Bitcoin halving is around the corner: How to trade it

- How Bitcoin halving will affect the cryptocurrency market and what you can do to capitalize on it.

- Halving is regarded as a strong bullish catalyst.

- The history may be a lousy financial advisor this time.

- Altcoins will track Bitcoin's price movements.

In less than five months, the Bitcoin network will go through a momentous event that has the potential to bring about drastic changes to the cryptocurrency market. Bitcoin's block reward will be slashed in half, which won't pass unnoticed.

Bitcoin halving in a nutshell

Every 210000 blocks, the Bitcoin network undergoes a reduction fo the remuneration received by miners. The procedure is known as halving. Considering that miners spend about 9 minutes and 20 seconds on average to find a block, halving happens approximately once in four years. Initially, miners got 50 BTC for each discovered block. However, as a result of the upcoming halving, since 2020, they will get only 6 BTC for the same work.

Many industry players believe that halving will become a robust bullish catalyst for Bitcoin, that will eventually resume the upside trend and hit new all-time high (ATH) ahead of the event.

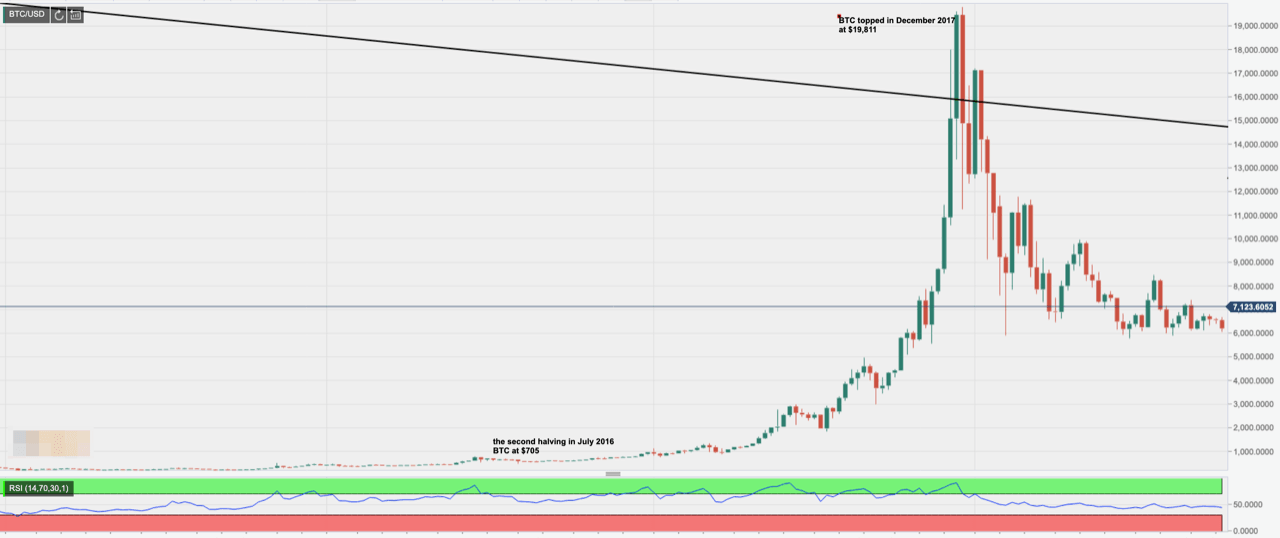

The experts from the investment company Grayscale noted that Bitcoin tends to gain ground both ahead and after the halving. BTC, the first cryptocurrency, began growing about a year before the event, continued moving to the North, and reached a new top approximately in a year after. In 2013 the value of bitcoin increased by 12000%, while in 2017, the price jumped by 13000%.

Notably, the correction that followed quickly morphed in a sharp sell-off. The first cryptocurrency tumbled down, but then resumed the upside ahead of the next halving.

This time may be different

Many experts, including Pantera Capital CEO, Dan Morehead, and Tom Lee, the head of the Fundstrat Global Advisors, predict the rise of the first cryptocurrency to a new ATH within a year or so after the event. The forecasts vary from $20000 to positive infinity.

However, the third halving may be less straightforward than the previous two iterations. Several experts believe that it will be a non-event as it has been already priced in. Moreover, this time we are heading towards the halving with bearish sentiments dominating the market, which is against the pattern of halving in 2012 and 2016.

Also, it should be noted that Bitcoin has a solid derivatives market that allows users to speculate on Bitcoin price via futures, options, and CFDs (contracts for difference). These investment tools distort market reactions to the fluctuation of physical supply and demand.

According to Meltem Demirors, the chief strategist of the investment company CoinShares, derivatives markets are a strange animal that have the power to deprive the producers of their right to set prices. She pointed out to other commodity markets with a substantial range of available derivatives, where the market is driven by speculation as the vast majority of the participants trade paper contracts to speculate on the price.

Altcoins will follow the lead

All top cryptocurrencies followed the same pattern. Many experts noted that altcoins are closely correlated with BTC prices. As a result, Bitcoin halving led to strong growth across the digital assets market.

The trend is clearly traceable on the second Bitcoin's halving that took place in July 2016.

Thus, Litecoin started growing a few months before Bitcoin's block reward reduction. However, having risen by several dollars, the cryptocurrency retreated to the previous levels. However, precisely one year later, Litecoin reached the highest levels in history. In July 2016, the coin was valued at $4.15, and in July 2017, it cost about $53.

Ethereum demonstrated similar momentum. At the time of the halving, the price fluctuated insignificantly. However, a year after the event, ETH rose from a level of $10 to over $270. Also, the first significant increase in XRP was recorded a year after the Bitcoin halving.

Correlation is waning

While the experience implies an impressive growth across the board, it is still difficult to predict exactly the impact Bitcoin halving may have on altcoins in 2020. According to the research carried out by HodlBlog, the correlation between Bitcoin and top altcoins had been growing every year until recently. So in 2017, 75% of the top 200 coins by market capitalization had a correlation of 0.67 or higher over the past two years. In 2018, the correlations between top cryptocurrencies and BTC was extraordinarily high. Over 75% of the top 200 coins had a correlation of at least 0.87.

However, in 2019 this indicator began to decline. The average correlation coefficient for the top 200 cryptocurrencies by market capitalization decreased from 0.89 to 0.58.

If the correlation is positive, the coin is likely to move in the same direction as Bitcoin. Negative correlation implies that the coin will tend to move in the opposite direction. If the correlation is zero, the coins have no linear dependency. This information can tell which coins will be most affected by the BTC price changes.

Bitcoin halving: The bottom line

Many iErndustry players use retrospective analysis to forecast a strong Bitcoin price growth after halving. While these expectations may prove to be right in the long run, the immediate market reaction may be less clear-cut due to increased volumes of derivatives and speculative trading. As a widely expected event, it is mostly priced in, which may result in "buy the rumor, sell the fact" type of reaction and cause Bitcoin's price decrease right after the event.

Altcoins with a high positive correlation with Bitcoin, such as Ethereum (ETH), Litecoin (LTC), or Monero (XMR) are likely to copy the price movements of the first digital coin in the long run.

If you consider speculating on Bitcoin or altcoins at the time of halving, make sure you have the right risk management strategies in place.

This article belongs to the 20 trading ideas for 2020 series. Check the full list of 2020 pieces.

Author

Tanya Abrosimova

Independent Analyst