Bitcoin price reverses from $100.6K as retail traders buy Trump-related tokens

- Bitcoin price stalled at $100,600 on Wednesday, capping its daily gains at 3%.

- Market data shows curtailed demand for Bitcoin as traders lean into Trump-linked assets and lending protocols.

- Bitcoin on-chain transactions plunged 37% in the last three days, signalling the current market rally is driven by fewer buyers.

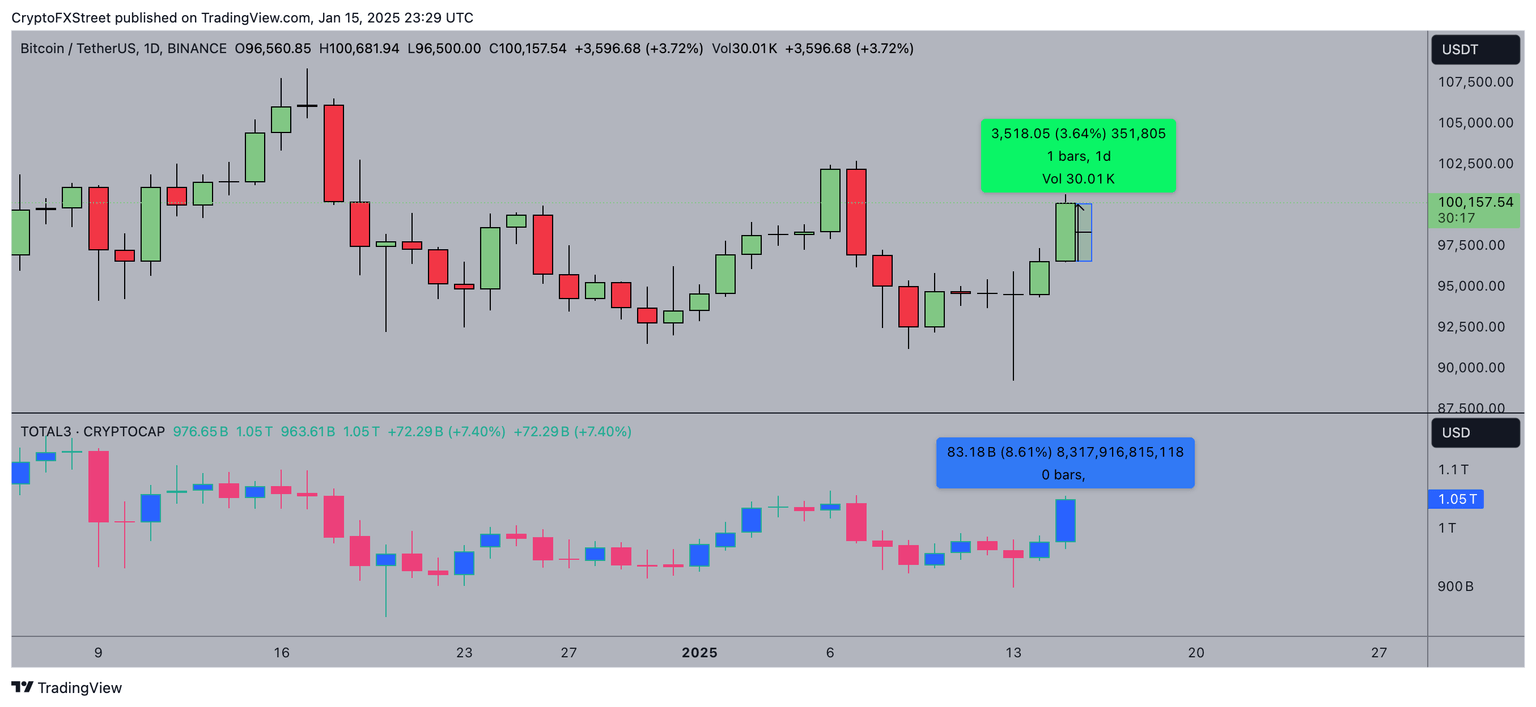

Bitcoin price hit $100,686 on Wednesday, posting 3.3% gains within the daily timeframe. Market data shows that the traders are leaning more towards the altcoin market following VanEck’s latest ETF filing.

VanEck ETF filing propels altcoin markets ahead of BTC

Bitcoin's price reached $100,686 on Wednesday, marking a 3.6% daily gain.

This uptick coincided with VanEck's filing for an Onchain Economy ETF with the U.S. Securities and Exchange Commission (SEC) on January 15, 2025.

The proposed ETF aims to invest at least 80% of its assets in digital transformation companies and digital asset instruments, encompassing sectors such as software development, mining operations, and cryptocurrency exchanges.

Despite Bitcoin's rise, the altcoin market outperformed, with the aggregate altcoin market cap (TOTAL3) gaining over 8.6% on Wednesday.

This suggests that investors are increasingly favoring altcoins, possibly in anticipation of regulatory approvals for altcoin-focused ETFs.

