Bitcoin Price Prediction: BTC/USD en route to $20,000 by end of 2020 – Confluence Detector

- Bitcoin price takes a breather above $9,600 after recovering from the dip below $9,400.

- Bitcoin price consolidation is set to continue ahead of a breakout above $10,000.

- Bloomberg’s commodities analyst McGlone believes Bitcoin price actions point to $20,000 by the year’s end.

Bitcoin price has employed defense mechanisms after a breakdown from highs above $10,000. The price formed a weekly low below $9,400 before recovering above $9,600. The trading commenced at $9,667 on Thursday but no progress was made farther than $9,674.48 (intraday high). BTC/USD has adjusted to $9,665. Slightly bullish momentum is developing amid expanding volatility.

The technical picture at the time of writing is neither bullish nor bearish. The tag of war between the bulls and the bears is of equal strength. Consolidation is expected to take precedence according to the various applied technical indicators such as the RSI and the MACD. However, an observation of the moving averages suggests that bulls have the upper hand, although they lack the strength to outperform the bears. In other words, the wide gap between the SMA50 and SMA 100 in the daily range places BTC in the bulls’ hands.

BTC/USD daily chart

-637268354192516194.png&w=1536&q=95)

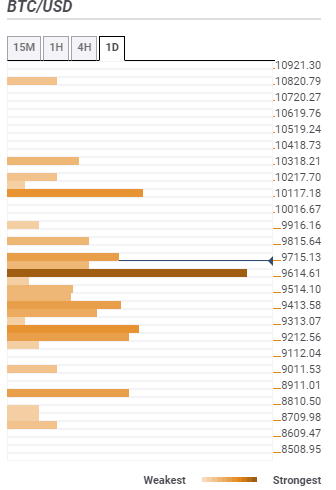

Bitcoin confluence resistance and support areas

Resistance one: $9,715 – Highlighted by the Bollinger Band 1-hour upper curve, previous high one-hour, previous high 15-minutes, Bollinger Band 15-minutes upper curve, SMA 50 1-hour, and the previous high one-day.

Resistance two: $10,117 – Highlighted by the previous month high, pivot point one-day resistance three, and the Bollinger Band one-day upper.

Support one: $9,413 – This region is home to the SMA ten one-day and the pivot point one-day support one.

Support two: $9,318 – This zone hosts the SMA 200 4-hour, the Fibo 38.2% one-week, and the pivot point one-day support two.

According to McGlone, a commodities analyst at Bloomberg, Bitcoin’s journey to $20,000 is not in any way affected by the selloff experienced this week. McGlone says that Bitcoin's price actions in the past few months and the weeks after the halving is resembling the actions in 2016. If the historical relation stays put, Bitcoin could make it to $20,000 by the end of 2020.

Bitcoin is mirroring the 2016 return to its previous peak. Fast forward four years and the second year after the almost 75% decline in 2018, Bitcoin will approach the record high of about $20,000 this year, in our view, if it follows 2016’s trend.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren