

BTC/USD 1-day chart

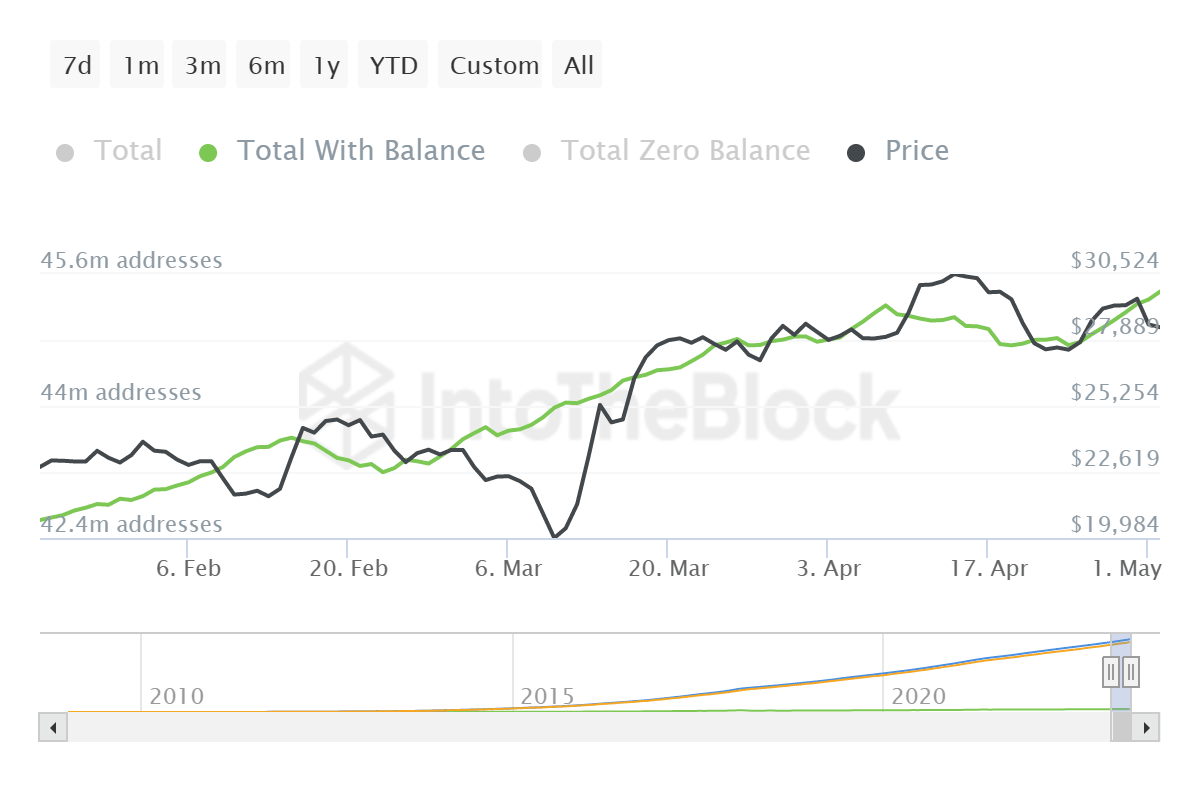

Nearly one million new users have joined the network over the last ten days, which is relatively significant for Bitcoin. This is because, generally, it takes the network at least two months, as per past instances. Bitcoin gained more users in the past couple of days than it did throughout March and April, with the total figure standing at 45.3 million.

Bitcoin total addresses with a balance

Put simply, all of the above instances indicate quicker growth and rising interests in the potential of cryptocurrency, which would come to light for as long as the US banking sector continues to decline.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.