- BTC/USD went up from $8,005 to $8.050 as markets opened this Tuesday.

- BTC/USD lacks strong resistance levels to $9,000.

BTC/USD bulls will be looking to overcome the $8,200 barrier in the short-term. Currently, they have taken the price up from $8,005 to $8,050 as the markets opened this Tuesday. To make matters more exciting, the daily confluence detector indicates that the market lacks strong resistance levels until $9,000.

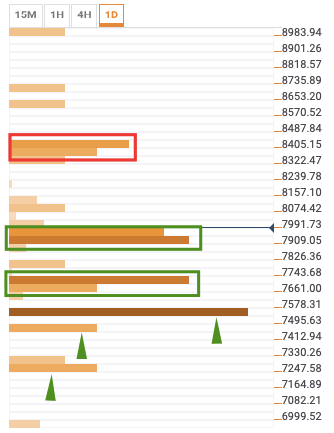

BTC/USD Daily Confluence Detector

As per the daily confluence detector, a resistance level stack lies from $8,325 to $8,445. The confluences at those levels are - 1-week pivot point resistance 1, 4-hour Bollinger band upper curve, and previous week high.

The support levels lie at $7,900-$7,990, $7,660-$7,740, $7,500, $7,475, and $7,300. The confluences at those levels are:

- $7,900-$7,990: 100-day simple moving average (SMA 100), 15-min Bollinger band middle curve, weekly 23.6% Fibonacci retracement levels, 15-in previous low, SMA 50, hourly Bollinger band middle curve, SMA 200, SMA 5, 4-hour previous high, daily 38.2% Fibonacci retracement level, and hourly previous low.

- $7,660-$7,740: Weekly 38.2% Fibonacci retracement level, hourly Bollinger band lower curve, 4-hour previous low, SMA 50, SMA 200, 4-hour Bollinger band, daily 61.8% Fibonacci retracement level.

- $7,500: 1-month pivot point resistance 3, SMA 10, and 1-day pivot point support 1.

- $7,475: No confluence detected.

- $7,300: Weekly 61.8% Fibonacci retracement level.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Fed-led rally could have legs towards $65,000

Bitcoin has risen 7% so far this week, supported by the US Fed interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Ethereum, BNB and POL holders on the watch as BingX faces loss of $26 million in hack

Crypto exchange BingX said on Friday that it suffered a hack, an attack that led to “minimal” losses that researchers at PeckShield estimate at $26.68 million. The attacker swapped the stolen altcoins for Ethereum, Binance Coin and Polygon tokens, according to on-chain data.

Pepe price forecast: Eyes for 30% rally

Pepe extends the upward movement on Friday after breaking above the descending trendline and resistance barrier on Thursday. PEPE’s dormant wallets are in motion, and the long-to-short ratio is above one, further supporting this bullish move and hinting at a rally on the horizon.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin (BTC) has risen 7% so far this week, supported by the US Federal Reserve (Fed) interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.