Bitcoin Price Prediction: Road to $8,000 may be bumpy – Confluence Detector

- BTC/USD bulls managed to clear an important barrier.

- The next important resistance is created by $8,000.

Bitcoin (BTC) has been hovering above $7,500 on Friday. A strong upside momentum on Thursday caused by BitMEX liquidations ahead of CME Bitcoin futures expiry, helped the coin to break above strong psychological resistance $7,000 and hit the highest level in the recent month $7,748. While BTC/USD retreated from the peak, many traders expect further recovery ahead of the halving event that will take place in May. However, the trip to the North is riddled with barriers and hurdles that may cause setbacks and discourage short-term bulls.

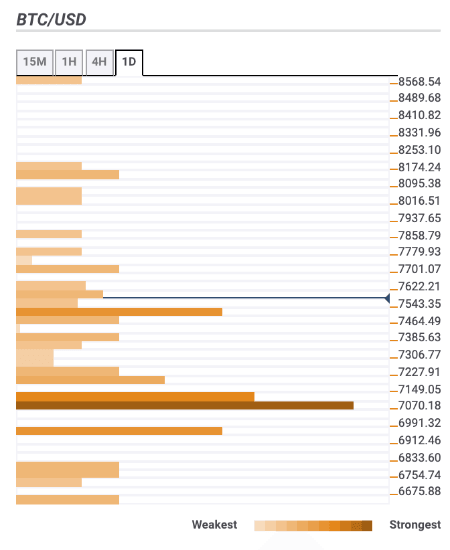

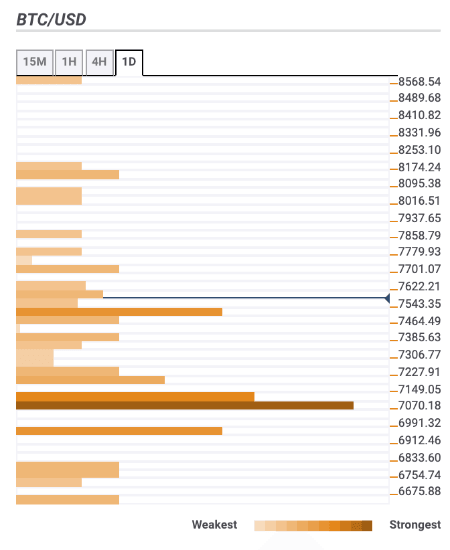

Bitcoin confluence levels

Technical barriers clustered both below and above the current price may keep BTC in the range in the nearest future. On the upside, several clusters of resistance levels are located until $8,000. This area is likely to serve as an upper boundary of the consolidation channel. On the downside, $7,000 will serve as a support area. Let's have a closer look at the technical levels for BTC/USD:

Resistance levels

$7,700 - Pivot Point 1-week Resistance 2

$7,650 - Pivot Point 1-day Resistance 1

$8,000 - daily SMA100 and daily SMA200

Support levels

$7,450 - 38.2% Fibo retracement daily, the middle line of 1-hour Bollinger Band, the upper line of the daily Bollinger Band

$7,200 - 61.8% Fibo retracement monthly

$7,000 - the middle line of the daily Bollinger Band, 4-hour SMA100, 23.6% Fibo retracement weekly, daily SMA10.

BTC/USD, 1-day

Author

Tanya Abrosimova

Independent Analyst