Following spot Bitcoin ETF applicants, SEC holds meetings with NYSE, NASDAQ and other exchanges

- Bitcoin price climbed back 3% on Thursday after falling below $41,000 yesterday owing to the Matrixport FUD.

- In the last two days, VanEck, Grayscale and Fidelity have filed for registration of securities with the SEC.

- The approval hype momentum is in full swing after the SEC met with NYSE, NASDAQ, and CBOE exchanges to discuss the spot BTC ETF.

Bitcoin price, a day the crash, has nearly recovered, thanks to the investors realizing the FUD behind the incident. On the other hand, the reason behind the FUD was also debunked as spot BTC ETF applicants took another step forward in reassuring users awaiting approval from the Securities and Exchange Commission (SEC)

Daily Digest Market Movers: Spot Bitcoin ETF applicants submit new filings

VanEck and Grayscale followed in the footsteps of Fidelity to file the 8-a forms on Thursday for registration of the securities. What is to be noted is that while it may sound like the applicants are refiling their applications, they are not.

This step is part of the process that requires this filing from all the applicants in order to ensure they do not miss out on anything that might hinder their approval during the first wave expected between January 8-10.

This filing serves as a brochure for investors who aren’t well versed with the investment product as it requires a description of the type of securities offered, details of issuance, distribution date, and terms from the applicant.

These filings came less than a day after the regulatory body held a meeting with the exchanges expected to help launch the applicants' investment products. SEC met with the New York Stock Exchange (NYSE), Nasdaq, and Cboe exchanges in order to receive their comment on the potential spot Bitcoin ETF approval.

All these incidents point towards a bullish outcome, but nothing can be certain about happening until it happens.

Technical Analysis: Bitcoin price recovers

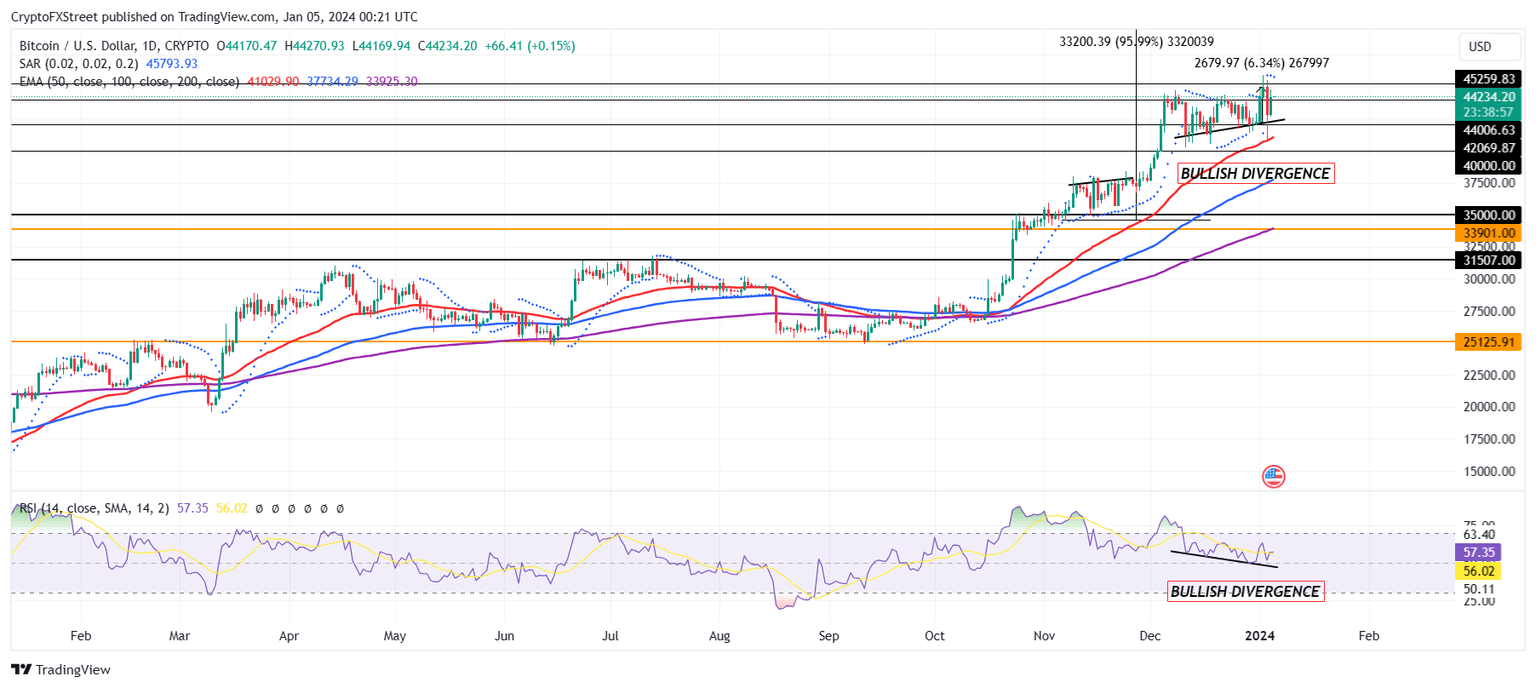

After falling below $41,000 on Wednesday, Bitcoin price freaked investors out, but at the time of writing, after a 2.3% recovery, the cryptocurrency is back to trade at $44,234. Largely, this price action is still satisfying the bullish divergence observed in the past few days.

This means that BTC is on track and will likely continue the uptrend it is in to breach the $45,000 mark ahead of the spot BTC ETF approval. It might witness some resistance around $45,259, but flipping it into a support floor will enable further rise.

BTC/USD 1-day chart

On the other hand, if the barrier remains unbreached, BTC could trace its steps back to $44,000 or lower to invalidate the short-term bullish thesis.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.