In summary, VanEck's recent ETF filing appears to have invigorated the altcoin market, leading to a notable shift in investor focus away from Bitcoin.

Market data indicates that while Bitcoin price experienced muted gains, the heightened interest in altcoins may have diverted some capital away from BTC, challenging its ability to maintain upward momentum.

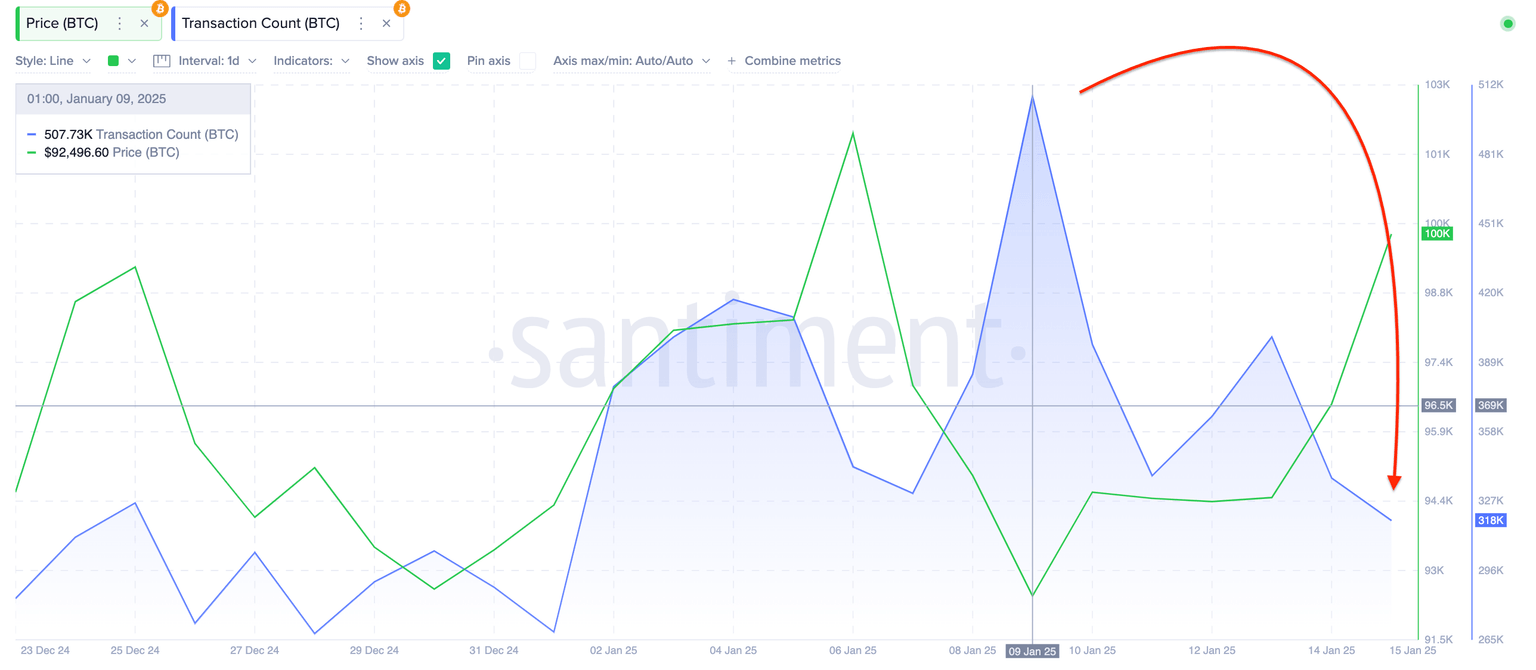

Bitcoin transactions plunge 37%, signaling potential roadblocks ahead

Bitcoin’s 3.6% price gains this week, trailing the broader market average, raise concerns about the sustainability of its rally.

Adding to these concerns, recent on-chain transaction trends reveal potential risk factors that could weigh on Bitcoin’s momentum.

While broader crypto market prices have flipped bullish, transaction activity on Bitcoin’s core blockchain network continues to decline.

The blue-shaded area in the Santiment chart below validates this narrative by illustrating the daily transaction count on the blockchain.

At the market's recent peak on January 9, investors executed 507,730 transactions on the Bitcoin blockchain.

However, this figure has since dropped 37%, with only 318,000 transactions recorded on Wednesday.

Such a significant decline in transaction volume during a price rally signals several bearish risks.

First, it suggests that retail traders are largely absent from the current rally, likely contributing to the steep drop in transaction counts over the past three days.

Furthermore, the data highlights that Bitcoin’s recent price action has been fueled by an increasingly narrow pool of traders.

This shrinking volume reinforces concerns that Bitcoin may struggle to sustain upward momentum.

With fewer active participants, Bitcoin faces heightened vulnerability to rapid price swings, particularly if institutional traders exploit thin liquidity to induce favorable volatility.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.