Bitcoin Price Predictions: Bitcoin bull Tom Lee says 2020 will be positive for BTC

- Bitcoin will have a positive year, Fundstrat's Tom Lee says.

- BTC/USD needs to regain $8,450 to mitigate immediate bearish pressure.

Bitcoin (BTC) has lost nearly 6% of its value during recent seven days and hit the low of $8,217 on Friday. At the time of writing, BTC/USD is changing hands at $8,330 with the short-term recovery capped by SMA50 1-hour at $8,370. Bitcoin's market share has settled at 66.2% after a short-loved dip below 66.00%.

Tom Lee is bullish about Bitcoin

The co-founder of Fundstrat, Tom Lee, confirmed his bullish stance on Bitcoin. Speaking in the interview with CNBC, he said that 2020 would be a great year for Bitcoin. Among the reasons that will drive the first cryptocurrency to new records, he mentioned the upcoming halving and Middle East tensions and geopolitical uncertainty, which is also good for Bitcoin.

Earlier this year, Tom Lee predicted a 100% growth of Bitcoin in 2020 as the current price does not reflect the effects of the upcoming halving.

Read more about Bitcoin's halving

BT/USD: technical picture

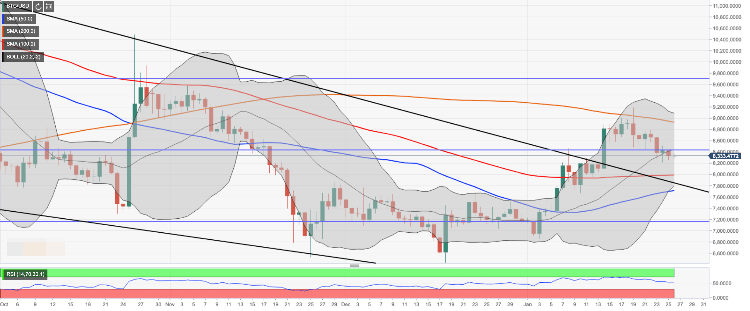

On the daily chart, BTC/USD topped at $9,184 and reversed to the downside. While the coin has lost nearly 7.5% in recent seven days, the downside move still qualifies for the natural correction from a 16% rally since the beginning of 2020. Bitcoin is likely to reach strong support in the area of $8,000-$7,700. This zone is packed with important technical indicators that are likely to slow down the bears and initiate a recovery.

Thus, the first support is created by SMA100 daily marginally below psychological $8,000. Once it is out of the way, the broken downside trend line at $7,800 will come into focus. It is followed by SMA50. daily at $7,700. If the bears manage to push BTC below this zone, the sell-off is likely to gain traction with the next target as low as $7,150 (61.8%. Fibo retracement for the upside move from December 2018 low to July 2019 high).

On the upside, strong resistance is created by $8,450. This zone is reinforced by 50% Fibo retracement. The ultimate upside barrier is created by a psychological $9,000 with SMA200 daily located on the approach.

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst